Shiba Inu is currently trading around the $0.000025 mark and is attracting bullish sentiments in the indices. It has spiked more than 200% in a year and tripled investors’ money in a short period. SHIB is among the most sought-after cryptocurrencies in the market due to its high volatility and unpredictable behavior. It can rise millions of percent in a year but also dip thousands of percent during the same period. This has made investors try their luck in the markets because if it delivers, they can make life-changing gains.

Also Read: Shiba Inu: You Could Have Made $1 Million With Just $10 In SHIB

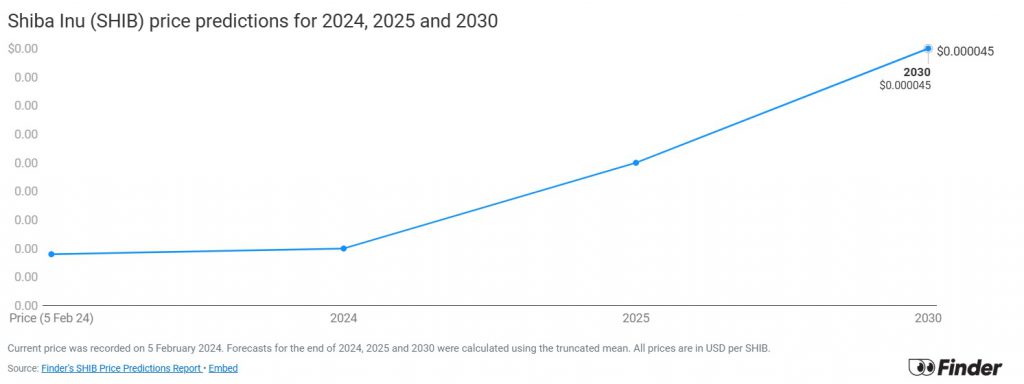

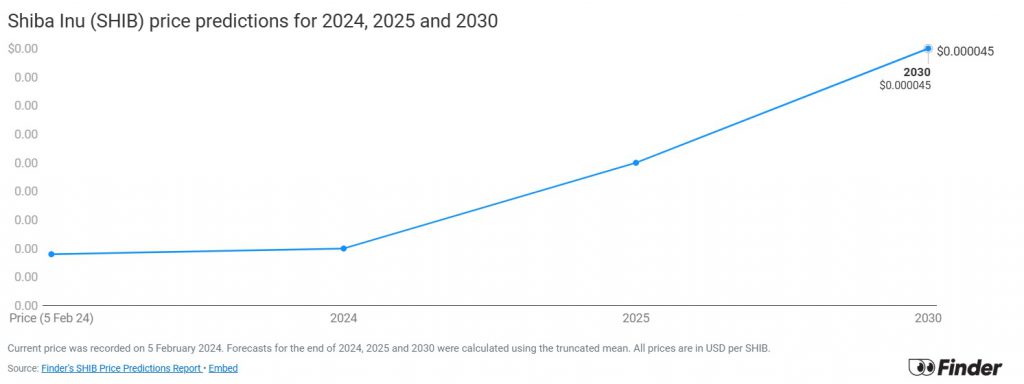

Shiba Inu Price Prediction: An 80% Surge on the Cards, Target $0.000045

The Finder’s panel of cryptocurrency experts predicts that Shiba Inu could reach a target of $0.000045. That’s an uptick and return on investment (ROI) of approximately 80% from its current price of $0.000025. Therefore, an investment of $1,000 could turn into $1,800 if the forecast turns out to be accurate. Moreover, the timeframe for the 80% rise is quite long as Finder’s predict it could reach there in 2030.

Also Read: How High Can Shiba Inu Surge In December 2024?

That’s considered a long-term holding and is close to five years from today. Not everyone can hold on to the token that long but those who do could make good profits. Finder’s analysts have forecasted that when Bitcoin rises, SHIB has more chances of hitting new highs. Around 70% of analysts from the firm believe that it’s time to buy and hold SHIB. Only 30% believe that traders need to dump the token.

Also Read: Shiba Inu: $1000 Worth Of SHIB Becomes $31.7 Million Today

“My point of view is optimistic regarding Shiba Inu’s future price trajectory. I base this on the expectation of increasing utility and adoption of the Shiba Inu ecosystem, which could drive demand and consequently the price. Furthermore, the growing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs), primarily hosted on the Ethereum blockchain, which Shiba Inu leverages, could positively impact its value,” said a Finder’s analyst Samy Ben Bahmed.”