Memecoins, in general, have seen a meteoric rise over the last week. Shiba Inu (SHIB) has gained several spots in the top 100 rankings and sits just below its rival, Dogecoin (DOGE).

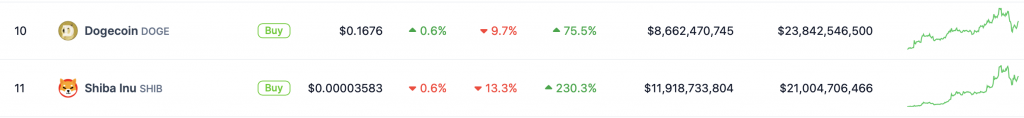

Shiba Inu’s (SHIB) price has rallied by 230% in the weekly charts, 272.1% in the 14-day charts, and almost 300% over the previous month. Dogecoin (DOGE), on the other hand, has rallied 75.5% in the weekly charts, 96.8% in the 14-day charts, and 112.6% over the last month. However, both assets have faced a steep correction in the daily charts. SHIB’s price has fallen 13.3% in 24 hours, while DOGE has dropped 9.7% in the same time frame.

Also Read: PEPE Surges 50%: Outshines Dogecoin (DOGE) and Shiba Inu (SHIB)

Will Shiba Inu (SHIB) overtake Dogecoin (DOGE) this year?

SHIB’s market cap currently stands at $20.3 billion, while DOGE’s is $23.8 billion. SHIB’s market is just about 13% away from DOGE’s. Hence, if the popular meme coin continues its bullish trajectory, it may surpass DOGE in the rankings.

Also Read: Shiba Inu & Dogecoin Must Be in Your Portfolio in 2024: Here is Why

Shiba Inu (SHIB) and Dogecoin (DOGE) are the most significant and known meme coins. However, DOGE has the advantage of entering the scene first. DOGE debuted in 2013, almost 11 years ago, while SHIB entered the ring in 2020, about three-and-a-half years ago. However, SHIB has made quite an impression in its short history. However, given the latest correction, SHIB might not overtake DOGE yet. With that said, Shiba Inu (SHIB) could flip Dogecoin (DOGE) sometime later in the year.

Dogecoin (DOGE) might be a part of X’s upcoming payment feature. If so, the asset might see a sudden spike in value. On the other hand, Shiba Inu (SHIB) is working on a new burn mechanism, rumored to burn trillions of tokens yearly. Both developments could significantly push the asset’s prices.