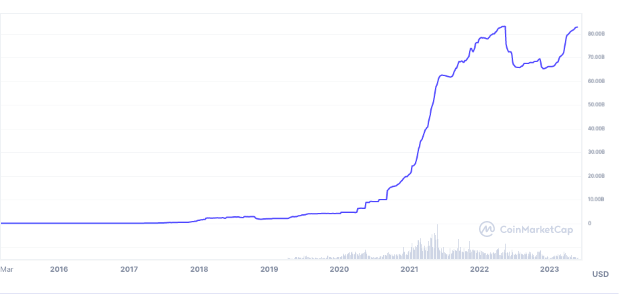

Tether’s market capitalization has been on the rise over the past few months. From the lows of $65 billion registered towards the end of last year, the number is already up to $82.99 billion. In fact, as illustrated below, Tether’s market cap is inching toward its current ATH of $83.2 billion registered last May.

Also Read: After Silvergate, Stablecoins Use for Crypto Trading Likely to Improve

The rise in Tether’s market cap can be attributed to the recent string of bank failures in the U.S. The role of the U.S. dollar in crypto trading has been shrinking. In fact, as analyzed in a recent article, USD’s market share has fallen consistently relative to stablecoin trading pairs, giving Tether another dimension to encash upon. Parallelly, the regulatory crackdown initiated by rivals including Paxos’ BUSD also helped align the stars in Tether’s favor. Another explanation for Tether’s climbing market cap could involve the Tron network, according to a recent Kaiko report.

“The majority of all USDT—$46bn— are issued on Tron, compared with just $36bn issued on Ethereum.”

Now, one may question, why is such a big chunk of USDT issued on Tron, given that the network has fairly less DeFi activity and several top exchanges like Coinbase do not support it? Well, Kaiko pointed out that several offshore exchanges including Binance and OKX hold their largest USDT balances on Tron. This means market makers and whales prefer this network over others because of its low transaction fees.

Tether’s trade volume hits lows

Even though Tether has been able to add to its market cap unlike its other counterparts, it’s worth noting that USDT’s trading volume has significantly declined of late. Fingers can be pointed towards crypto’s extended winter, the malnourished trading appetite, and lackluster sentiment. Parallelly, Binance recently re-introduced trading fees for USDT asset pairs, further putting the Tether’s volumes on a slippery slope.

According to CoinGecko’s data, Tether’s daily trading volume dropped below the $10 billion threshold this weekend. This occurrence took place for the first time in four years. Before this, the level was visited back in March 2019.

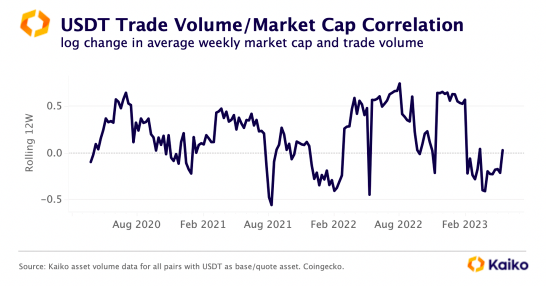

According to past precedents, changes in trade volume have been “loosely correlated” with changes in Tether’s market cap. That being said, occasional surges have been registered during periods of notable market activity. However, the correlation is currently hovering around zero.

To put things into perspective, let’s consider USDC’s case. Overall, Circle’s stablecoin has a “clean correlation” between trade volume and market cap. Simply stated, as and when USDC’s volume has grown, its market cap has increased similarly. Kaiko labeled Tether’s market-cap x trade volume discrepancy to be suspicious. Specifically, its report noted,

“Overall, USDT’s market cap has little correlation with trade volume, which is questionable considering the primary use case for this stablecoin is trading.“