Shiba Inu’s price awaits a cup and handle breakout to inspire a new price hike following last week’s massive pump. Although a bullish technical pattern was active on the chart, investor demand and whale activity would need to step up for an immediate rally.

Shiba Inu has declined by as much as 14% in the last five days, with sentiment easing after a milestone Robinhood listing on 12 April. Hopes of another short-term rally would likely subdue until SHIB tags a strong support line, especially as Ethereum whales and smaller investors adopt a wait-and-watch approach.

Shiba Inu whales and investors take back seat

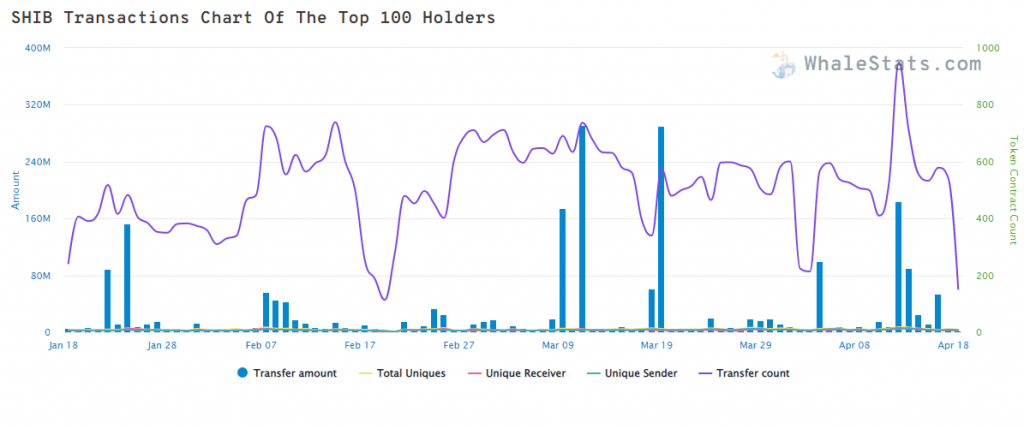

Although Shiba Inu was heavily traded by Ethereum wallets on 12 April, such transactions have declined sharply over the last few days. Data from Whalestats showed that SHIB transactions by the top 100 Ethereum whales, who hold 24% of SHIB’s circulating supply, were almost at a 1-month low. Furthermore, SHIB did not feature among the most purchased tokens or most used smart contracts during the day.

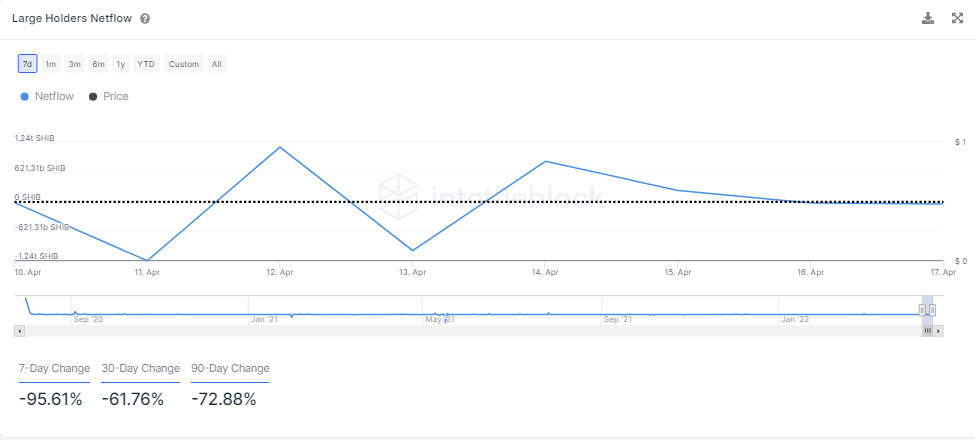

Meanwhile, investors have been reducing their positions as well. Shiba Inu’s large holders NetFlow was down by 95% over the week, showing that those addresses holding above 0.1% of SHIB’s supply were still engaging with selling activity.

Looking at Shiba Inu’s daily chart, it’s quite plausible that investors and whales were waiting for an attractive price level to start buying SHIB once again. Another 9% decline would bring SHIB at $0.00002118-$0.00002015 support – an area that has triggered three massive SHIB rallies in 2022.

What to lookout for

Shiba Inu’s candles were currently locked within a cup and handle pattern – a bullish technical setup that presented a 23% upside potential. A daily close above $0.0000280-resistance could trigger the expected spike and investors should keep their peeled for such an outcome.

To capitalize on the breakout, investors can get into early positions by setting up entries at $0.0000280 and exits at $0.000035360. Stop-loss can be kept at $0.0000200. The trade setup carried a 0.92 risk/reward ratio.