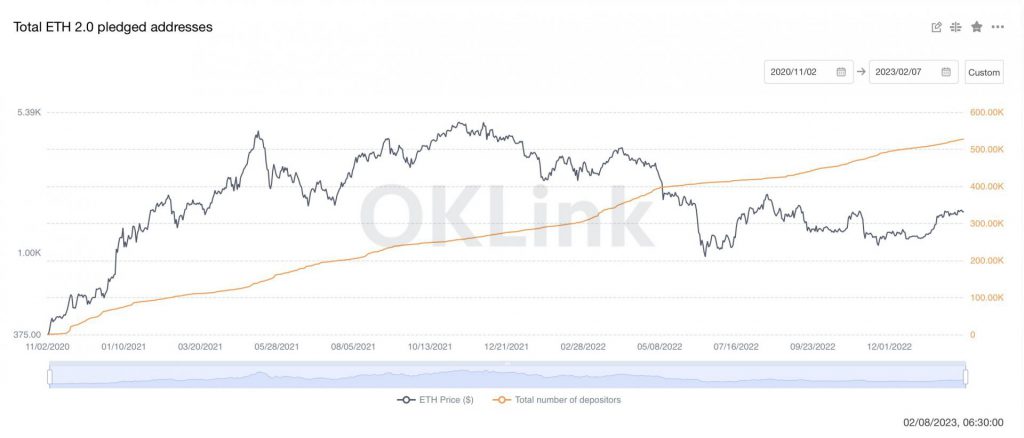

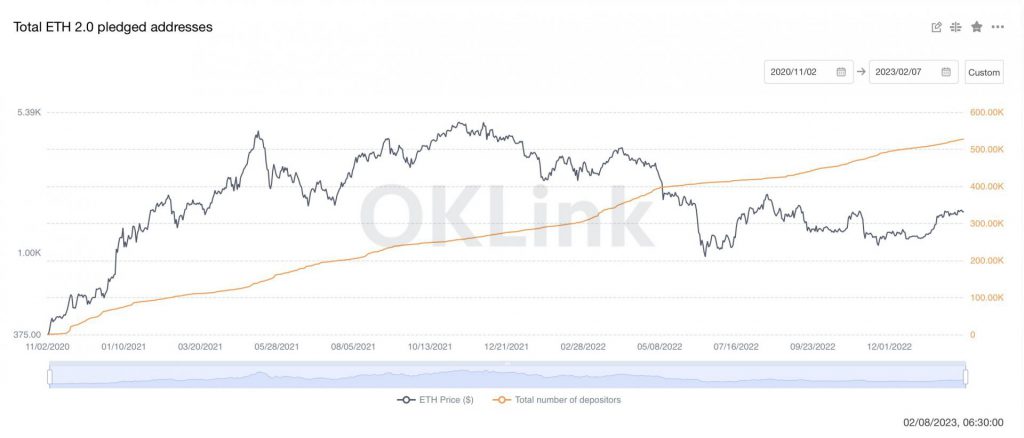

The number of non-zero addresses on the Ethereum (ETH) network has exceeded 94 million. Moreover, the number of addresses staking ETH has crossed 527K. Both milestones are significant as they represent new highs for the Ethereum network.

Additionally, the weekly median gas price on the ETH network has reached a six-month high. Rising gas prices and a 5.6% rally over the last week indicate high demand for the second-largest cryptocurrency.

