Shiba Inu’s price has been climbing down the ladder since November 2021. From a high of $0.000088 registered in Q4 last year, SHIB’s value has already shrunk to $0.000011.

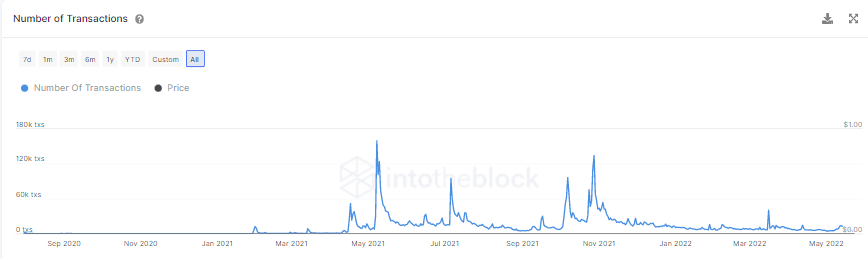

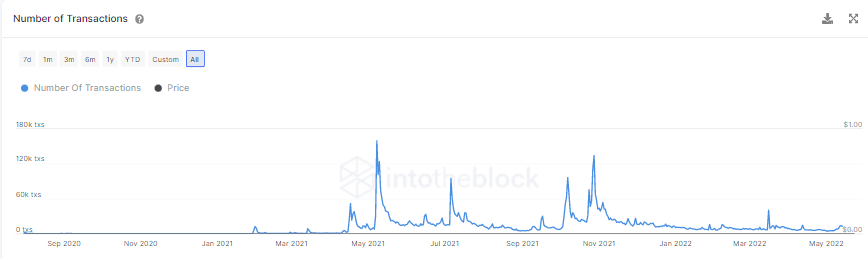

Alongside the price deterioration, the state of Shiba Inu’s on-chain metrics too has worsened. Consider the number of transactions, for starters. Back last year, as can be seen from below, the reading of this metric used to hover around 100k on good days, otherwise oscillated between 20k-30k on usual days. Now, nonetheless, it has shrunk down to 5k of late.

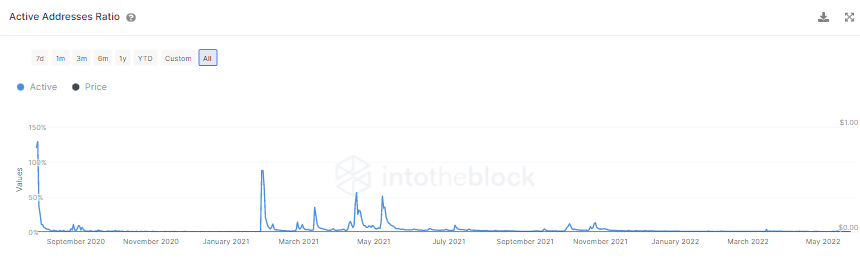

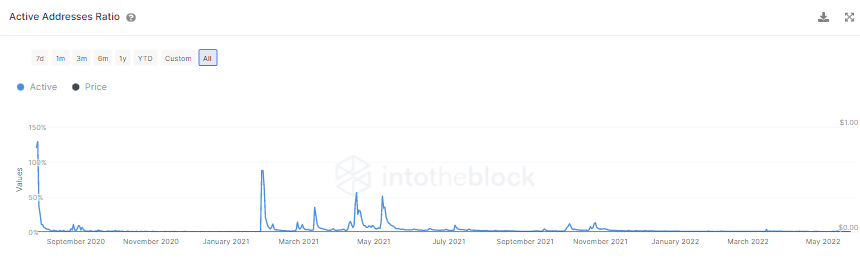

Quite similarly, the active address ratio too hovered around 50% during last year’s ripe phase. From double digits, however, the same is down to merely 0.4% now. The erosion can be observed from the snapshot attached below.

Furthermore, it is critical to note that the addresses with balance too broke the uptrend a few weeks back and stooped a bit lower, indicating that market participants had been selling their Shiba Inu tokens. Back in mid-March, 1.15 million addresses used to be active on a daily basis. But at press time, the number is around 1 million merely.

So what time to give up hope already?

Well, as far as Shiba Inu is concerned, the community plays quite a crucial role in determining the direction in which the asset’s price swings. Time and again Shiba Inu rallies have taken place independently when people from the broader market had been least expecting it. And most of the time, the SHIB Army sentiment has triggered the same.

On-chain metrics do play a crucial role in shaping the trend bias, but it takes merely one catalyst to change the entire narrative. So now, even in the current bear market, expecting a Shiba Inu rally doesn’t seem to be completely out of the box. Perhaps, the launch of Shibarium, for starters, could instigate the same this time.