The collapse of financial institutions like Silicon Valley Bank left a mark on the financial landscape. However, the cryptocurrency industry was spared and instead of slumping, it was on an uptrend. But one part of the crypto ecosystem took a major hit. Nonfungible tokens or NFTs were making headlines once again, but the fervor around the space did not seem to last too long.

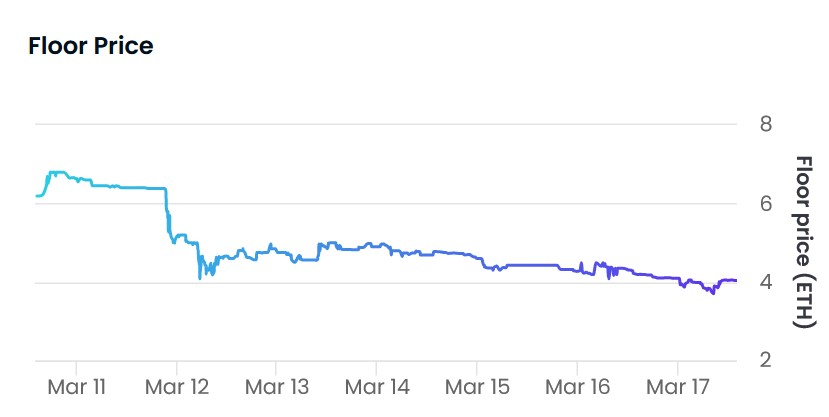

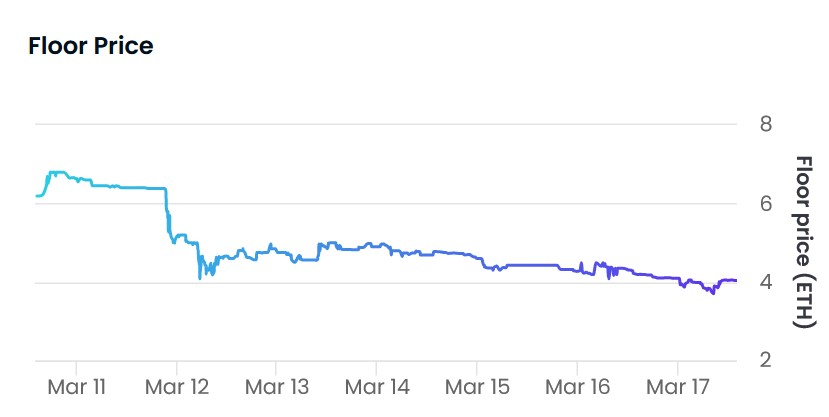

According to recent data, the NFT trading volumes witnessed a slump as the failure of SVB came to light. DappRadar noted that the NFT trading volumes dipped to a low of $38 million on March 12. This plummet was from a high of $68 million to $74 million on March 10. According to DappRadar, NFT trading volume has decreased by 51%, since the beginning of March, while revenues have dropped by around 16%.

The above chart also sheds light on the daily NFT sales count that dropped by 27.9% between March 9 to March 11. Additionally, the number of “active” NFT traders on March 11 was just 11,440, the lowest since November 2021. The lowest daily total of single transactions so far this year was 33,112.

The latest series of plummets was a surprise as the NFT market had recently started recovering. The trading volume of the space soared to a high of $2 billion for the first time since the Luna crash.

This plummet was attributed to the de-pegging of the USD Coin [USDC]. As multiple banks collapsed, USDC lost its peg and plunged to a low of $0.87. The report noted that this directed investors’ attention away from the NFT space. This further caused traders to become “less active.”

Which NFT collection took the most beating?

It should be noted that not all non-fungible token collections were impacted by the decline. “Blue chip” NFTs did not have to worry as the floor prices of collections like CryptoPunks and Bored Ape Yacht Club [BAYC] were minimally decreasing. The report read,

“The recovery was quick, showing the resilience of these top-tier NFTs. Blue-Chip NFTs remain a steady investment in a disrupted market.”

Yuga Labs, the firm behind BAYC even confirmed that they had limited exposure to the failure of the U.S. banking system. Moonbirds collection, on the other hand, dropped to a low of 4 ETH from 6.18 ETH on OpenSea. This 35.3% dip was detrimental and was a result, of its exposure to SVB.