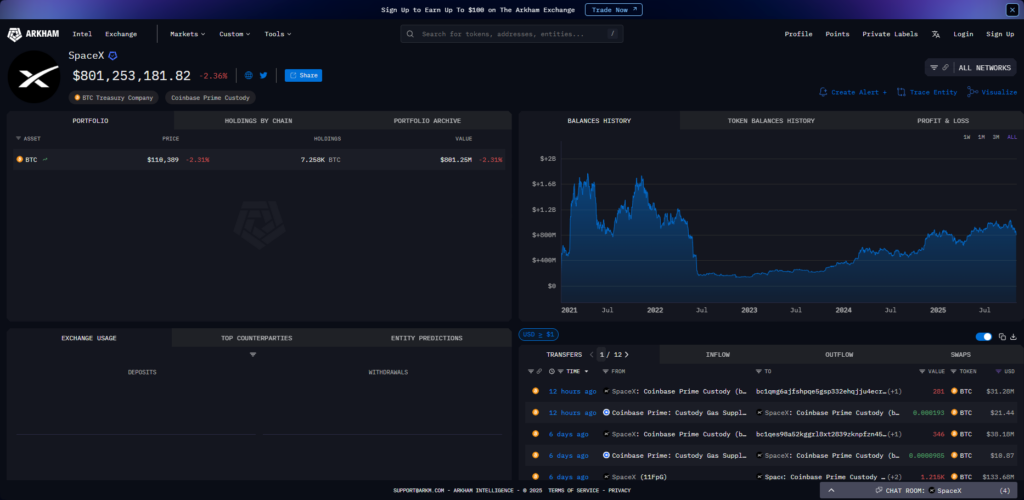

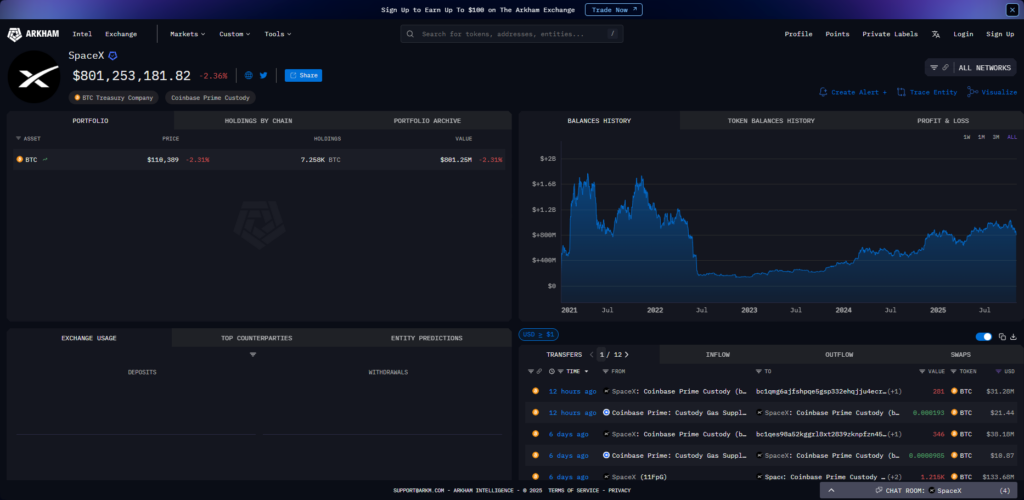

SpaceX‘s Bitcoin transfer activity totaling $31.28 million has been tracked by Arkham Intelligence, marking the aerospace company’s third major Bitcoin movement in just under two weeks. The transfers involve 281 BTC that were moved to new wallet addresses, and this comes as Tesla’s Bitcoin holdings remain substantial at approximately $1.25 billion, or 11,509 BTC tokens according to data from Arkham Intelligence right now.

