The past day has been quite rough for all asset classes across the board. With Bitcoin dropping below $20,000, the cryptocurrency market continues to bleed profusely. On the other hand, stock prices have also nosedived.

All the major averages concluded Thursday’s trading session on a bearish path. Having fallen by 2.05%, Nasdaq remained the worst affected. Concurrently, the S&P 500 was down by 1.85%, while the Dow Jones Industrial Average was down 1.66%. The banking sector’s woes seemed to be the deepest. In fact, the benchmark stock index of the banking sector—the KBW Bank Index—was down by around 8% in just a day, marking the biggest one-day decline since June 2020.

Also Read: President Biden Proposes 30% Tax on Electricity Used to Mine Cryptocurrency

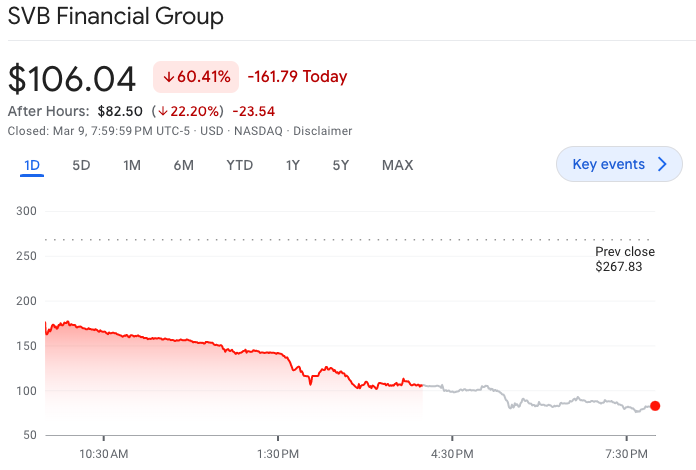

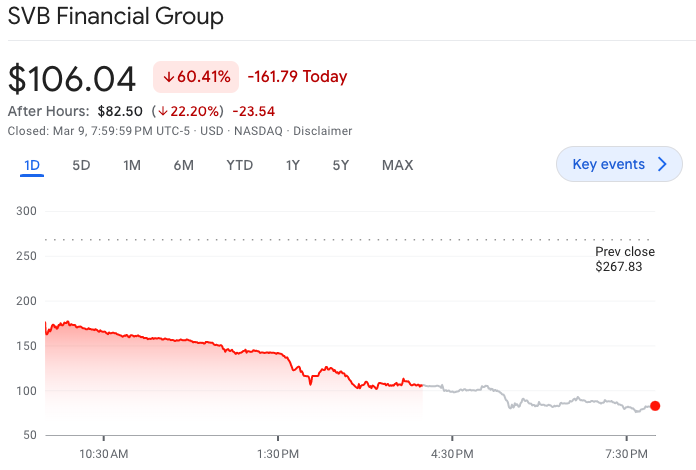

However, the biggest loser in the banking index was SVB Financial Group, the parent of Silicon Valley Bank, which shed over 60% of its value on Thursday. In effect, it closed at $106.04 on Thursday. However, its misery tale continued even during the after-market hours. SIVB dropped by another 22% and was priced around $82.5.

The bank has around $212 billion in assets. For context, it is less than a tenth the size of JPMorgan.

Also Read: President Biden Calls to Double Capital Gains Tax

As a matter of fact, Jim Cramer asked investors to pile up SIVB stock a month back. He asserted that it was “still cheap” and could rally more. Since then, its value is down by 66%.

On the other hand, Founders Fund, the VC fund co-founded by Peter Thiel, has reportedly asked companies to withdraw funds amid rising concerns about the bank’s financial position.

Also Read: Ripple CEO: SEC’s Enforcement Actions Are ‘Not Healthy’

Timeline of events

Alongside the pessimism associated with President Biden’s tax hike proposals, the entity shot itself in the leg. Silicon Valley Bank’s parent company revealed late Wednesday that it sold around $21 billion of securities from its portfolio, which will result in a post-tax loss of $1.8 billion for Q1.

Additionally, SVB sold $1.25 billion of common stock and $500 million of securities that typify convertible preferred shares. Plus, General Atlantic agreed to purchase $500 million of its common stock. Thus, the total amount being raised was up to $2.25 billion.

Now, on any given day, raising money on short notice is seldom a good sign for a bank. In a recent letter to shareholders, SVB’s Chief Executive Officer Greg Becker said that the actions were being taken because the entity expects “continued higher interest rates, pressured public and private markets, and elevated cash burn levels” from their clients as they invest in their businesses.

Now, according to Bloomberg News, SVB does business with almost half of all U.S. venture capital-backed startups. It is also tied to 44% of venture-backed technology and healthcare companies that went public last year. Notably, those sectors have been severely damaged and are on the lookout for liquidity.

Chalking out the timeline of events, General Partner at Uncommon Capital tweeted:

Stalwarts from the cryptocurrency industry, from executives like Binance’s CZ to investors like Anthony Pompliano, have all been talking about the current state of affairs. With Silvergate Capital’s abrupt shutdown and the latest Silicon Valley Bank episode, Wall Street has started questioning if the sector is stepping into a crisis. Even though it all seems chaotic at the moment, only time will tell if we’ll witness another banking crisis like the one in 2008.

Also Read: After Silvergate, Stablecoins Use for Crypto Trading Likely to Improve