Ripple’s XRP has traded within a symmetrical triangle for the last 12 days as volatility settled down post its 28% rally. Low retail volumes and social activity hinted at an extended consolidation and XRP investors might have to wait slightly longer for the next price swing.

Since 12 May, XRP has shifted within the boundaries of a symmetrical triangle, logging successive lower highs, and higher lows. The pattern represents a period of consolidation before the price breaks to the upside or downside, depending on market conditions.

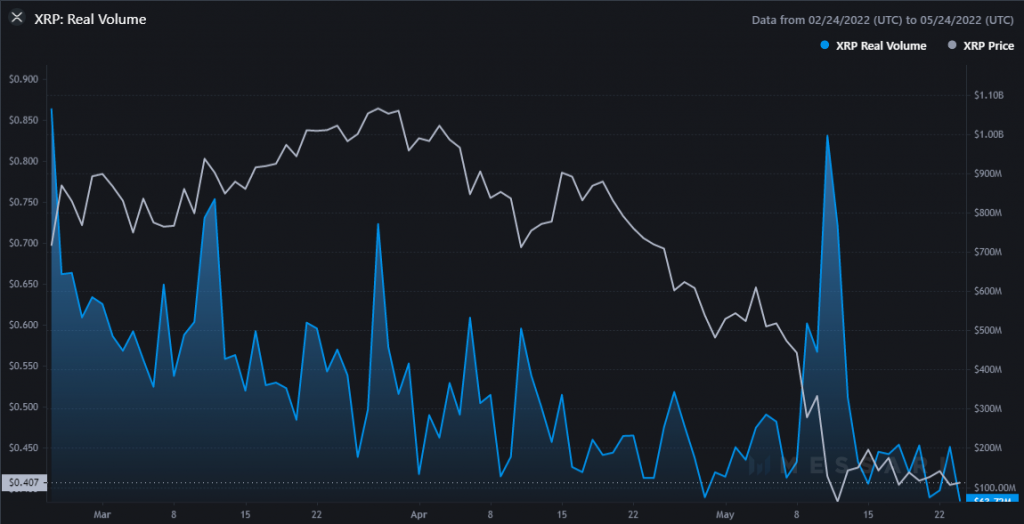

Now, when such patterns take shape, it’s necessary to look at external volumes. When volumes start to rise during periods of consolidation, the same can act as a prelude to price swings. However, in XRP’s case, that was not the case just yet.

Volumes inconsistent for a breakout

As per Messari, XRP’s real volume was significantly low since its latest rally. The volumes have averaged around $200 Million and dropped to $56 Million at press time, suggesting waning interest among investors.

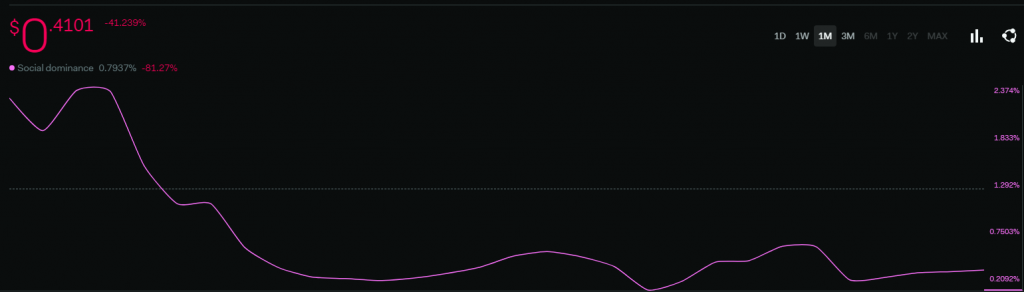

A spike in social media mentions can also trigger an increase in price volatility but unfortunately, XRP’s social score was unimpressive of late. The monthly social dominance was down by 81%, indicating that the alt movement in May had not ignited curiosity among social media users.

XRP 4-hour Chart

With volumes at a low, XRP’s price would likely continue to trade sideways over the short term. The 4-hour Bollinger Bands floated between $0.43-$0.40 and investors must keep an eye out for a close above or below these levels to prepare for the next price swing.

However, it’s worth pointing out that XRP’s bias was more bearish than bullish, with indicators RSI and MACD trading below their respective half-lines. Hence, a move to the downside is more likely unless a Bitcoin upswing pushes alts, including XRP, against their bearish structures.

Investors can take up short calls below $0.40 and cash out at $0.33 in case of a breakdown. A stop-loss can be kept at $0.44. The hypothetical trade setup carried a 1.8x risk/reward ratio.