The relationship between the equity and crypto market has been ever-evolving. Nonetheless, people often tend to put the two asset classes on either side of the same equation and draw parallels.

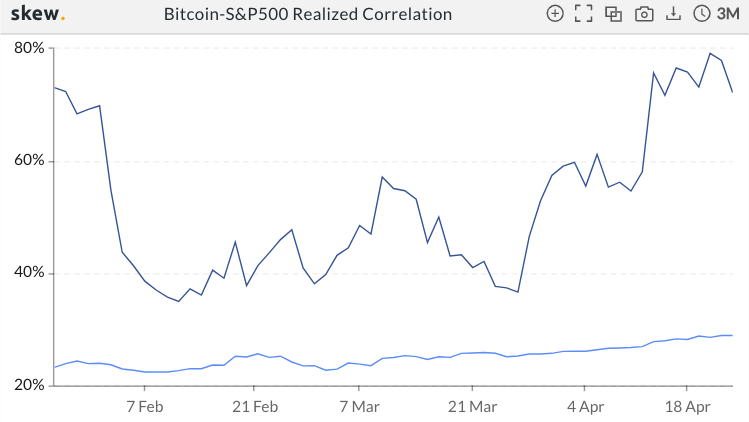

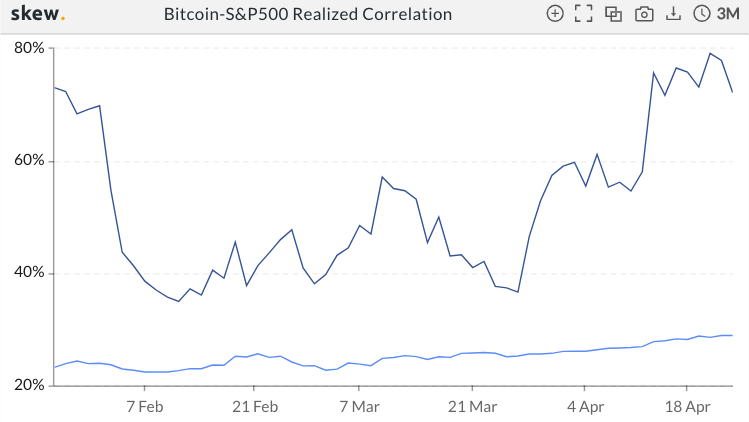

On 20 April, Bitcoin’s correlation to the S&P 500 hit its multi-month high and flashed a value of 79.2%. However, as the week ended, the number dipped down to 72.2%.

Over the past three months, several downtrend phases have been noted on the chart. However, most of them—not all—were initiated during the last few days of the week, rather than during the initial few days or mid-week period. Notably, something similar had panned out this time too.

So, it can be deduced that Bitcoin and the stock market’s movements have been fairly independent of each other during the initial days of most weeks, but have usually aligned by the end of them.

How top movers stocks have been reacting?

Now, it is usually presumed that price fluctuations in the crypto market are way more intense when compared to the stock market fluctuations. However, volatility has been becoming more and more synonymous with stock price movements of late.

Consider this – On Friday, the top stock losers shed double-digit percentage figures from their value [HCA HealthCare by -21.82%, Intuitive Surgical Inc. by -14.34%, and Universal Health Services Inc. Cl B by -13.96%]. Similarly, the top gainers too noted 7%-8% gains each [Kimberly-Clark Corp. by 8.13%, SVB Financial Group by 7.53%].

Meta and Netflix’s recent 26% share dump advocates the same narrative of how the stock market has gradually started becoming even more price sensitive.

Uno reverse: The volatility roles change

Asset prices in the crypto market, on the other hand, have remained stagnated in and around their current levels of late. On the whole, it seems like the volatility has been sucked out of the crypto market.

As can be noted below, the crypto volatility index’s reading of 65.5 is quite similar to what was noted 6-months back. The current levels are, in fact, nowhere close to previous local peaks.

Analyst Benjamin Cowen had recently suggested that stocks are becoming more like crypto. To a fair extent, that assertion aligns with our analysis.

Despite the short-term detachment, it shouldn’t be forgotten that EoD the macro geopolitical landscape remains to be same for both the asset classes and they would continue to impact each other’s movement one way or the other going forward.