Solana Fibonacci analysis unleashes a jaw-dropping bullish setup for SOL, as red-hot technical indicators blast off into perfect alignment. The crypto market volatility has ignited an absolute powder keg of trading opportunities, with veteran analysts focused on explosive targets at $225 and $260, backed by solid technical data.

Also Read: Grand Theft Auto 6 PC Version Could Release in 2026, Hints Corsair CEO

Solana’s rebound potential: Fibonacci levels, volatility, and price prediction insights

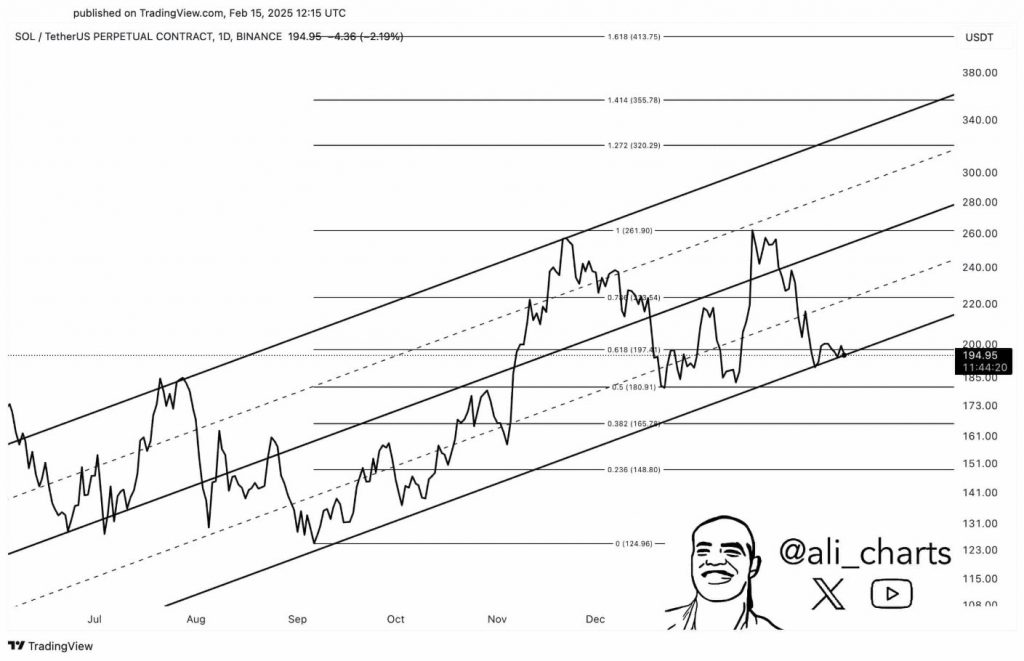

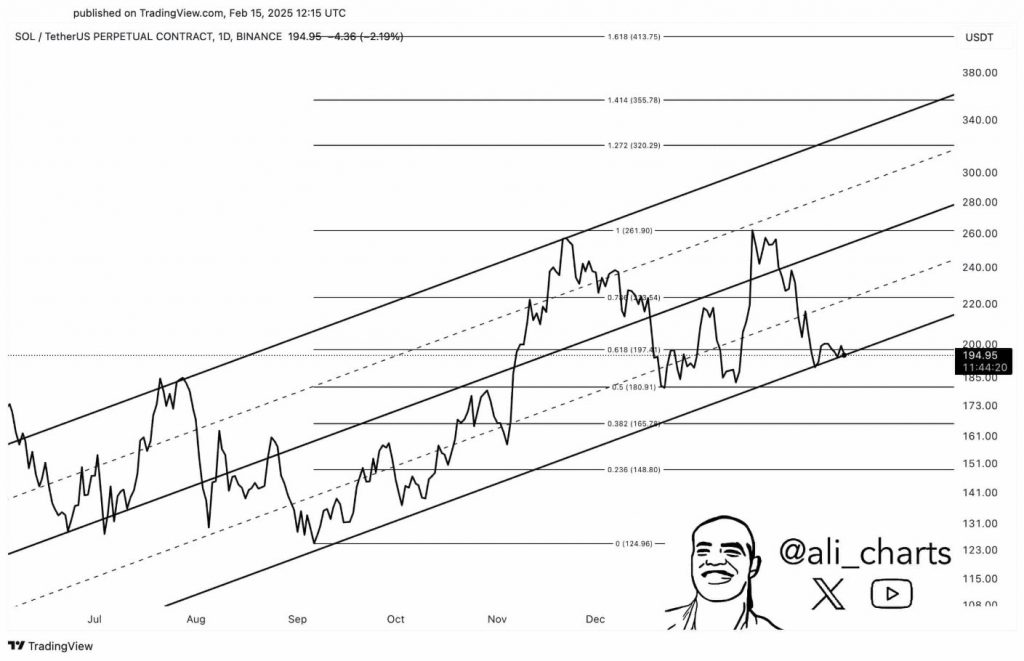

Technical Analysis Unleashes Channel Power

Analyst Ali Martinez stated:

“SOL has been following a clear parallel channel, a pattern often associated with steady price movement within defined levels.”

The Solana Fibonacci retracement levels have created an absolute monster of a technical setup, with the game-changing 61.8% level locked and loaded at $225. Technical analysis Solana experts are watching a face-melting MACD crossover that’s historically sent prices into the stratosphere. The cryptocurrency market volatility has created an absolute pressure cooker for explosive upward momentum within the tested parallel channel formation.

