Shiba Inu (SHIB) last traded above the $0.00003 mark in December of last year. The popular cryptocurrency has faced a gradual price decline over the last 10 months. SHIB’s lackluster performance has caused much worry among investors and fans. There is a possibility that Shiba Inu (SHIB) will recover some of its losses if the Federal Reserve rolls out its interest rate cuts later this month. Let’s discuss why it could be the only way for SHIB to reclaim the $0.00003 price level in 2025.

Why An Interest Rate Cut is Shiba Inu’s Only Chance of Hitting $0.00003 in 2025

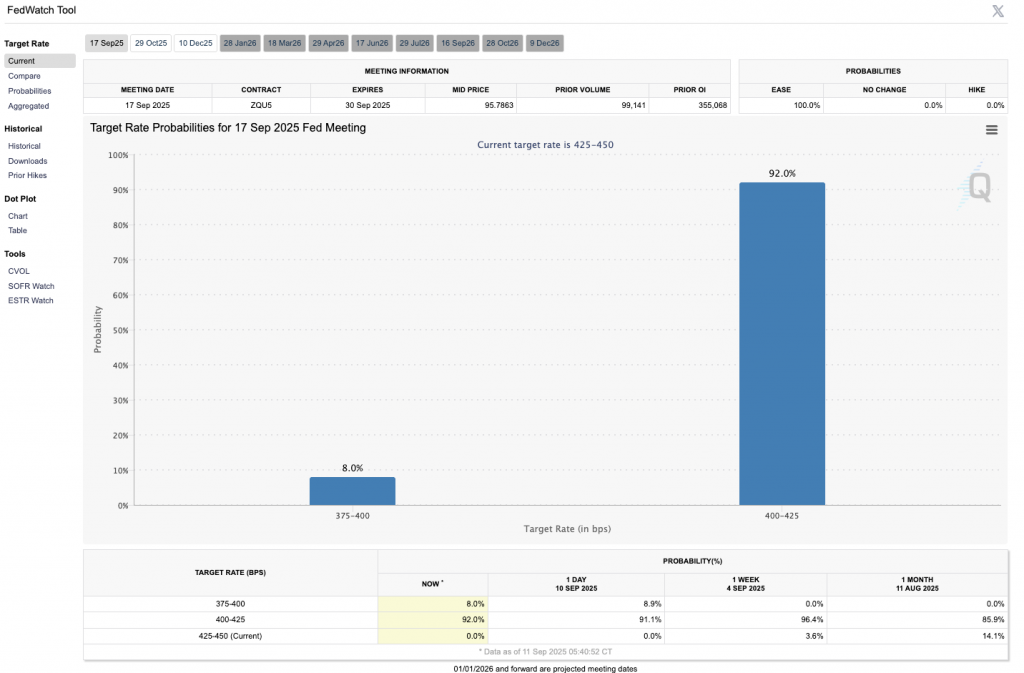

Inflation in the US has cooled for the month of August. The falling inflation figures have further boosted the chances of an interest rate cut in September. According to the CME FedWatch tool, there is a 92% of a 25 basis point interest rate cut in September and an 8% chance of a 50 basis point rate cut. Rate cuts often lead to investors taking on more risks as borrowing becomes easier. Shiba Inu (SHIB) and the larger crypto market could greatly benefit from an interest rate cut.

Bitcoin (BTC), Ethereum (ETH), BNB, and XRP have hit new all-time highs in 2025. BTC and ETH climbed to new peaks with increased ETF inflows. Shiba Inu (SHIB) does not have an ETF yet. Moreover, the chances of SHIB getting an ETF are quite low, given that the asset is a memecoin with a lot of risks. Shiba Inu (SHIB) has to rely on adoption and online buzz to generate steam. An interest rate cut could be the only thing that can propel SHIB’s price to the $0.00003 price level.

Also Read: Leading Expert Predicts Shiba Inu Surge if Ethereum Hits $10K

Shiba Inu (SHIB) has tried to bring more utility to the SHIB ecosystem. However, very few applications have been built on SHIB’s Shibarium network. The asset may rally if investors begin taking more risks. Such a scenario may unfold in the instance of an interest rate cut.