In a significant milestone for the cryptocurrency sector, Bitcoin exchange-traded funds (ETFs) listed in the United States experienced a notable increase in trading, with $4.6 billion worth of shares exchanged, according to data from the London Stock Exchange Group (LSEG). This surge closely follows the approval of these groundbreaking products by the U.S. securities regulator.

The approval signifies a pivotal moment for the cryptocurrency industry. It raises questions about whether digital assets are still perceived as risky by many professionals. It further can establish broader acceptance as a viable investment alternative.

A Turning Point for Digital Assets

The green light for eleven spot Bitcoin ETFs. This includes prominent options like BlackRock’s iShares Bitcoin Trust (IBIT.O), Grayscale Bitcoin Trust (GBTC.P), and ARK 21Shares Bitcoin ETF (ARKB.Z), representing a turning point for the cryptocurrency industry. These ETFs, which commenced trading on Jan. 11 morning, have sparked intense competition among industry participants vying for market share.

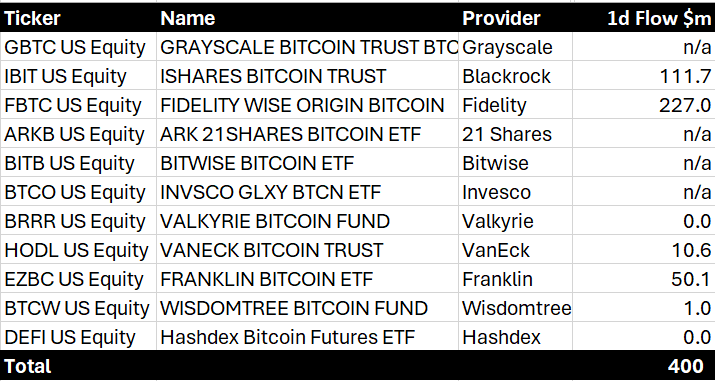

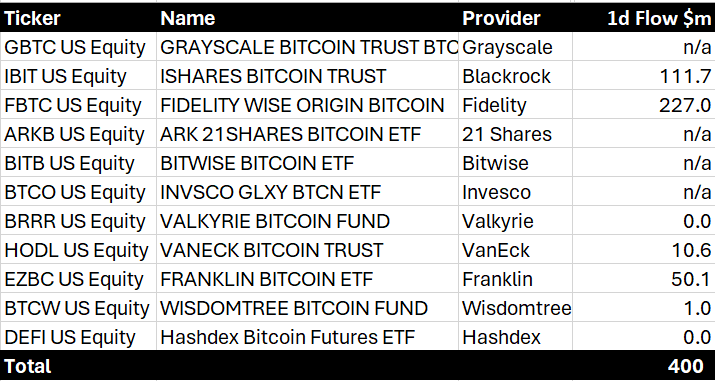

BitMEX Research data indicates a total net positive inflow of $400 million for the seven spot Bitcoin ETFs. Specific ETFs have garnered attention in this surge. This comes with FBTC witnessing a net inflow of $227 million, IBIT registering a net inflow of $112 million, EZBC with a net inflow of $50.1 million, and HODL showing a net inflow of $10.6 million. Notably, Grayscale, BlackRock, and Fidelity have emerged as dominant players based on trading volumes, according to LSEG data.

Also Read: Elizabeth Warren Says SEC Was Wrong In Bitcoin ETF Decision

Looking Beyond the Initial Trading

While the initial trading volumes for these new ETF products have been robust, experts emphasize the importance of not interpreting this as a short-term phenomenon. Todd Rosenbluth, a strategist at VettaFi, cautioned,

“Trading volumes have been relatively strong for new ETF products. But this is a longer race than just a single day’s trading.”

This underscores the necessity for a comprehensive evaluation of market dynamics and investor sentiment over an extended period.

Also Read: Spot Bitcoin ETF Trading Volume surpasses $4.5B in it’s First Day

The surge in trading activity, totaling $4.6 billion, for U.S.-listed Bitcoin ETFs signifies a critical moment for the cryptocurrency industry. The approval and subsequent trading of these groundbreaking products will serve as a litmus test for the broader acceptance of digital assets as mainstream investment options. As competition intensifies among ETF providers, ongoing scrutiny of trading volumes and investor behavior will be imperative to understanding the enduring implications of this industry-defining development.