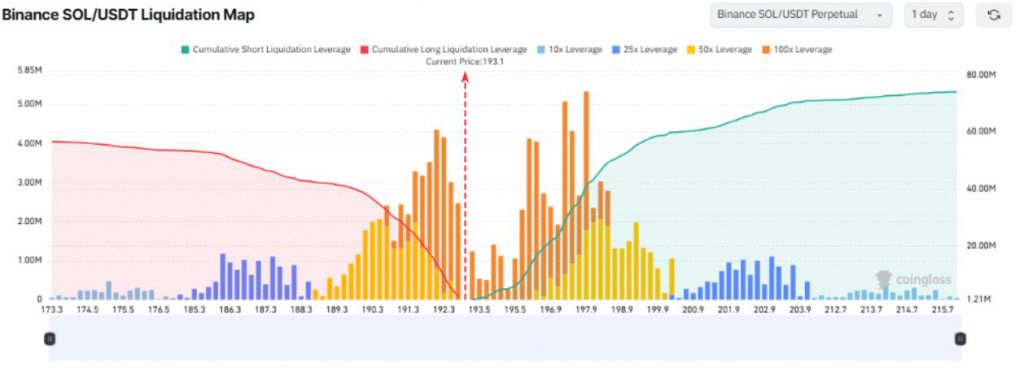

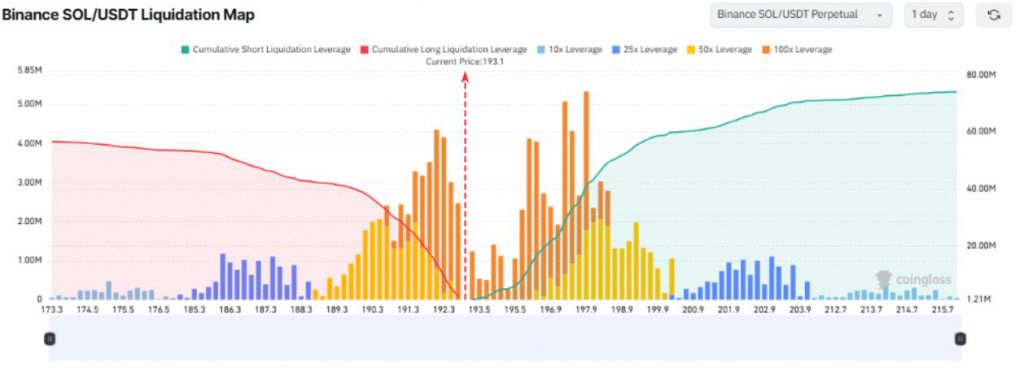

Mind-Blowing Liquidation Data Screams Market Reset

Fresh altcoin investments data exposes a nuclear-level spike in long liquidations near $193, while short liquidations sit shockingly quiet. The Solana Fibonacci patterns reveal bears getting absolutely crushed, as multiple high-octane indicators converge for an epic recovery phase. Market veterans hammer home that the strong $190 support level is the ultimate takeoff for amazing momentum.

Also Read: XRP Price Prediction: AI Sets Price For February 25, 2025

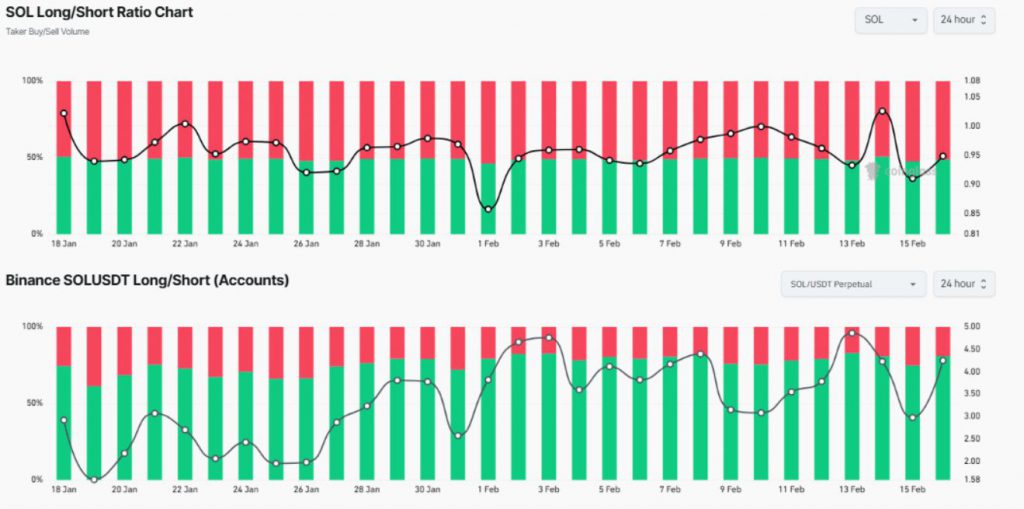

Long Positions Go Absolutely Ballistic

Technical analysis Solana legends point to a Long/Short Ratio that’s gone completely nuclear, showcasing unstoppable market conviction. The cryptocurrency market volatility has unleashed an absolute tsunami of strategic positions, with experienced traders loading up at current levels like there’s no tomorrow. This seismic shift in sentiment supercharges broader altcoin investments trends, signaling relentless buying pressure.

Open Interest Hits the Afterburners

SOL futures open interest is absolutely exploding, revealing massive institutional power entering the arena. The Solana Fibonacci patterns have increased this activity surge, as multiple elite-tier indicators scream concentrated buying pressure. Market data shows open interest going absolutely parabolic, historically the mother of all signals for great price movements in altcoin investments.

Also Read: De-Dollarization and the Privacy Debate: The Geopolitical Push for CBDCs

Price Targets Set for the Moon

The unbreakable $190 support level stands guard for SOL’s rocket-fueled path. Technical analysis Solana veterans spotlight multiple high-conviction Fibonacci-derived targets at $225 and $260. The current market structure, fortified by the bulletproof parallel channel formation and nuclear MACD crossover, lays down an absolutely perfect technical foundation for these price objectives.