During his address to the nation on Wednesday, Russian President Vladimir Putin announced the partial mobilization of the military. He said, that he was “defending” Russian territories and the West wanted to destroy the country.

He further accused the US of nuclear blackmail and said that Russia can respond. Per CNBC,

Putin accused the West of engaging in nuclear blackmail against Russia. Putin said that Russia had “lots of weapons to reply” to what he called Western threats and said that he was not bluffing.

Additionally, the Russian President ordered an increase in funding to boost the country’s weapon production to support Moscow’s war effort in Ukraine.

Stocks react

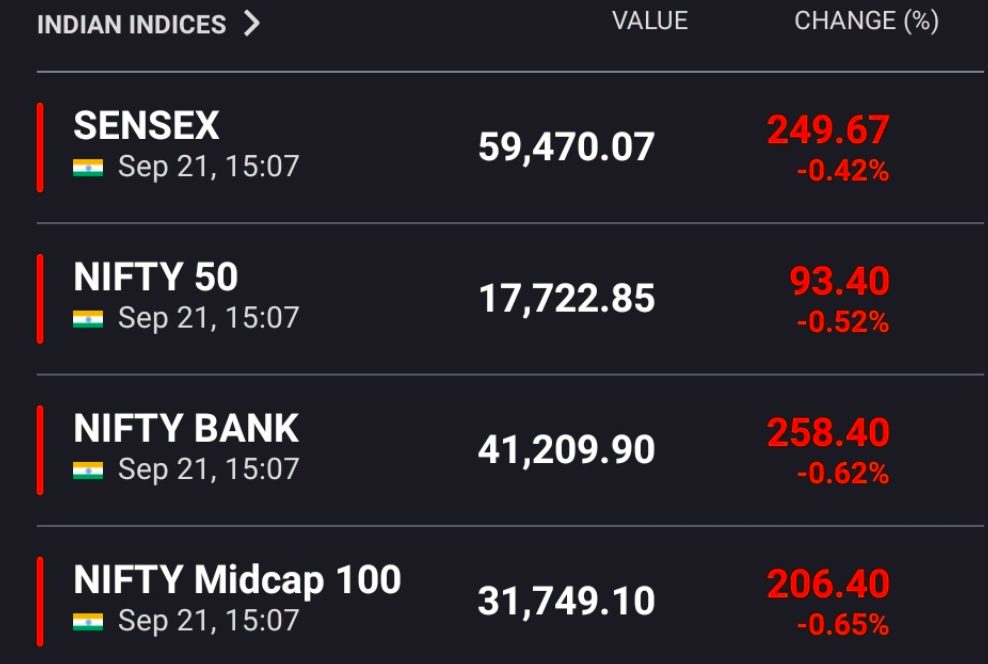

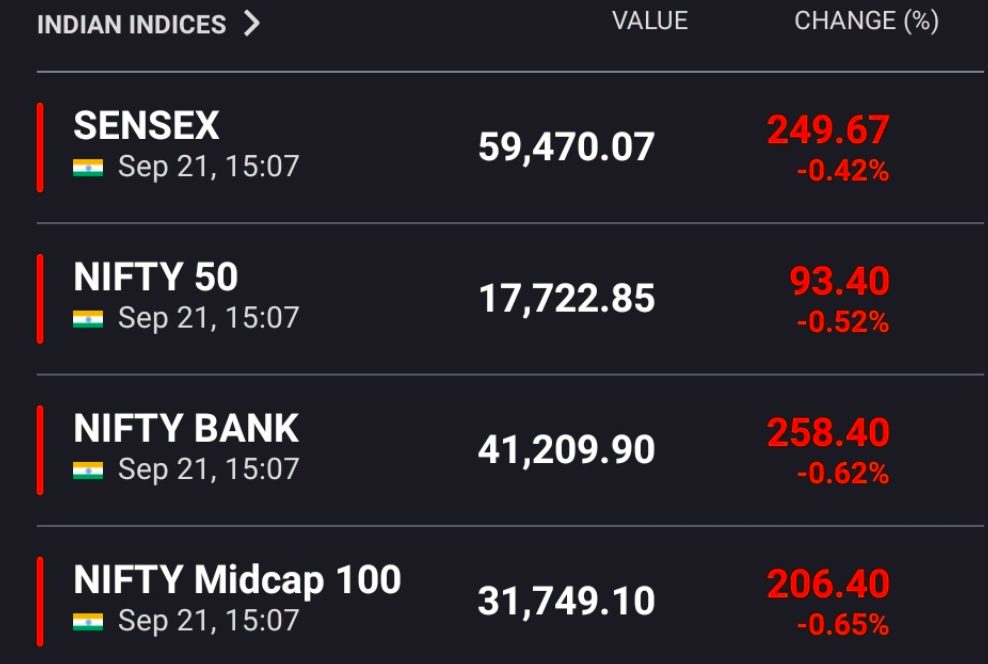

Asian stocks were quick to drop down on the charts. In India, for instance, both the Sensex and the Nifty 50 were trading in red at press time, after losing approximately 0.42% and 0.52% respectively. Alongside, other sectoral-specific and capitalization-specific indices were also trading in the red.

Right from Singapore’s SGX Nifty, Japan’s NIKKEI 225, Hong Kong’s Hang Seng, and South Korea’s KOSPI, to the Taiwan Weighted, Jakarta, and Shanghai Composite—all Asian markets were soaked in blood after registering dips in the 0.12% to 1.79% bracket [right-most column] on Wednesday.

US’s Nasdaq closed 0.95% lower, at 11,425.05 on Tuesday. The S&P 500, on the other hand, closed at 3,855.93, down by 1.13% yesterday.

BTC and the Crypto market

As highlighted above, Putin’s speech managed to infuse volatility into the broader financial market. The crypto market did not outrightly react, but top cryptos like Bitcoin and Ethereum were trading in red on the daily, post registering minor losses up to 1%.

However, there’s another factor that can inject volatility into the crypto market over the next few hours. Notably, the Federal Reserve began its two-day meeting yesterday. So, the interest-rate hike announcement will come by 2 p.m. ET today, when it releases the quarterly forecasts for inflation, the economy, and the future path of interest rates. Per CNBC,

“The Fed is expected to fire off another three-quarter point rate hike—it’s third in a row.”

Furthermore, Fed Chair Jerome Powell will start addressing at 2:30 p.m. ET. Over the past few months, crypto asset prices, especially that of Bitcoin, have been quite volatile around FOMC meetings. So, this time around also, a similar reaction can be expected.

Alongside, it is a known fact that markets—more often than not—produce chain reactions. That is, when one market is down, it ends up pulling the other, and so on. And given the correlation that Bitcoin shares with the stock markets, volatile movements can be expected today.

Also Read: Is Bitcoin becoming more tangled with Asian equities?

Additionally, a recent CryptoQuant analysis brought to light that when Bitcoin fell from $19.7k to $18.4k and rose back to $19.6k, approximately 3x more long positions were liquidated when compared to the short positions. This suggests that even though the price rose briefly over the last couple of days, short positions continued to remain open and trader sentiment remains to be divided.

The same split-state expects to extend. Per the analyst, market volatility will be “maximized” when the FOMC rate is announced.