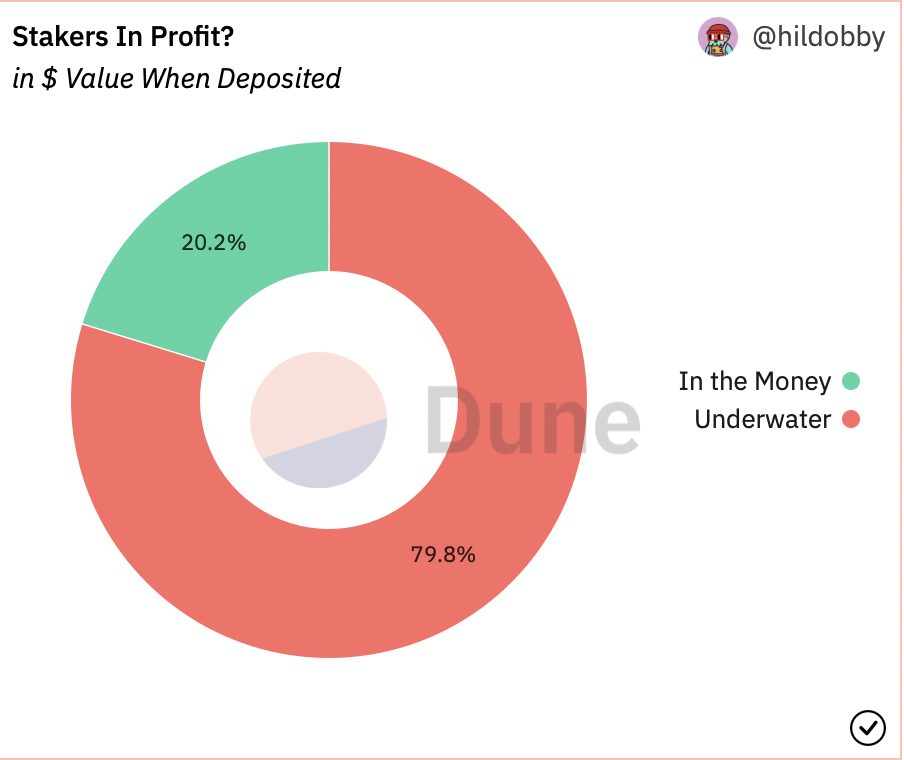

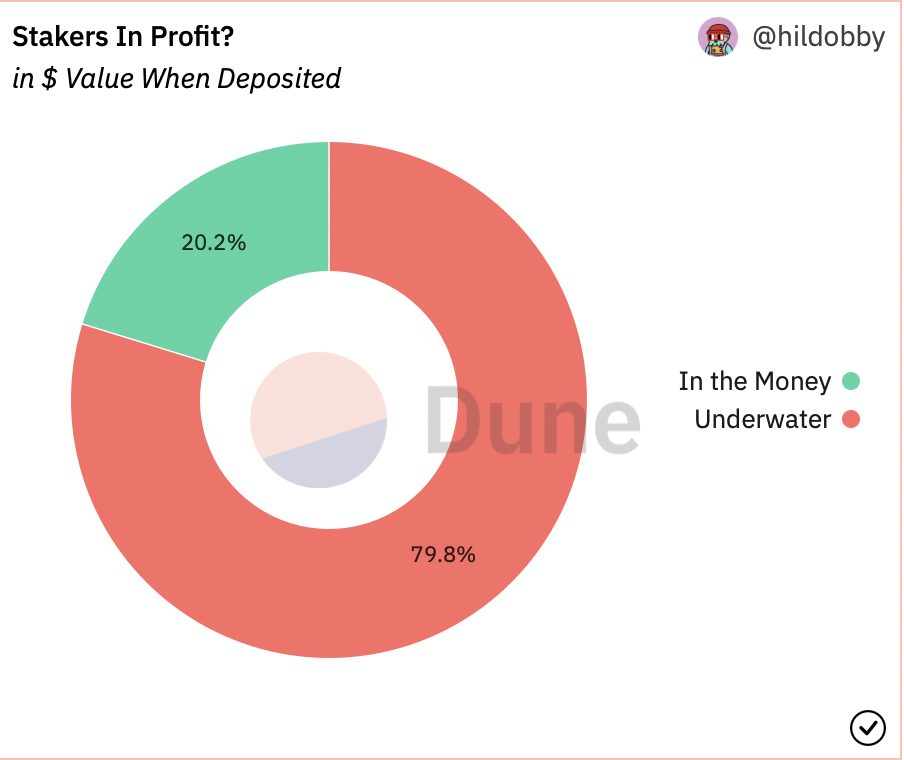

The demand could be attributed to Ethereum’s upcoming Shanghai upgrade, allowing stakers to unlock their ETH. Furthermore, according to Dune analytics, 79.8% of stakers are still at a loss. Only 20.2% of stakers are currently in the money. This counters the argument that there could be a sell-off after the Shanghai upgrade. Hence, stakers will likely not want to sell their ETH at a loss and might continue to stake their Ether to gain rewards.

Read more: How to Stake Ethereum.

Ethereum successfully withdraws staked ETH on testnet

A testnet called Zhejiang recently successfully replicated staked ether (ETH) withdrawals for the first time. The accomplishment brought the network closer to its historic conversion to a fully functional proof-of-stake network. The update began at epoch 1350 at 15:00 UTC and was completed at 15:13 UTC. The goal of the test network is to provide developers with a practice run for withdrawals that will take place on the main Ethereum blockchain.

Furthermore, Zhejiang is the first testnet and will be followed by two others. The Sepolia testnet update will be followed by the Goerli testnet upgrade sometime in the upcoming weeks.

Moreover, traders are keeping an eye on Shanghai’s potential impact on the market. Some traders think Shanghai will promote more staking. Meanwhile, others believe the price of ETH will fall as stakers hurry to remove their long-held cash due to selling pressure. However, given that most stakers are at a loss, a selloff seems unlikely.