Shiba Inu (SHIB), one of the most popular crypto projects, is now accepted as a payment by luxury watchmaker Breitling. This has been made possible by a partnership between Breitling and the crypto payment platform, BitPay.

Other cryptocurrencies supported by BitPay besides Bitcoin and Shiba Inu include Bitcoin Cash, Dogecoin, Ethereum, Litecoin, Wrapped Bitcoin, and the other five USD-pegged stablecoins (BUSD, DAI, GUSD, USDC, and USDP). These cryptocurrencies can also be used for payments by the luxury watch brand’s customers.

Previously, Tag Heuer and Hublot, two high-end Swiss watchmakers, declared they would accept cryptocurrency through BitPay.

Hublot, a Swiss luxury watchmaker, said earlier in June that customers could now use cryptocurrencies to pay for 200 limited-edition watches that had just been produced. According to a tweet from Hublot, only consumers of the US eBoutique will be able to use this payment method.

Shiba Inu developments

Shiba Inu has seen many adoption cases this year, even amid the current market crash. It has proven time, and time again, that it is one of the most popular crypto projects.

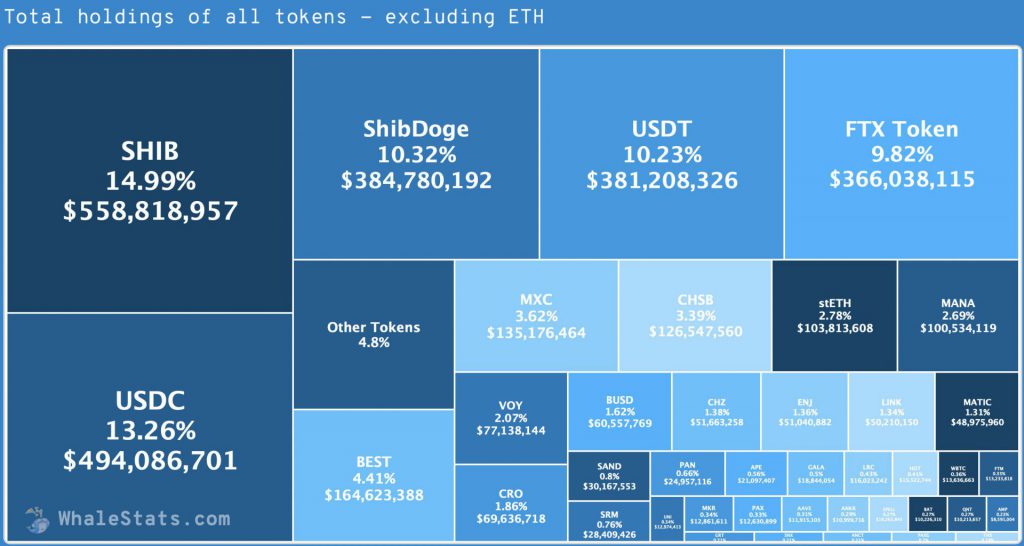

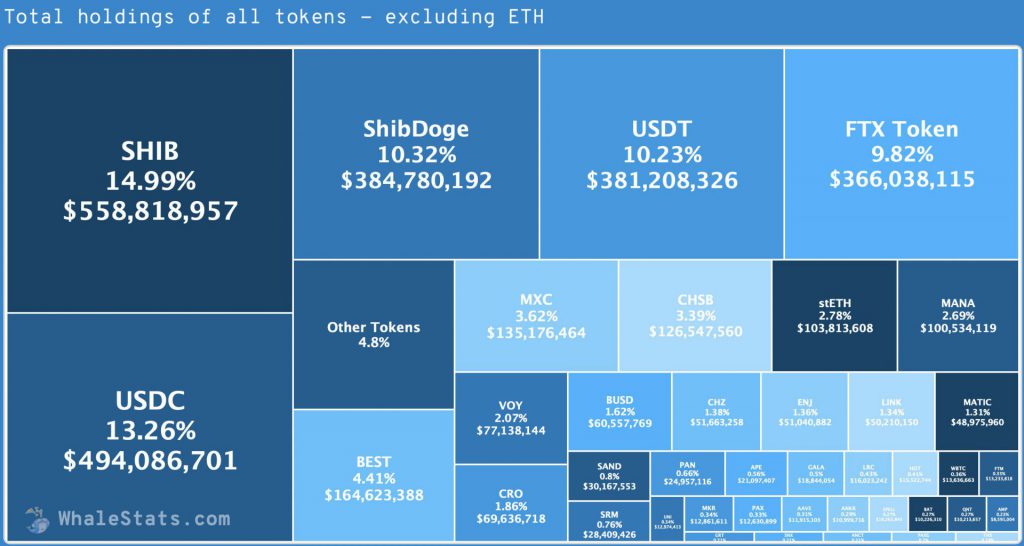

Moreover, Shiba Inu is a favorite among Ethereum (ETH) whales. According to Whalestats, it is the highest-held token among the top 100 ETH whales.

However, on the flip side, Crypto.com announced on Twitter that their Crypto Earn rewards program would no longer support 15 coins. Shiba Inu and Dogecoin (DOGE) are included in the 15 tokens.

Additionally, SHIB’s layer-2 protocol, Shibarium, is almost on the verge of release. According to a blog post by Unification, the development team behind the initiative, Shibarium will be ready for public testnet by Q3 of this year.

Moreover, Shiba Inu has had quite a successful week in the market. At press time, SHIB was trading at $0.00001091, up by 33.8% in the last seven days. The project recently overtook DAI to take the number 12 spot on the list by market cap.