The advent of DeFi (decentralized finance) is changing the way humans conduct banking, lending, borrowing, and trading. Nonetheless, the downside of impermanent loss still plagues the sector. Impermanent loss is a situation where profits made from staking are less than what is possible by just holding the asset. Many investors chose to rely on centralized exchanges to escape impermanent loss.

However, 2022 has proven that centralized firms might not be the safest option, with FTX being a prime example. This is where SmarDex comes into play. SmarDex is an automated market maker (AMM), with a unique solution to solve and tackle impermanent loss.

The project has earned $33 million in total value locked (TVL) in just over a week. Their method produces fewer impermanent losses than any other system. Additionally, they are supported by a study that is in the top 0.1% of papers on academia.edu. The paper is titled “The SMARDEX Protocol: A Novel Solution to Impermanent Loss in Decentralized Finance.” Researchers from the premier institution in Europe, École Polytechnique Fédérale de Lausanne, are a core part of the team. The group has created an innovative solution that can compete with companies like Binance and UniSwap.

SmarDex provides services such as liquidity providing, farming, and staking. The SmarDex protocol automatically takes care of optimizing user profits. The platform also provides minimal fees for its staking initiative and it has the least possible slippage in the market.

How good is SmarDex?

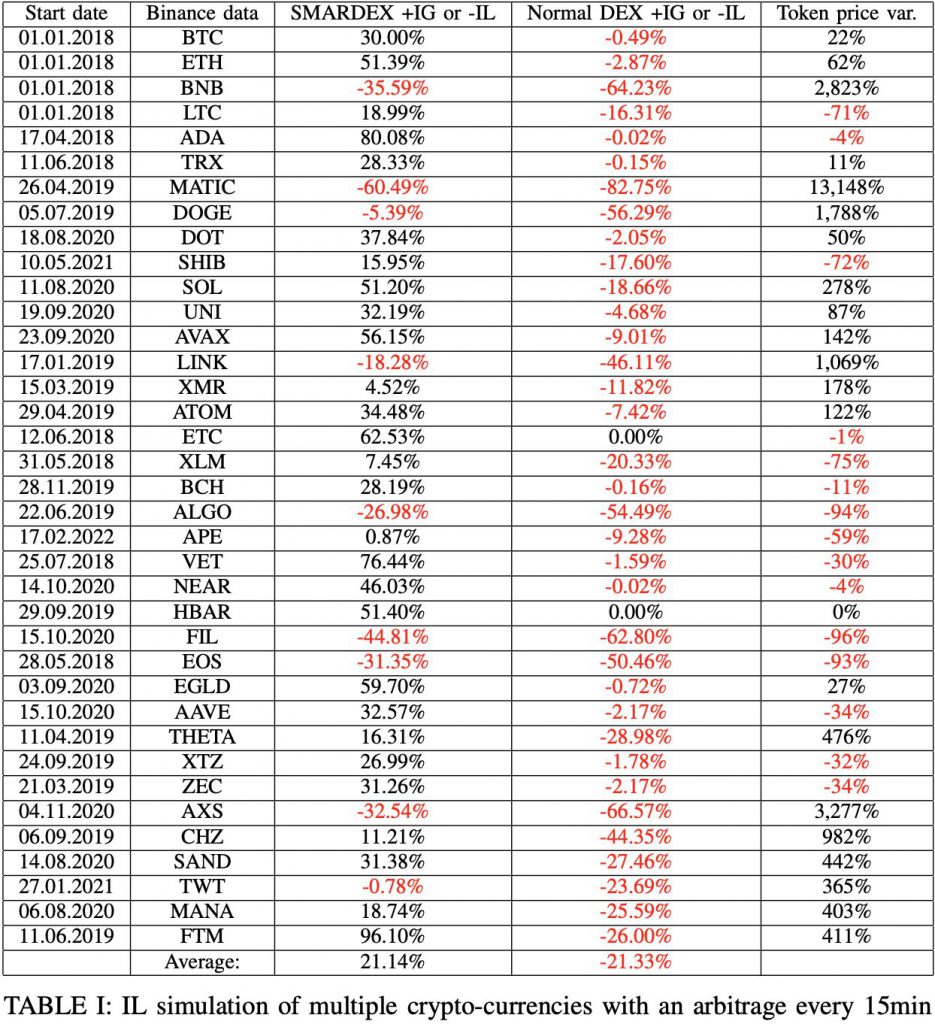

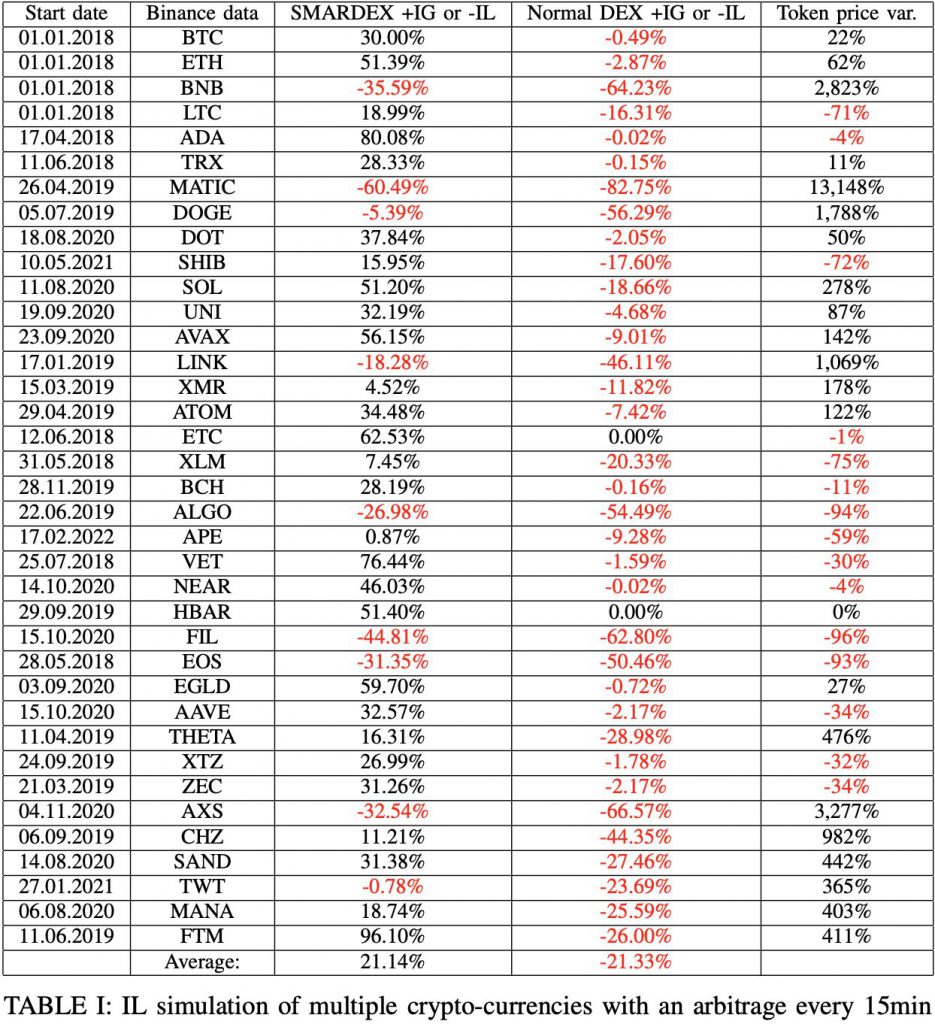

