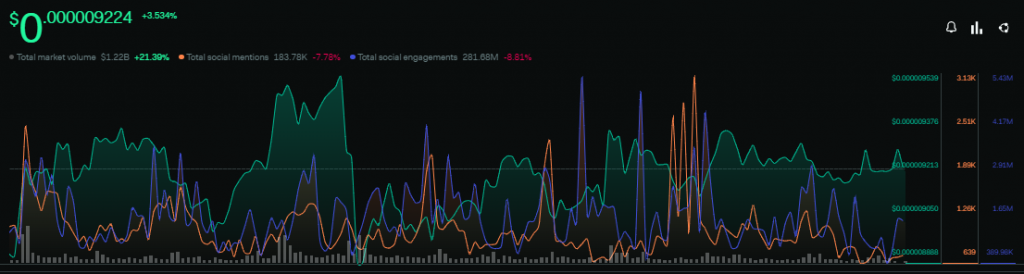

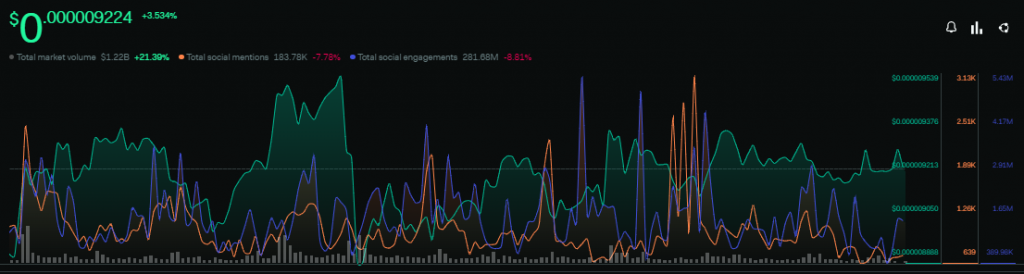

Similar to Bitcoin, even Shiba Inu’s price noted a mild increase of 3.53% over the past week. Post the said surge, the 14th-ranked crypto seemed to be heading in the right direction to delete another zero from its price. At press time, the $5.07 billion market-capped asset was seen exchanging hands at $0.000009243.

Despite noting an improvement on the price front, the community sentiment seemed to be dented. Data from the analytics platform LunarCrush revealed that the Shiba Inu-associated social mentions had dropped 7.78% in the last 7 days. The number of social engagements, on the other hand, shrunk by 8.81%.

The not-so-refined sentiment was reflected in the state of the network activity. According to data from ITB, the number of active addresses dropped by a whopping 60.81% over the past week. On the other hand, the number of new addresses joining the network noted a mere 1.42% hike.

Simply put, an address is considered to be active when it becomes a direct participant in a successful transaction. And new addresses, as such, gauge the number of fresh entrants into the ecosystem. Conventionally, the higher both the numbers, the better, for they hint towards improving participation by traders and investors. Effectively, the ongoing downtrend of the former and the minor uptick of the latter ain’t encouraging per se.

Nevertheless, Shiba Inu Accumulation Is On

Despite the chalked-out trends, market participants continue to accumulate Shiba Inu tokens. Just over the past 3 hours, the buy trades exceeded the sell trades by 40.3 billion SHIB tokens. The number stood at an elevated 73.84 billion in the 12-hour frame.

Alongside, Shiba Inu also managed to grasp the attention of whales. On Friday, the second largest meme-token was a part of the top 10 purchased list among the 1000 biggest Ethereum whales.