Keeping up with the ever-increasing network activity has always been challenging for humble, old blockchains like Ethereum, Solana, and BNB. To some extent, the scalability issue has hindered the adoption path of L1 solutions. With time, however, faster and better solutions have been created on top of existing layers to address the said issue.

Resultantly, L2 networks started stealing the thunder from L1s last year, and stalwarts had started preaching that the former would lose their relevance over time. Now, amid the harsh market conditions, top L1 networks are undergoing their litmus test.

L1 networks and their respective tokens managed to fare reasonably well during previous bear markets. Consider this – during 2018’s choppy phase, BNB outperformed almost all top 100 assets and showed strength. However, things do not seem to be in its favor this time.

Ethereum, Solana, BNB – Which network has been able to step up?

L1 networks’ on-chain metrics had been painting a bleak picture since November last year. Ethereum and BNB Chain seem to be on a much more slippery slope when compared to Solana. Take the case of the number of user transactions itself, for starters.

Per CMC’s data, BNB Chain has noted the “greatest drawdown,” with its daily transactions falling 58.2% from the day of its ATH. Solana and Ethereum, on the other hand, are down 18.1% and 13.7%. The red numbers for all the networks suggest that the demand for network resources has fallen, and network utilization has taken a bad hit.

Alongside, in terms of daily active addresses, CMC highlighted,

“… we found that BNB Chain and Ethereum declined by 68.8% and 27.2% respectively since November 2021. Solana, on the other hand, managed to grow its daily active address base by 20.4% in this time.”

Solana’s network activity rise can be attributed to the expansion of its NFT and DeFi ecosystem. Notably, its integration with OpenSea and the rising adoption of its native Phantom Wallet contributed to the surge. On the other hand, no outhouse or in-house factor could shield the other two networks.

Read More: Here’s why Solana could be the face of OpenSea

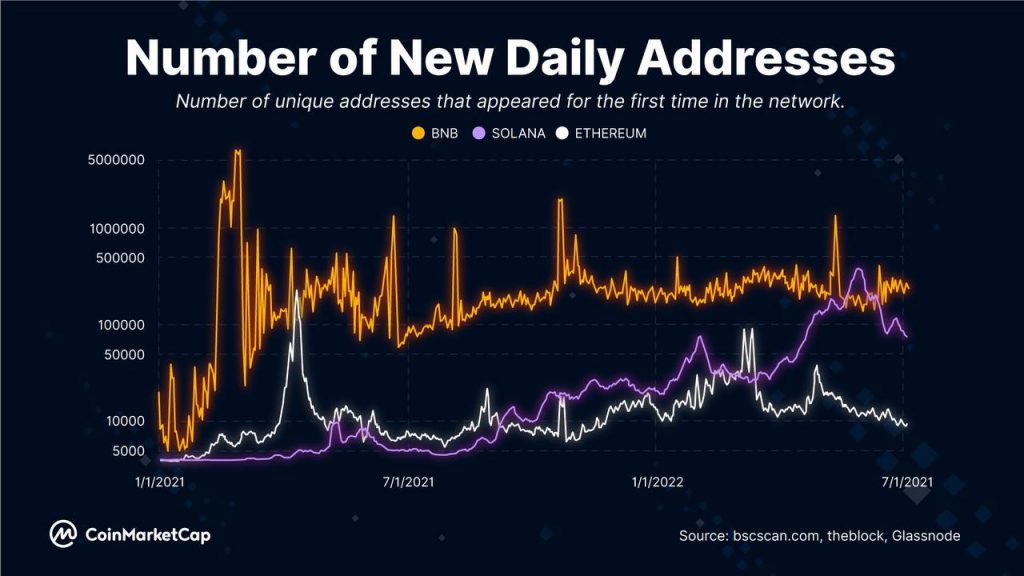

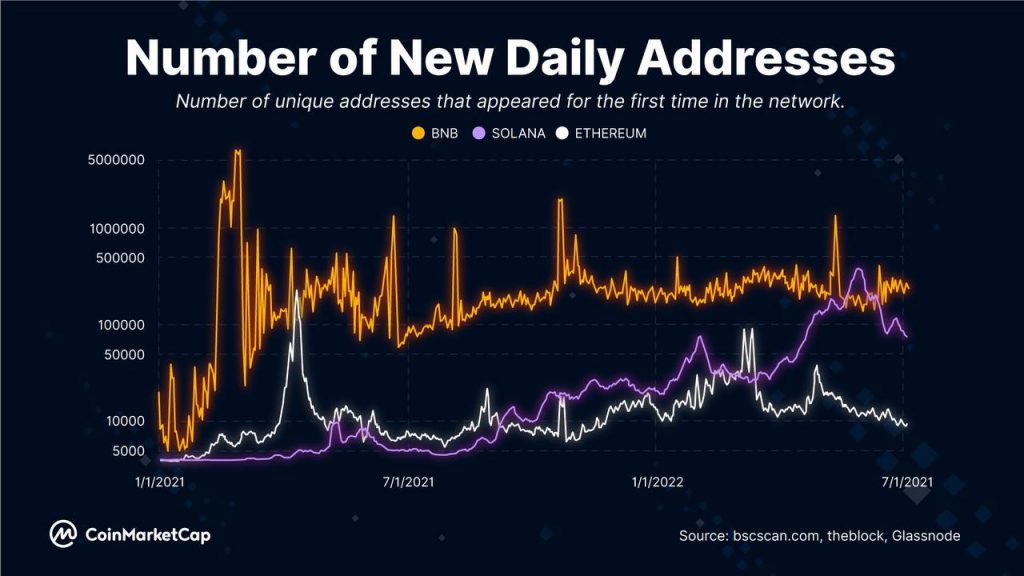

New network participation, like other metrics, has been gradually falling for Ethereum and BNB Chain. Solana has, however, managed to “buck” the trend.

Post reaching its ATH, BNB Chain’s new daily active addresses have dipped by approximately 17.9%. Ethereum’s numbers, on the other hand, shrunk by more than half [51.8%, to be precise].

Solana, again, saw its new daily active addresses rise by 58.6% in the same period, making it the only major L1 network to grow its user base throughout the bear market consistently.

Beware, though!

Clearly, per the datasets above, Solana has been in a better position when compared to Ethereum and BNB Chain. Even though this is positive, traders shouldn’t forget that the same factors have been plaguing the network and have triggered outages repeatedly.

So, even though Solana is HODLing the torch and leading the pack, it might not necessarily be the long-term winner until issues are resolved.

Read More: Solana Suffers Outage, Network Halted Globally