The cryptocurrency market was seen recovering from its recent carnage. Amidst this, Solana [SOL] in particular was recording a notable increase of 6.36% over the last 24 hours. This was comparatively higher than the other assets in the market. This follows the July 8 filing of two Form 19b-4 applications by the Chicago Board Options Exchange [CBOE], one for the VanEck Solana Trust and the other for the 21Shares Core Solana ETF. The filings read,

“Much like Bitcoin and ETH, the Exchange believes that SOL is resistant to price manipulation and that ‘other means to prevent fraudulent and manipulative acts and practices’ exist to justify dispensing with the requisite surveillance sharing agreement.”

The Securities and Exchange Commission [SEC] has 240 days to determine whether to accept the rule modification that will allow CBOE to offer the VanEck and 21Shares products. But Eric Balchunas, a Bloomberg ETF analyst suggested that Solana ETFs would have a final deadline of mid-March 2025.

Balchunas noted that whether or not Trump is elected U.S. President in November will have a significant impact on the possibility that the SEC will approve the Solana ETF. According to the analyst, the Solana ETFs will probably be “dead on arrival” if Biden wins the election. But things could go either way if Trump wins.

Also Read: Solana Weekly Forecast: How High Can SOL Rise This Week?

Is Solana Eyeing $160?

Solana had been struggling over the past month similar to the other assets in the market. SOL surged by 7% over the past 24 hours. At press time, the altcoin was trading at $143.00. The daily volume of the network rose by 54% and was at $3,491,927,463.

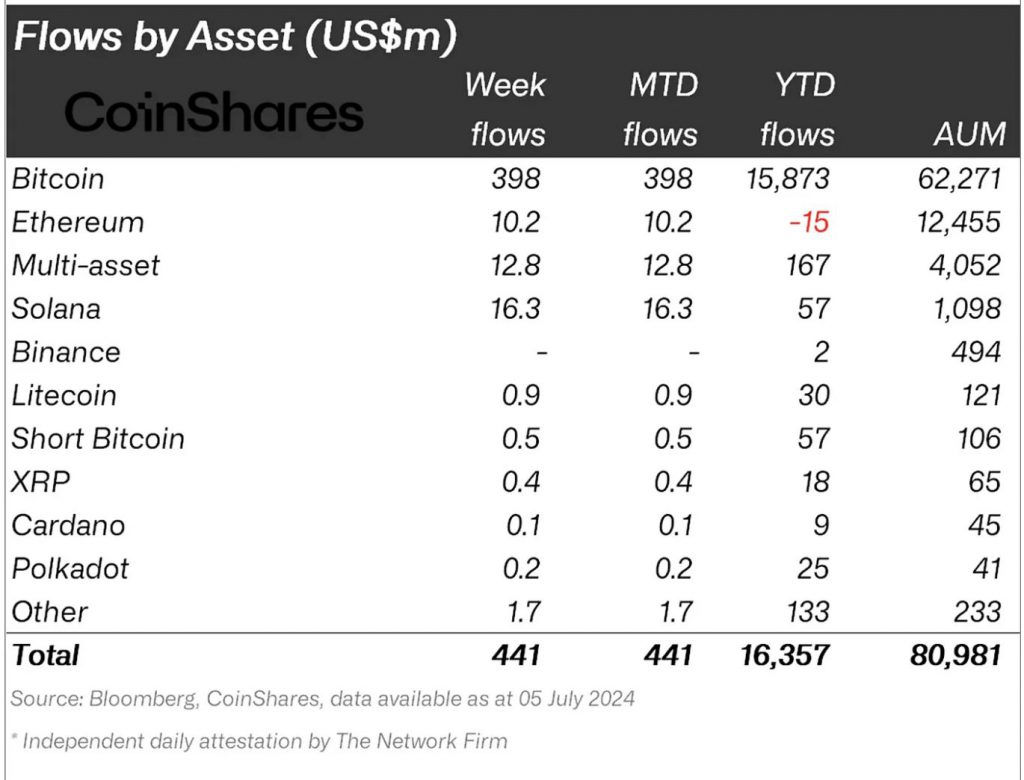

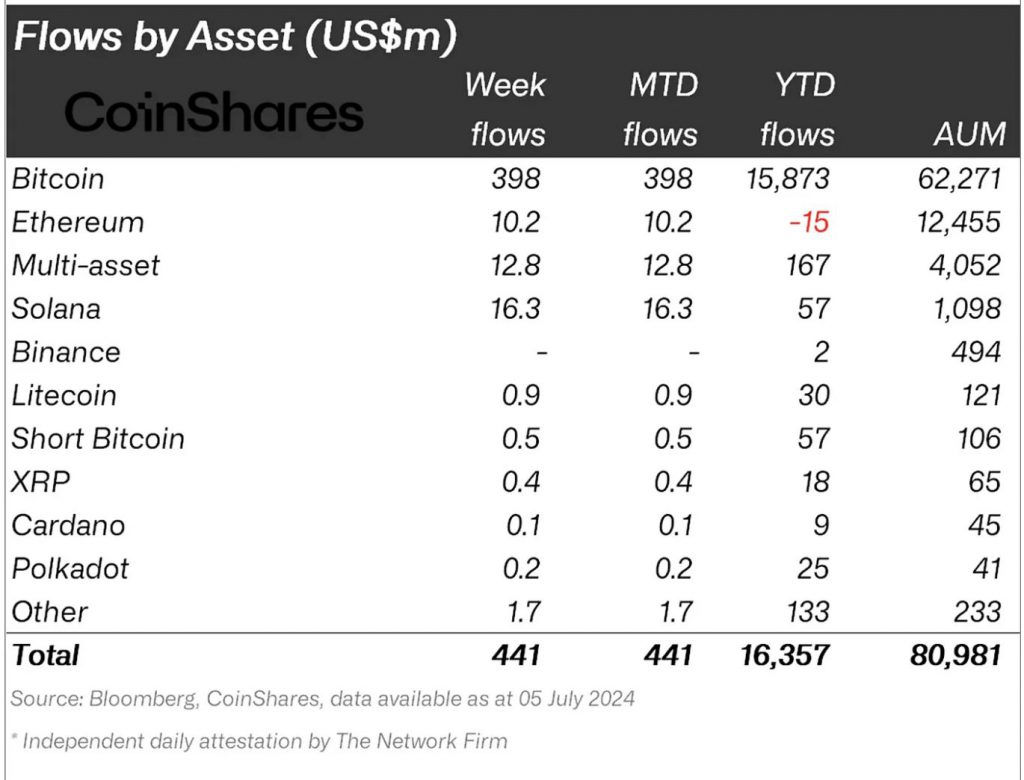

Solana-based investment funds had inflows of $16.30 million last week. This was above the $10.20 million inflows of Ethereum [ETH] at the same time. With this significant gain, SOL’s total inflows for the year have jumped to $57 million.

Also Read: Solana: VanEck Says SOL ETF is More Likely if SEC Fires Gensler