Investors have earnestly been waiting for Bitcoin to commence its next bullish leg. The largest asset has been able to erase a significant amount of investor losses in 2023. On the YTD frame, BTC is up by more than 82%. Macroeconomic factors, like inflation number releases, have started becoming non-events. Despite the better-than-expected outcome revealed a day back, Bitcoin’s price failed to react.

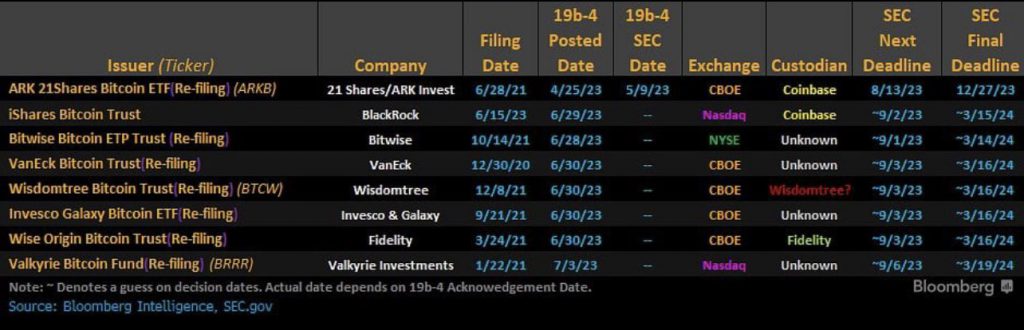

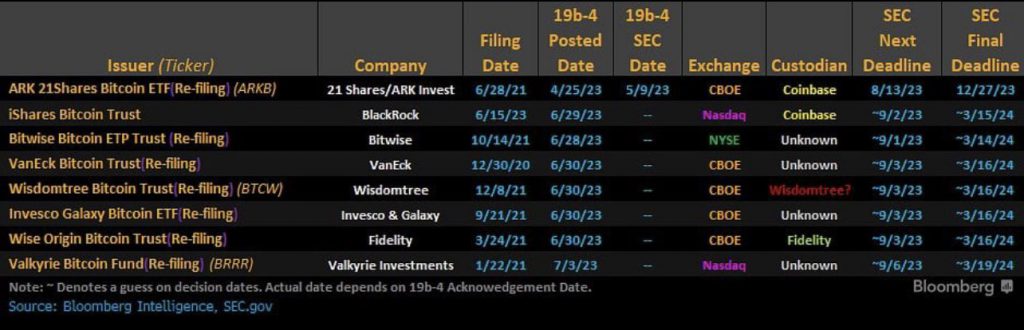

Well, ETF catalyst might once again help Bitcoin ride the bullish wave. As illustrated below, 21Shares, ARK and CBOE [Chicago Board Options Exchange] are first in line because their next SEC decision date is Aug. 13, 2023. The approximate deadline for all other filings is in the first week of September. So, if the regulatory agency ends up green-flagging the spot applications, then, an organic rally will likely fructify. Nevertheless, if the SEC delays its decision to Q4 2023 or Q1 2024 then, a ‘non-event’ neutral reaction can be expected from Bitcoin.

Also Read: Spot Bitcoin ETF Approval by SEC ‘Fairly High’: Bernstein

Bitcoin will rise by the end of 2023: Mike Novogratz

Some community members are worried about a rejection. So in the worst-case scenario, if that happens, we might see a reactionary dip immediately, but it wouldn’t dent Bitcoin’s fundamentals that hard. The market has seen several rejections in the past. In fact, on such days, Bitcoin has ended up rising.

On Dec. 22, 2021, when Valkyrie and Kryptoin’s request wasn’t sanctioned, BTC rose and shed merely 0.6% of its value. However, the next day, it turned the tables and rose by 4.63%. Likewise, when Wisdomtree’s application was rejected on Oct. 11, 2022, BTC lost merely 0.38% but it went on to gain 0.5% and 1.1% over the next two days, making up for losses. Thus, either way, Bitcoin’s fundamental rebound in the coming months is likely.

Several from the space are quite optimistic about the SEC’s rulings. Brokerage firm Bernstein, for instance, recently asserted that the spot BTC ETF Approvals by the SEC are “fairly high.” Even Mike Novogratz seems to be on the same page. In a recent interview with Bloomberg, the Galaxy Digital Founder predicted that regulators will approve the Bitcoin ETFs. Parallelly, he feels that the end of the year is the time to expect a proper bullish turnaround from Bitcoin.

The market conditions have changed over the years. The players involved now include the world’s largest asset manager and several other prominent names. Even though the slate looks clean now, there are still slight odds of things going haywire. Just like how ETFs instigated the current recovery the market is seeing, they can also disrupt it. However, history gives us hope. End of the day, only time can decide the ultimate fate of the market.

Also Read: Europe: First Bitcoin ETF to Go Live After 1 Year Delay