Spot Bitcoin & Ethereum trading has been officially cleared by regulators right now, and the SEC along with CFTC issued a joint statement that allows NYSE Bitcoin approval and also Nasdaq Ethereum listing. In fact, this historic ruling allows the institutional adoption of crypto within the full US crypto regulation frameworks, and it continues to be a critical turning point in the history of the traditional financial markets as of writing.

🚨 The NYSE, Nasdaq, CBOE, CME, etc, will soon have spot trading for BTC, ETH, and more. https://t.co/qZo3YsYDQA

— matthew sigel, recovering CFA (@matthew_sigel) September 2, 2025

Spot Bitcoin & Ethereum Trading: NYSE, Nasdaq Listings and Institutional Adoption

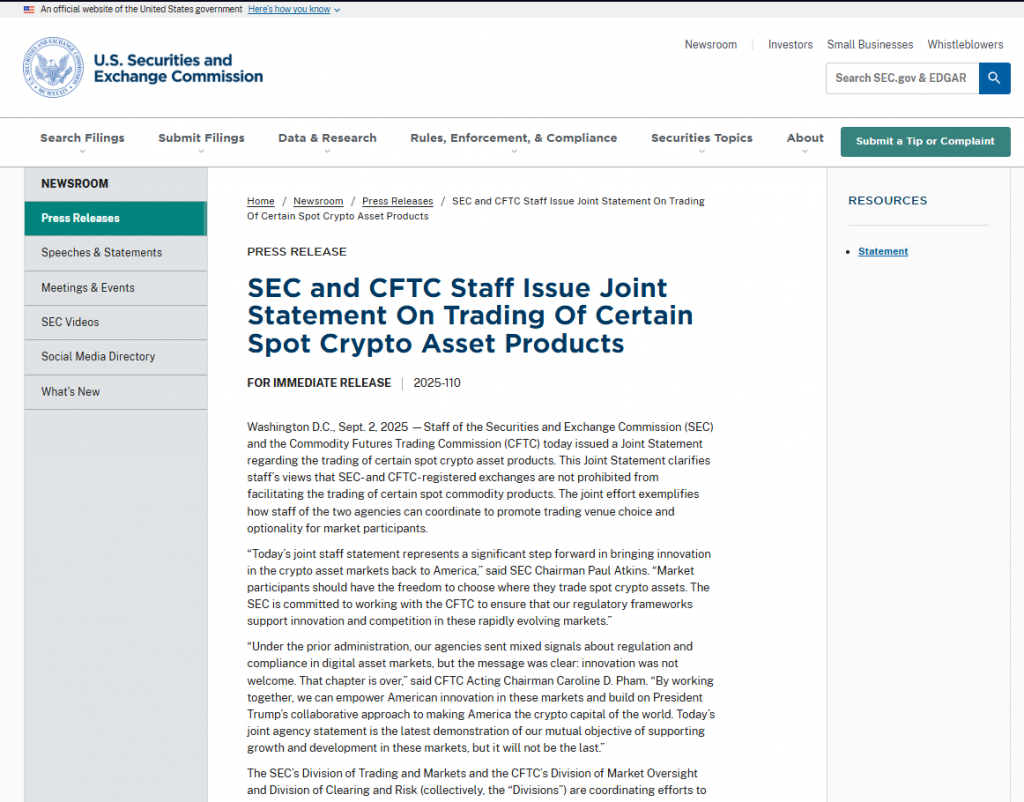

The regulatory breakthrough came through a joint statement from the Securities and Exchange Commission and also the Commodity Futures Trading Commission, which clarifies that registered exchanges can actually facilitate spot Bitcoin & Ethereum trading without regulatory barriers right now.

SEC Chairman Paul Atkins said that:

“Market participants should have the freedom to choose where they trade spot crypto assets. The SEC is committed to working with the CFTC to ensure that our regulatory frameworks support innovation and competition in these rapidly evolving markets.”

Regulatory Framework Enables NYSE Bitcoin Approval

The joint statement addresses years of uncertainty surrounding institutional crypto adoption by providing some clear guidelines for spot Bitcoin & Ethereum trading on traditional exchanges. NYSE Bitcoin approval along with Nasdaq Ethereum listing can now proceed under established US crypto regulation protocols, even though the process has been lengthy.

Also Read: Traditional Exchanges vs Crypto-Native Platforms: Key Differences

CFTC Acting Chairman Caroline D. Pham had this to say:

“By working together, we can empower American innovation in these markets and build on President Trump’s collaborative approach to making America the crypto capital of the world. Today’s joint agency statement is the latest demonstration of our mutual objective of supporting growth and development in these markets.”

Market Impact of Institutional Crypto Adoption

This regulatory clarity actually enables spot Bitcoin & Ethereum trading through established financial infrastructure, and it addresses security concerns along with compliance requirements that have limited institutional participation. The NYSE Bitcoin approval and also Nasdaq Ethereum listing create new pathways for institutional crypto adoption while maintaining robust US crypto regulation oversight right now.

Also Read: Institutional Investment Strategies for Digital Assets