Take-Two stock is currently, at the time of writing, seeing increased investor attention after the company has officially priced its 4.75 million share spot secondary offering at exactly $225.00 per share. This strategic financial move, along with growing buzz around the upcoming GTA 6 release date, has actually prompted Morgan Stanley to raise its price target for Nasdaq: TTWO from $210 to a much higher $265, which is quite significant, really.

Also Read: 71% Say Bitcoin Will Reclaim Its Peak by May End, Are They Right?

Take-Two Stock Rallies as GTA 6 Buzz and Targets Align

Take-Two stock is, right now, really benefiting from this secondary offering announcement and also from the analyst upgrades that have followed. The timing of the $225 share price offering seems to be, in many ways, aligned with growing market confidence in Take-Two’s future revenue potential, particularly as GTA 6 development continues to progress and generate excitement.

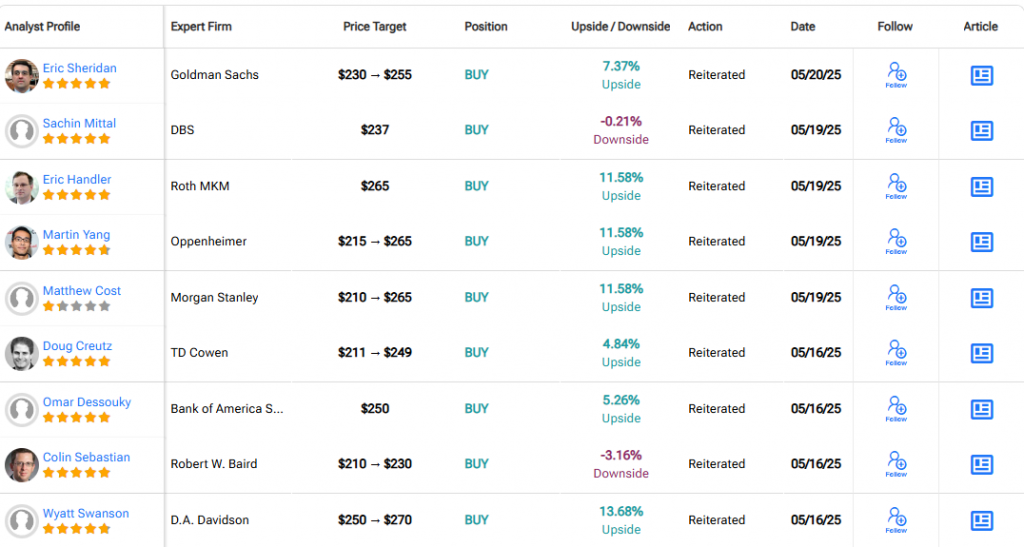

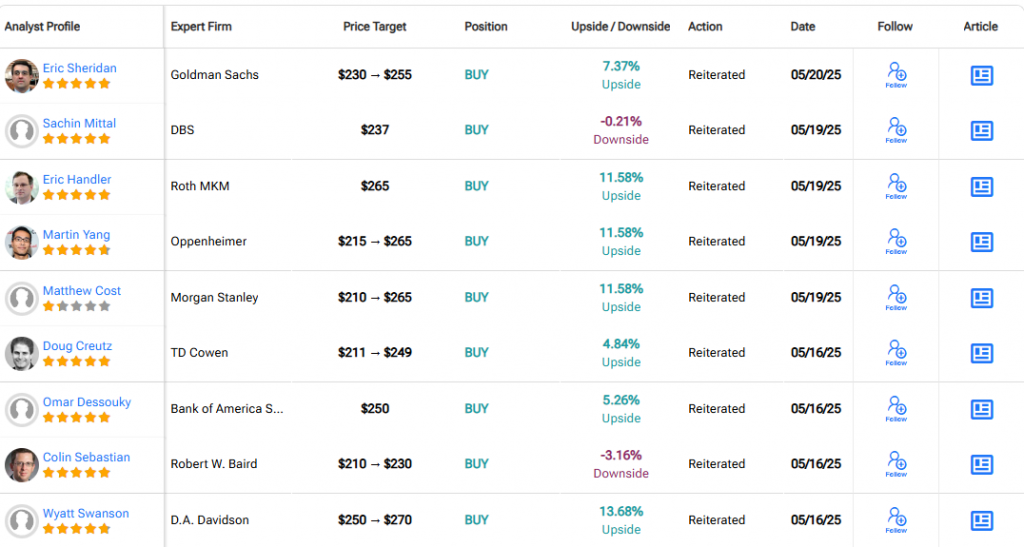

Analyst Optimism Fuels Growth

Morgan Stanley analysts stated: “We are raising our Take-Two target to $265 from $210.”

UBS analysts had this to say: “We believe Take-Two is well positioned heading into FY26 with multiple potential catalysts on the horizon.”

Also Read: Pi Coin Skyrockets 11.7% in 24 Hours: Is $2 an Option for PI?

Will Take-Two Stock Go Up?

Take-Two stock appears, based on current information, that it’s positioned for some potential growth, according to multiple analysts and industry watchers. The recent $225 share offering and the positive reception it received suggests that there is some market confidence in Nasdaq: TTWO. Many analysts view the anticipated GTA 6 release date as a major catalyst that could, in the coming years, significantly boost future earnings and company valuation.

Wedbush analysts stated: “Take-Two has a clear line of sight to over $10 in EPS by FY27 driven by GTA 6.”

UBS analysts said: “We are raising our price target to $248 from $236 to reflect the company’s strong positioning and upcoming product pipeline.”

Also Read: Exclusive: Bitcoin Empowering Global Finances, Reshaping Modern Portfolios