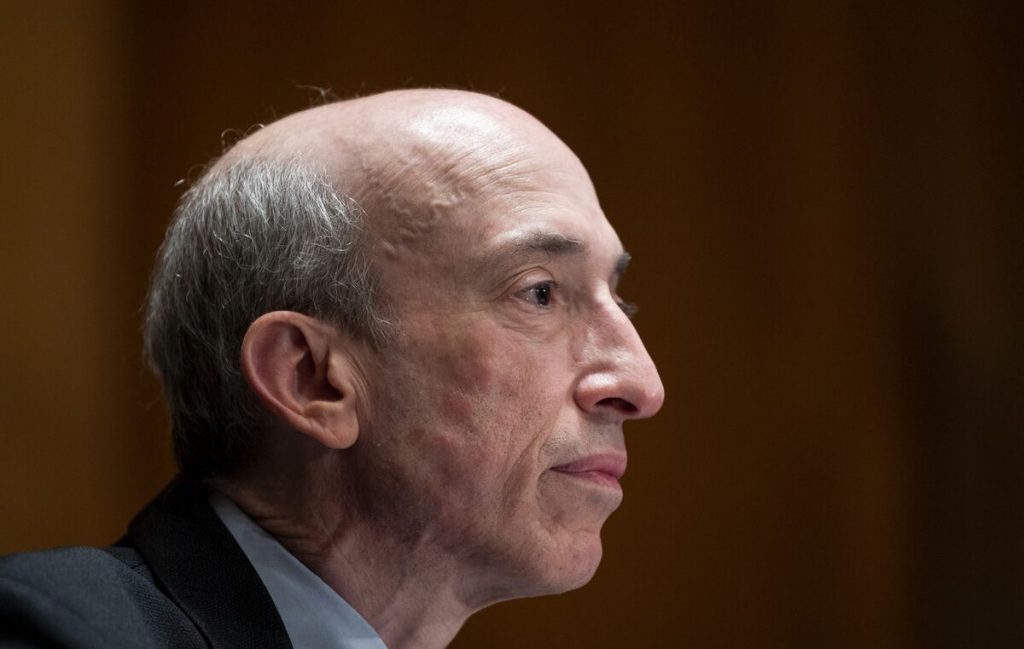

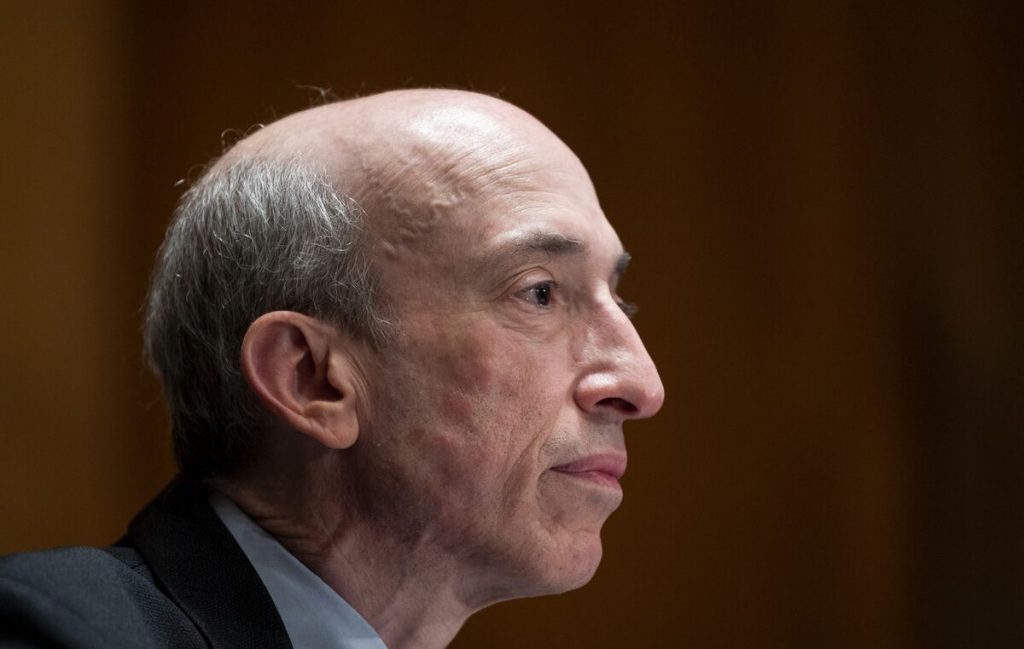

The crypto community refused to be silent at recent comments made by the US Securities and Exchange Commission’s (SEC) chair. Specifically, the SEC head, Gary Gensler, sparked controversy by calling Bittrex a securities exchange. A statement made in a recent tweet by the official.

The comments follow convoluted regulatory practices abounding throughout the industry. Moreover, in that statement, Gensler attacked the community for suffering “from a lack of regulatory compliance, not a lack of regulatory clarity.”

Gensler Speaks on Bittrex Exchange

Yesterday, the SEC announced that crypto exchange Bitterx and its co-founder, Willian Shihara, were charged by the agency. Specifically, they were facing violations for operating an unregistered securities exchange. Conversely, amid similar action elsewhere, the community had understandably responded.

Yet, what made the situation worse were the comments made by the regulatory agency’s chairman. Subsequently, the SEC head, Gary Gensler, sparked controversy with his decision to label Bittrex a securities exchange. Specifically, in noting that the development speaks to a “lack of regulatory compliance, not a lack of regulatory clarity.”

Conversely, the main argument against those statements is their clear falsity. They place the burden of regulation on crypto platforms when the entire industry has been hampered by unclear regulatory action taken by the regulator. Moreover, some users have even questioned whether or not this decision places all exchanges under the categorical definition of “securities exchange,” according to U.Today.

There is a clear disconnect between the regulatory standards the SEC has enacted and expected compliance. Still, amidst the Ripple conflict utilizing the decades-old Howey Test, it is clear that Gensler must adjust how he approaches regulation. Conversely, the actions taken by congressmen in seeking his dismissal encourage that fact.