The crypto market has been in its consolidation phase of late and tokens like Shiba Inu have been bearing the side effects of the same. After noting a 2% daily drop in value while a weekly drop stood at 8% SHIB was priced at $0.00001051 at press time.

The Shiba Inu community is making noise

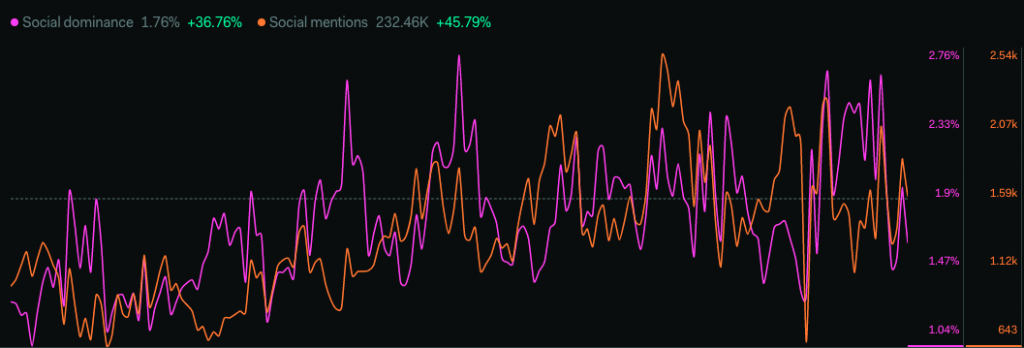

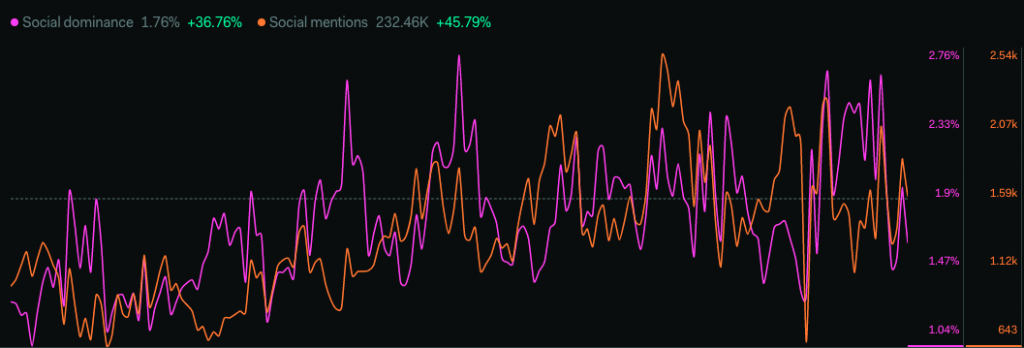

The state of Shiba Inu’s sentiment-related metrics has been improving over the past few days. As can be noted from below—both—the social dominance and mentions have noted an upward inclination from where it stood last week at this time.

Per data from LunarCrush, the latter has escalated by 36.7%, while the former by 45.79% in the said timeframe. This essentially means that more and more people are chit-chatting about Shiba Inu on social platforms lately.

An improving social sentiment usually aids in cushioning the price, for it is indicative of brewing interest amongst market participants. However, before jumping to a conclusion, it is equally essential to peek and see what kind of chitter-chatter has been going on.

Over the past week, the bullish sentiment associated with Shiba Inu has noted a 47% appreciation. However, in the same period, bearish social talks also increased by 55%. This essentially means that the community stands divided at this point.

Trader sentiment

Gauging the trader sentiment, at this indecisive juncture, would help us in decrypting what to expect from Shiba Inu.

At press time, the 12-hour long: short ratio stood under one [at 0.93, to be precise], indicating that derivative traders had slightly more short positions open relative to long ones. The same bearish sentiment was also reflected in the funding rate.

On exchanges like CoinEx and Bitget, the rate was in the negative territory, while on other prominent exchanges like Gate, FTX, Huobi, etc., the number was mildly positive.

However, when zoomed out and viewed, it can be seen even though the sentiment remains to be bearish, the intensity of the same has been reduced, which is a positive takeaway.