Musk’s Crypto Strategy: SpaceX Bitcoin Transfer and Tesla Holdings Explained

SpaceX Bitcoin Transfer Patterns Bring Up Questions

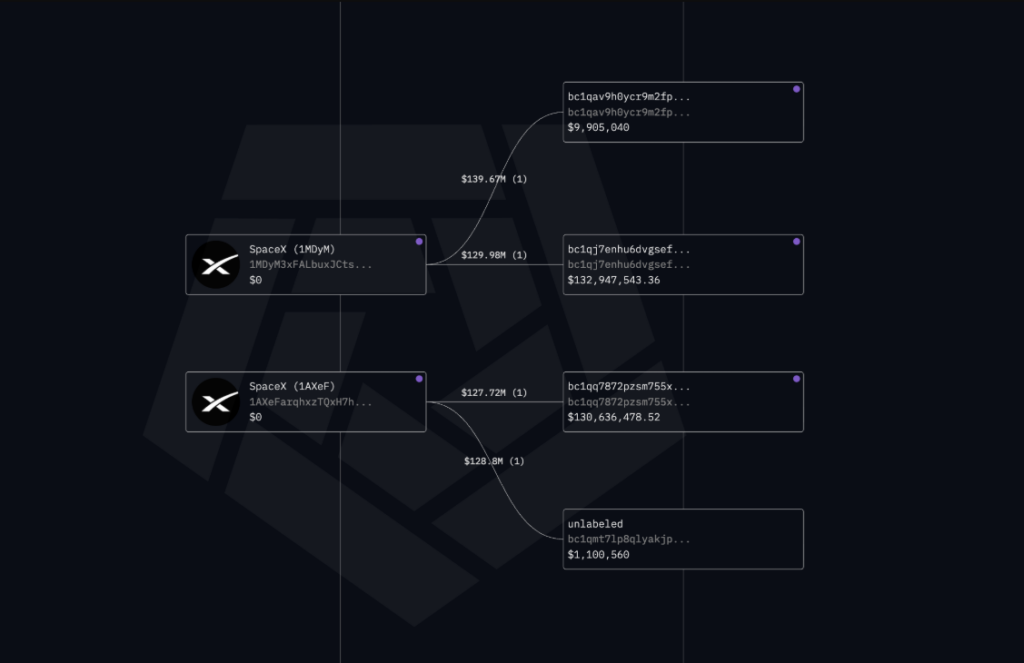

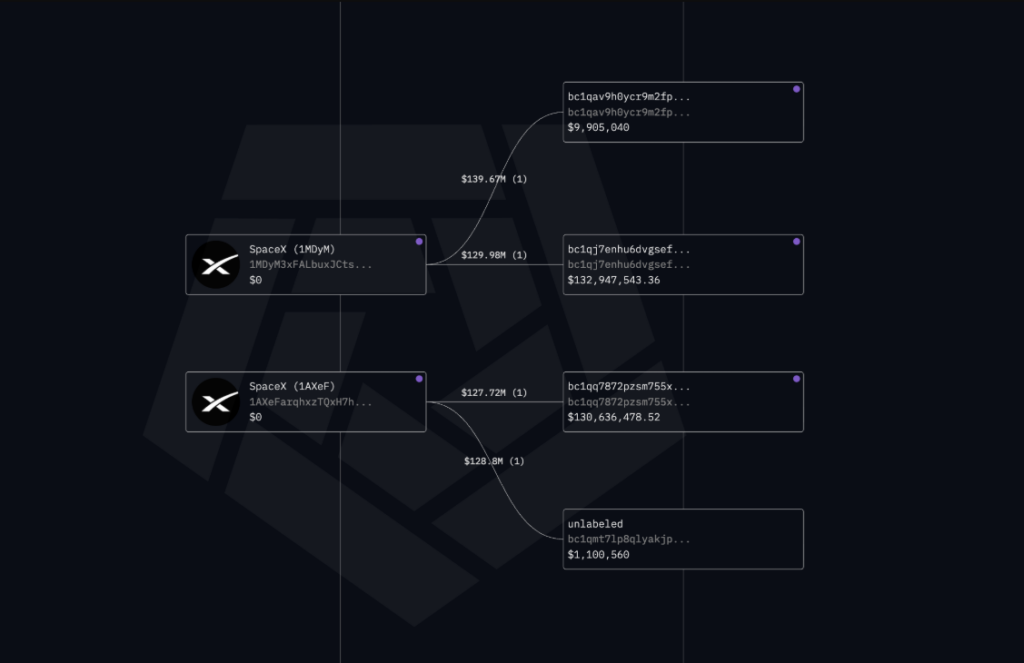

The recent SpaceX Bitcoin transfer is actually the third significant movement within 10 days, which has brought up questions about the company’s intentions. Previous transfers on October 21 involved 2,495 BTC worth approximately $257 million, and blockchain analysis by Lookonchain along with Arkham Intelligence confirmed these transactions.

According to Arkham Intelligence, SpaceX’s Bitcoin portfolio is valued at around $790.95 million right now. The transactions sent Bitcoin from SpaceX wallets to addresses that were associated with Coinbase Prime Custody.

One analyst also had this to say about the SpaceX Bitcoin transfer frequency:

“3 transfers in 10 days isn’t ‘custody.’ It’s positioning before a major policy shift.”

Blockchain analyst Dean Steinbeck from Arkham Intelligence commented:

“Corporate entities like SpaceX are increasingly active in managing crypto treasuries to optimize liquidity and risk.”

Also Read: Rocket Lab (RKLB) Jumps as Morgan Stanley Sets $68 Target, Cites SpaceX Link

Tesla Bitcoin Holdings and Musk’s Renewed Defense

Tesla Bitcoin holdings present a different picture, with the electric vehicle manufacturer maintaining 11,509 BTC tokens valued at $1.25 billion. Collectively, SpaceX along with Tesla now hold BTC worth $2.04 billion.

In a significant shift from his 2021 environmental criticism, Elon Musk recently also defended Bitcoin’s energy-based foundation. Musk stated:

“That is why Bitcoin is based on energy: you can issue fake fiat currency, and every government in history has done so, but it is impossible to fake energy.”

Strategy Executive Chairman Michael Saylor responded:

“The laws of nature are superior to the laws of man.”

Cryptocurrency expert Laura Shin noted in recent commentary:

“These corporate wallet activities often precede strategic decisions, but in SpaceX’s case, it appears to be housekeeping.”

Also Read: SpaceX Starship Megarocket Launch Sends Space Stocks Soaring

Corporate Bitcoin Holdings Face Scrutiny

The SpaceX Bitcoin transfer activity also comes amid larger debates over institutional holders. Whether these transfers reflect routine custody operations or reflect more significant strategic shifts in Musk crypto strategy remains unknown. The transparency that was given by tracking by blockchain using Arkham Intelligence makes such movements to be monitored closely.