The Ethereum community has been eagerly awaiting for the network’s Shanghai hard fork. The said upgrade is slated to take place over the course of the next few months and intends to unlock staking withdrawals. Last week, Ethereum’s Zhejiang testnet processed its first ETH withdrawal, bringing the network a step closer to the actual upgrade.

Read More: Staked Ethereum Undergoes 1st Withdrawal On ‘Zhejiang’ TestNet

When is Ethereum’s Shanghai upgrade scheduled?

Without mentioning an affirmative date, the official website stated that the upgrade is “planned for Q1/Q2 2023.” Once successfully done, the withdrawal functionality will be enabled.

Shanghai “marks the end of an undefined lock-up period” for ETH staking. This means that apart from staking ETH and earning rewards, users will be able to un-stake their tokens to regain full access to their entire balance. Parallelly, there will also be an option to re-stake to sign back up and start earning additional rewards.

Also Read: Ethereum: How To Prepare For Staking Withdrawal

Alongside the Shanghai upgrade, another concurrent upgrade will be taking place. Shedding light on the same, the website noted,

“For the Shanghai upgrade to take effect, a simultaneous upgrade to the Beacon Chain must take place named Capella.“

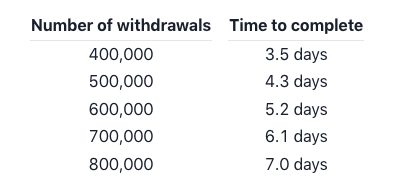

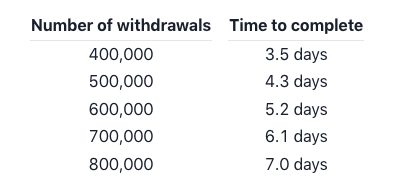

Notably, only 16 withdrawals at the most can be processed in a single block. This means around 115,200 validator withdrawals can be processed per day, assuming no missed blocks).

Also Read: How to Stake Ethereum [2023]

According to the rough estimate, for around 400k withdrawals to be processed, it will take 3.5 days. Likewise, for 800k withdrawals to be processed, nearly 7 days will be needed.

Also Read: Latest Ethereum Shadow Fork Provides Testing Ground for Shanghai Upgrade

Ethereum’s staking ratio is currently at 14%. However, JPMorgan believes that the said upgrade will increase the network’s staking ratio over the mid-term. The financial giant said that ETH’s ratio has plenty of space to rise. This is because the average for other proof-of-stake networks is nearly four times as high.

Read More: JPMorgan: Ethereum Staking Ratio will Increase In Medium term