Even though the infamous FTX crash occurred days ago, its after-effects continue to linger in the market. Amidst this, several assets associated with the exchange went on to plummet along with the entire market. While Bitcoin [BTC] revisited its two-year lows, other assets like FTX Token [FTT] and Solana [SOL] were drowning in corrections.

Solana’s downfall surprised the vast majority of the market. While speculations took the front stage, the Solana Foundation decided to shed light on its exposure to the FTX crash. In a blog post, the foundation noted how it entailed $1 million in cash or cash equivalents on the exchange. This was before FTX decided to put a pause on withdrawals.

Six months after the introduction of Mainnet Beta, in August 2020, FTX/Alameda made its initial acquisition of SOL from the Solana Foundation.

The Foundation further confirmed that this was less than 1 percent of its cash therefore, the crash’s impact on the platform was minimal. However, the foundation went on to update its balance sheet the Solana Foundation elaborated on its exposure to the troubled platform.

It reportedly entailed about 3.24 million shares of FTX Trading LTD common stock, about 3.43 million FTT, and around 134.54 million SRM. It should be noted that these were worth more than $160 million before things went down.

In addition to this, Sollet Bitcoin which is a tokenized version of Bitcoin on Solana was also impacted.

FTX was in charge of keeping the Bitcoin that supported those tokens, but according to November 10th balance sheet findings, the exchange had no Bitcoin on its asset side. According to the Solana Foundation, as of that time, it had added $40 million invested in Sollet-based assets like soBTC. It further said that “the status of the underlying assets is unknown at this time.”

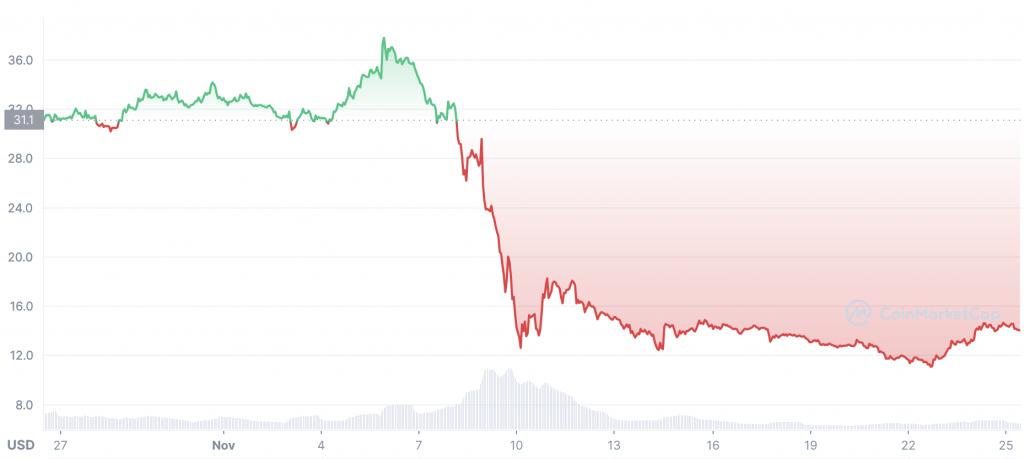

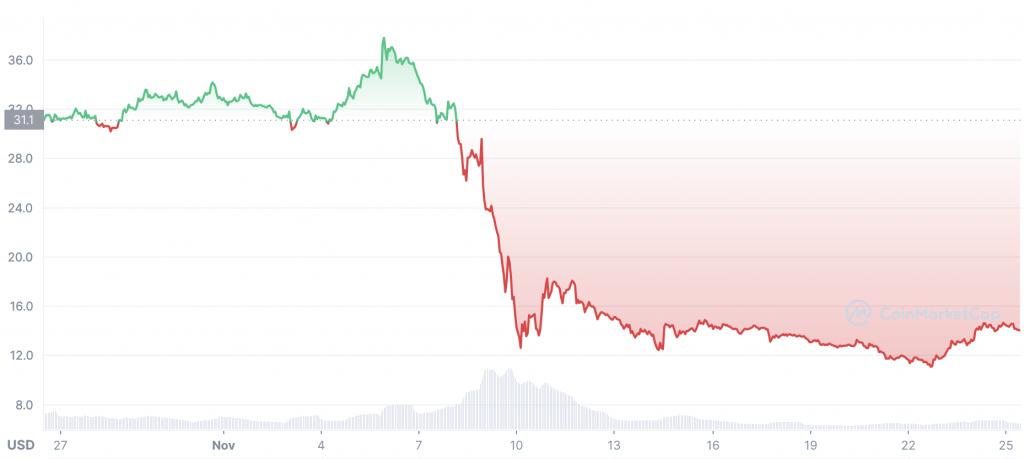

Solana sinks below $14

As mentioned earlier, Solana was among the worst-hit assets post the FTX crash. While it was trading for a low of $11.01 earlier this week, it managed to jump back to $13.99, at press time.

It should be noted that its current level was attained following a drop from a high of $38.55. At present, SOL continues to trade 94.62 percent below its all-time high of $260.06.