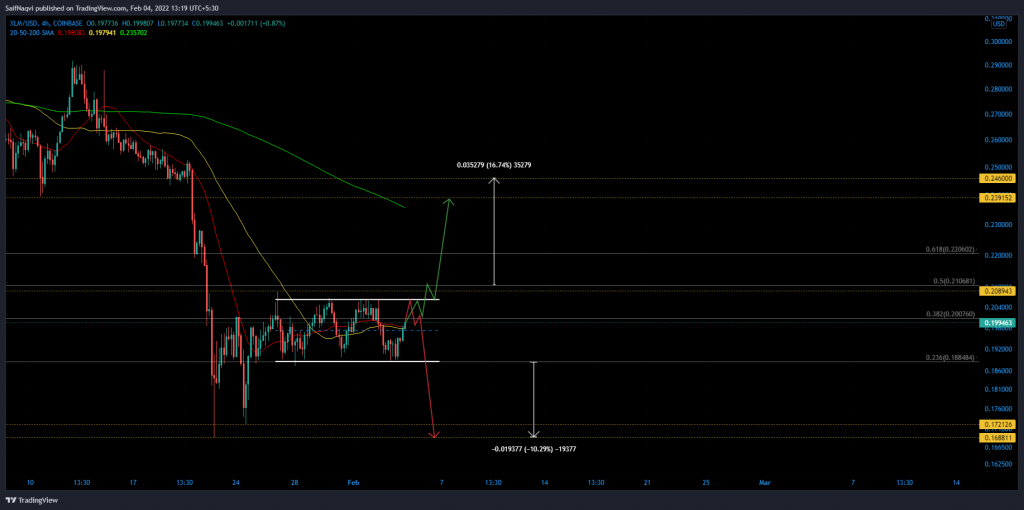

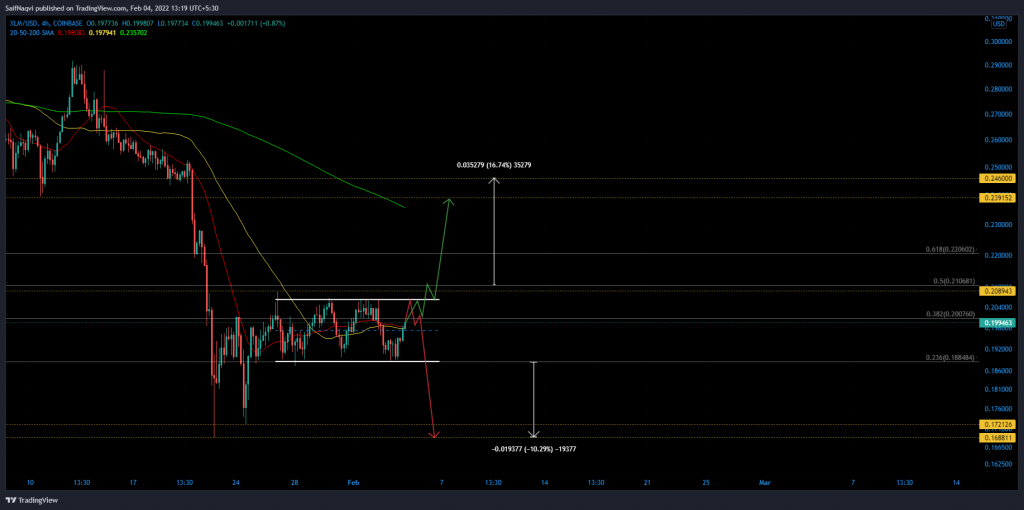

Stellar Lumens’ horizontal channel has played out for over a week with no breakout yet. However, the market sat up nicely for a few quick trades, depending on one’s risk apatite. At the time of writing, $0.192, up by 0.6% over the last 24 hours.

Stellar Lumens 4-hour Time Frame

Three highs set up at $0.206 and three lows at $0.188 (23.6% Fibonacci) outlined a horizontal channel on XLM’s lesser time frame. A fourth attack at the upper trendline was almost imminent after bulls gained momentum above the 20 (red) and 50 (yellow) SMA’s. A breakout would set XLM on course to $0.247. The resulting 11% hike would likely be quenched at the 4-hour 200-SMA (green) and daily 50-SMA (not shown) close to the target point.

Meanwhile, a rejection at the upper trendline would call for a new low at the 23.6% Fibonacci level (calculated from XLM’s decline from $0.253 to $0.168). Should bears discover strength for a breakdown, XLM would look for support between a newly discovered demand zone between $0.172-$0.168.

Trading Strategy

There are a few ways one can trade XLM on the 4-hour chart. Buy orders can be placed at the current level and take-profits can be set at $0.206. The high probable trade would result in a 3.7%-4% profit.

Those trading for a breakout must wait for the candles to advance above the 50% Fibonacci level. Although some gains would be foregone in this case, a safer entry point at $0.210 accounted for any throwbacks or bull traps between $0.206-$0.210. Take profits can be set at $0.246 while stop-losses should be maintained at $0.205. The hypothetical trade carried a risk/reward ratio of 5.

Finally, short traders can wait for a red candle to develop at $0.206 and set take-profits at $0.188. The trade would account for an 8% profit. A breakdown can be followed up by another short setup between $0.172-$0.168.

Conclusion

Trading a horizontal channel is rather straightforward. One must buy at support and sell at resistance. However, a breakout can get tricky, especially during throwbacks. The abovementioned levels can help one decide how to trade XLM’s multiple scenarios.