Last week was quite fruitful for crypto investors. With Bitcoin surpassing $31k, most other assets ended up riding the bullish wave. This week, however, brakes were applied. With bulls taking a breather, almost the entire market has been consolidating. At press time, only seven out of the top 100 were trading in the green on the daily, and Stellar Lumens was one among them.

Well, this Altcoin has been making quite some noise on social media. At press time, it was one of the trending topics on Twitter. In fact, data from LunarCrush pointed out that the social engagements associated with Stellar have risen by 270% over the past week, with the mentions registering a parallel 93% hike. At press time, XLM was trading around the psychological $0.1 mark, post noting a 20% appreciation in value over the past week.

Also Read: Bitcoin Cash Rallies 111% in 5 Days: Back From the Dead?

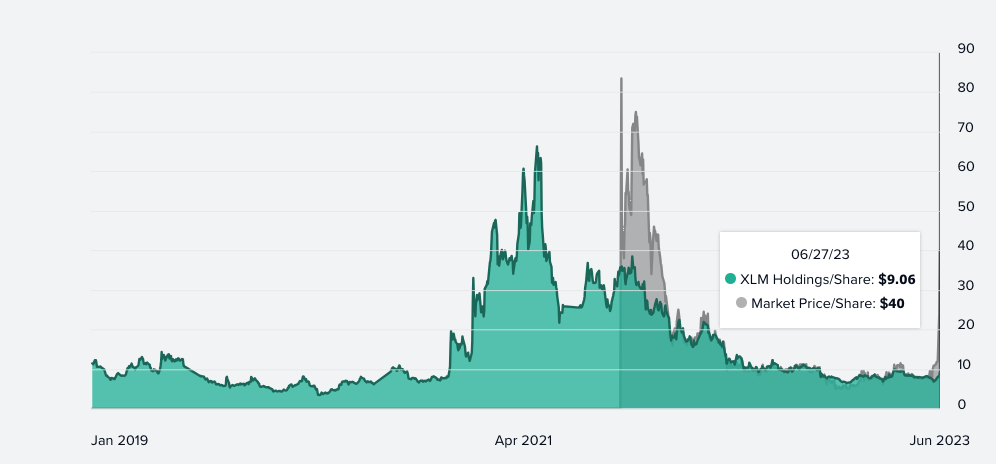

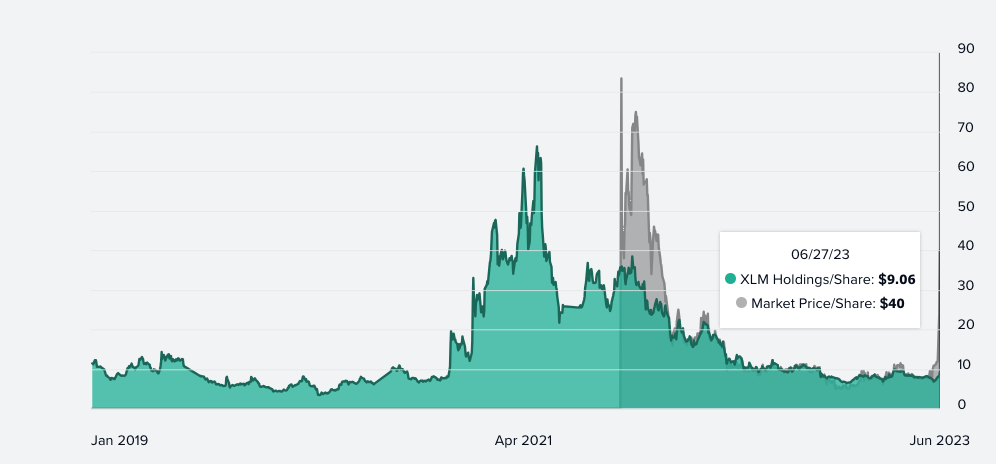

Grayscale Stellar Lumens Share Price

The share price of Grayscale’s Stellar Lumens Trust was the biggest beneficiary of XLM’s price rise. On June 12, the value of one share from the trust was just around $7.55. However, as of yesterday’s market close, the asset was trading 430% higher, at $40. The single day 99.6%, and $65.9% pumps on Monday and Tuesday, i.e. June 26, and 27, helped in pushing GXLM’s price to the said high. In the same period, XLM has only managed to notch up in value by 22%.

Also Read: Cardano Rallied 17,500% Last Bull Run: Will There Be a 2nd Wave?

As illustrated below, the last time the market price of the shares spiked to such a level was back around December 2021. The latest spike is one of the largest registered since then. At this point, if the $7,474,573 AUM of this trust is divided by the 824,600 shares outstanding, we’ll get a value of $9.06. Well, as of the latest close, that was exactly how much the holdings per share of the trust were worth.

Also Read: Crypto Investment Products See $199 Million Inflows: Bitcoin Contributes 94%