As per a simulation, the SmarDex protocol has an impermanent gain of 21.14%. Whereas a typical Dex has an impermanent loss of 21.33%. The protocol’s effectiveness is observed in a recent simulation.

Many simulations were conducted to evaluate the SmarDex protocol’s performance, in comparison to that of other DEXs. The results have mostly favored SmarDex over its rivals (100% of the time), showing that it outperforms other DEXs. To achieve precise and profitable outcomes, it is crucial to stress that the simulations were carried out using strict and defined techniques. Moreover, real-world data was included in the simulations to match the current market situation.

The successful simulation results implied that SmarDex offers a better trading experience than other DEXs. To verify the favorable results seen in the simulations, interested parties might put the protocol to the test in actual situations [13]. Furthermore, live tests might help to identify features in the functionality of the protocol that one cannot see in a simulated environment. In general, confirming the simulation results with real testing is a crucial step in determining the validity and dependability of the aforementioned dataset.

It appears from the numerous scenarios that the technology is sound and that older DEXs like UniSwap v2 might become irrelevant. The protocol’s success serves as a reminder of the value of ongoing DeFi research and development. It offers DeFi new opportunities and a promising path for users, developers, and investors.

To know more, you can read the project’s whitepaper, or visit their website, or Twitter page.

DISCLAIMER: THIS IS A SPONSORED ARTICLE.