Tariff dip tech stocks have created some really interesting buying opportunities for investors who are seeking exposure to the AI boom and also looking for solid tech stock investments amid the recent market volatility. President Trump’s recent “Liberation Day” tariff announcement has actually pushed many quality tech names down to what appear to be bargain levels, and right now, several companies offer compelling value.

Also Read: XRP vs Solana: 76% vs 11% Growth Potential – Which Crypto Wins in 2025?

Best AI Bargains To Buy During The Tariff Dip And Market Volatility

The recent tariff-related selloff has impacted almost all tech stocks, including those that are leading the AI boom. At the time of writing, this market volatility has created several stock bargains in the tariff dip tech stocks category that investors might want to consider adding to their portfolios.

Also Read: Asian Stock Market Crash: India, China, Japan, Singapore & Thailand Bleed

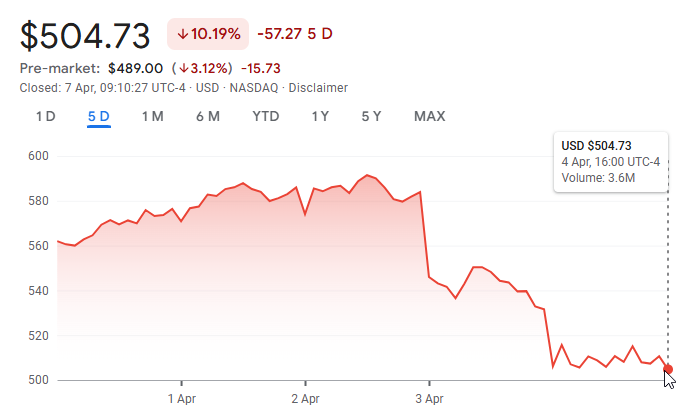

1. Nvidia (NASDAQ: NVDA)

Nvidia shares have fallen quite dramatically despite their strong position in AI infrastructure. The stock currently trades at a forward P/E of about 23 times this year’s estimates, which is actually quite reasonable.

Geoffrey Seiler from The Motley Fool, stated:

“Nvidia has predicted that data center capital expenditures will reach $1 trillion by 2028.”

Interestingly, semiconductors are reportedly exempt from Taiwan tariffs, which means that Nvidia’s growth path in the tariff dip tech stocks environment can continue without major disruption.

2. Amazon (NASDAQ: AMZN)

Amazon shares have also dropped following the tariff news, creating another opportunity among tariff dip tech stocks for investors to consider.

Also Read: Ripple: AI Predicts XRP Price For April 12, 2025

Amazon’s AWS division is, in fact, its most profitable segment and continues investing heavily in AI infrastructure and related technologies. The stock’s forward P/E of around 28.5 times marks one of its cheapest valuations in a decade or so, making it an attractive AI boom investment for the long term.

3. Meta Platforms (NASDAQ: META)

Meta has also declined substantially following the tariff announcements, joining other tariff dip tech stocks that might be worth a look.

The Motley Fool analysis noted:

“Meta is an ad-based business, so the impact of higher prices and a potential global recession could very well hurt its business in the short to medium term.”

Meta now trades at a forward P/E of just above 21, which represents quite a bargain amid the current market volatility for those looking at tech stock investments with AI exposure.

Also Read: Crash to Cash: Warren Buffett’s Bear Market Playbook Revealed!

The tariff dip has basically created some very interesting buying opportunities in these AI boom stocks. And even though there may be some additional short-term market volatility ahead, these tariff dip tech stocks could potentially position investors rather well for future growth in the coming years.