Investors in the U.S. have been waiting for the SEC to approve a spot Bitcoin ETF for quite some time now. The agency green-flagged the first leveraged BTC futures ETF in June this year. The approval came as a surprise to many. Nevertheless, it managed to rekindle hope, as community members saw this as an “early sign of SEC lightening up.” Prior, the commission had already given its nod to a host of futures ETFs, including ProShares’ BITO and BITI.

A bunch of companies, including BlackRock, Fidelity, Invesco, and VanEck yet again submitted their requests for a spot Bitcoin ETF in June. Even though the applications currently lie on the agency’s desk, regulators reportedly feel that the filings are inadequate. Specifically, the agency informed Nasdaq and CBOE Global Markets that the applications aren’t sufficiently clear and comprehensive. Notably, the aforementioned exchanges filed the applications on behalf of the investment managers.

The ‘spot’ concern

Brokerage firm Bernstein, however, seems to be on a different page. In a recent research report, it said that the probability of an SEC approval for a spot ETF remains to be fairly high. Bernstein pointed out that the agency is comfortable with regulated exchanges like the CME, and that is why it has already approved futures and leveraged BTC ETFs. However, the agency is skeptical when it comes to a spot BTC ETF because “spot exchanges [like Coinbase] are not under its regulation, and thus spot prices are not reliable and prone to manipulation.” However, there’s a loophole. Analysts led by Gautam Chhugani wrote,

“The court did not sound convinced that the futures price is not derived from the spot price, and thus to allow a futures-based ETF and not allow spot sounds like a difficult pill to swallow for the courts.”

Also Read: Crypto Investment Products See $199 Million Inflows: Bitcoin Contributes 94%

Existence of illiquid, inefficient products could lead to spot BTC ETF approval: Bernstein

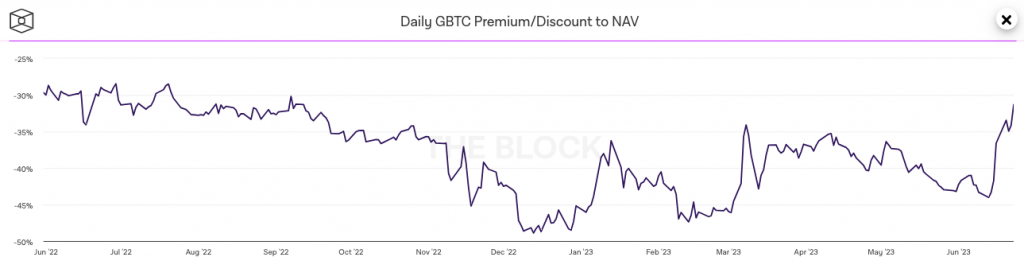

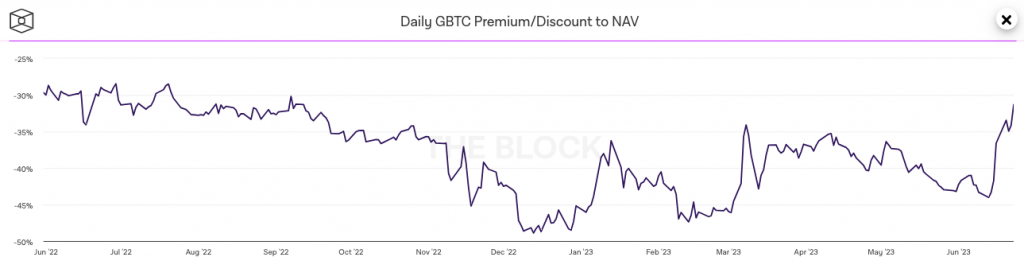

In fact, the report further underlined how the industry has now proposed a surveillance agreement between the spot exchange operator and regulated exchanges like Nasdaq. Other expensive, illiquid, and inefficient OTC products like Grayscale’s GBTC are currently trying to fill in the shoes of a spot BTC ETF. Despite its recovery on the YTD front, GBTC continued to trade at a 31% discount when compared to its NAV. According to Bernstein’s analysts,

“[The] SEC would rather bring in a regulated Bitcoin ETF led by more mainstream Wall Street participants and with surveillance from existing regulated exchanges, than having to deal with a Grayscale OTC product filling the institutional gap.”

Also Read: $7.4 Million Asset Managing Stellar Lumens Fund Shares Pump 430%