The cryptocurrency market has been devoid of momentum as of late. As a consequence, asset prices continue to remain stagnated. As illustrated below, the cryptocurrency volatility index reading peaked three times, around 125, since May. Post the latest downfall, however, it is down to a level as low as 75.9.

By using leverage, traders maximize their returns during periods of price fluctuations. Thus, they usually flock into the market in mass when the volatility is high. The current landscape is evidently unfavorable to traders. As a result, many from the community have started raising questions and asking if traders are even trading now.

Outlook For This Week

The market is currently at an interesting juncture, and it seems like things could change this week. Stablecoin transactions have been on the rise. As far as USDC is concerned, Glassnode revealed that the average volume attained an all time high of $284.79k.

Transactional volume is a double edged sword, for it takes into account both buy and sell side trades. Nonetheless, a recent CryptoQuant analysis report put things to perspective.

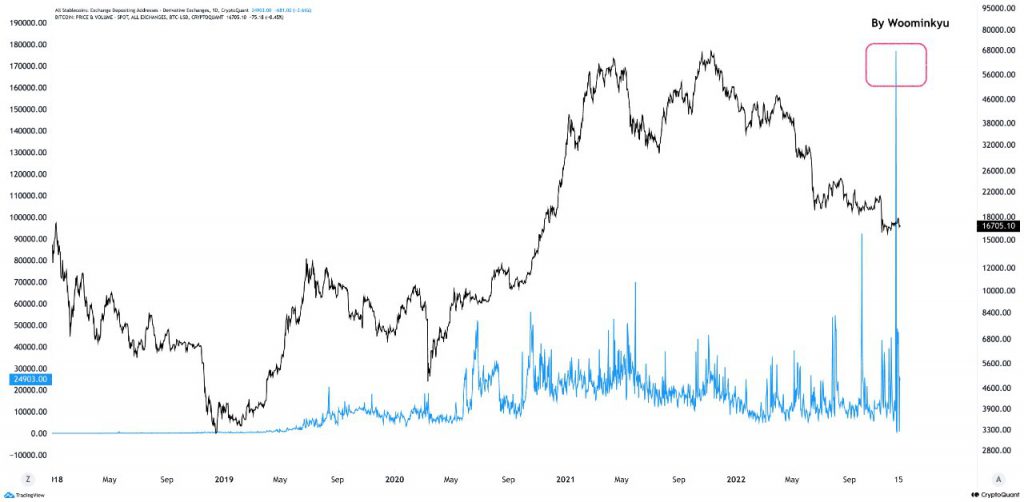

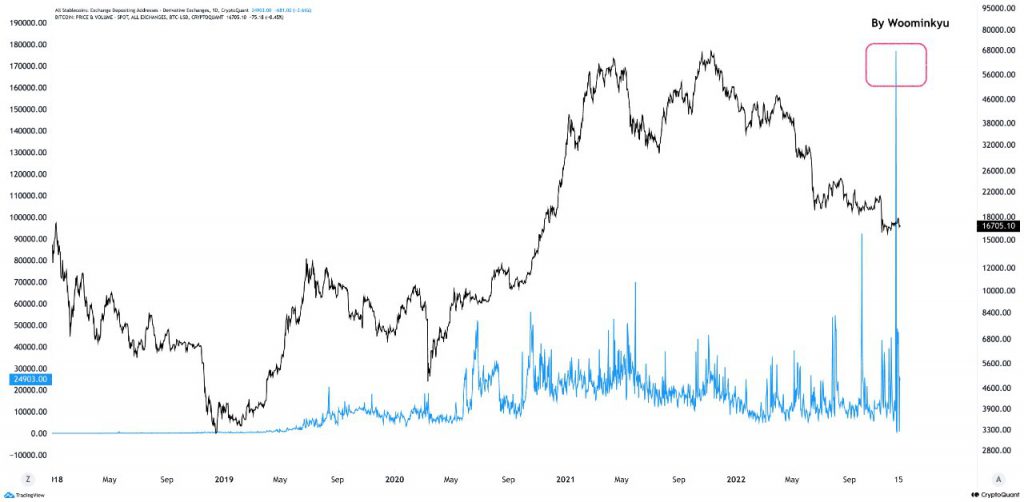

The report revealed that the number of coin addresses depositing stablecoins to all derivative exchanges reached new all time high recently.

Stablecoin pairs are usually the most preferred trading pair by traders. The rise in their deposits likely indicates that buying pressure is mounting up or more investors are getting involved in derivative trades.

The Derivatives Open Interest of top coins like Bitcoin and Ethereum, however, remain to be flat. The same indicates that traders have not yet started diverting their stablecoins towards major assets.

Data from Coinglass revealed that the Futures and Options Open Interest for Bitcoin, combined, stood around $10.1 billion on Monday. For Ethereum also, the cumulative OI remained stagnated around $14.5 billion.

However, once the diversion starts, the numbers can be expected to rise. The by-product of the same would then be a volatility influx.