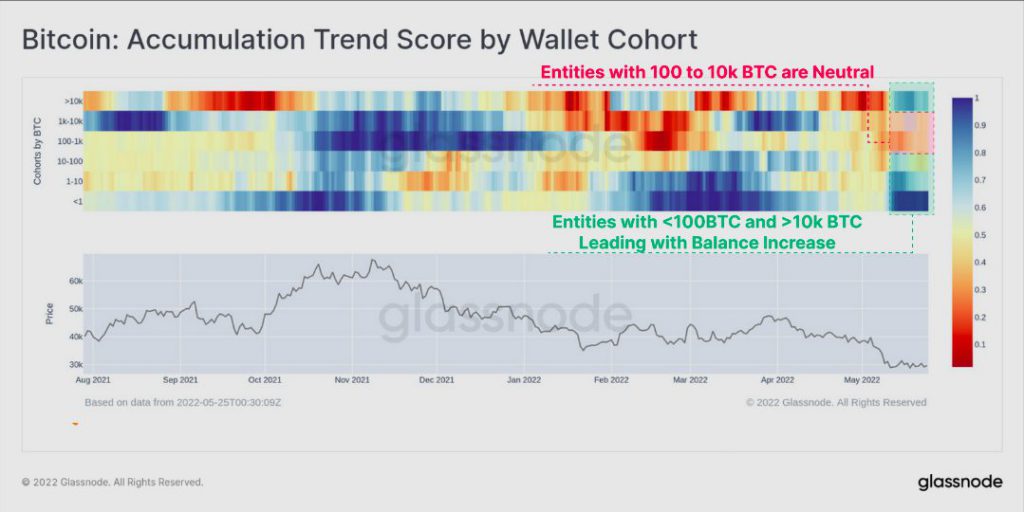

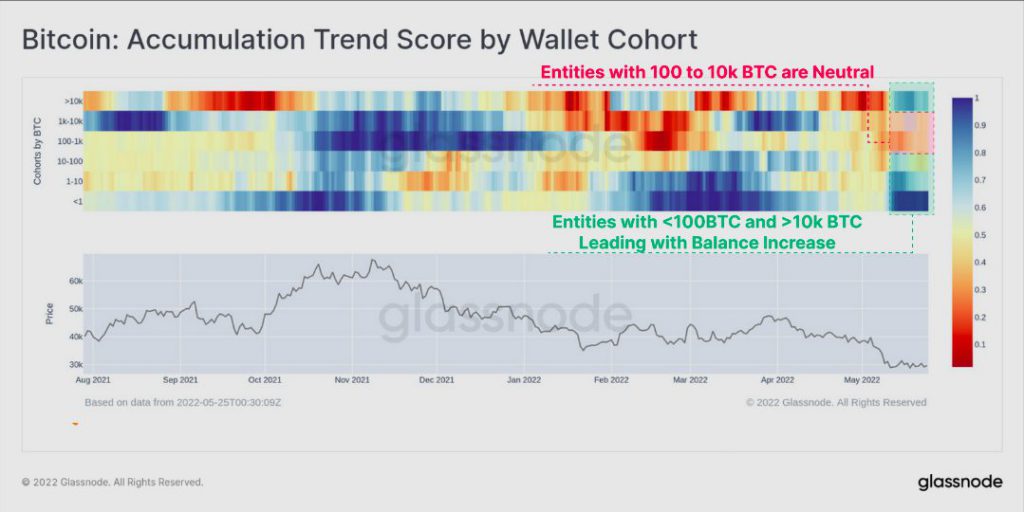

Bitcoin accumulation trend score has been improving lately. It is currently hovering around a near-perfect level [0.9]. Until 1.5 weeks back, the low conviction, intermittent trend was in play, but now, it has shifted to strong accumulation. This means that the existing entities on the network are adding significantly to their HODLings.

Per the trend score breakdown by wallet cohorts metric, entities holding < 100 BTC and >10k BTC have started flashing blue signals, indicating a significant increase in their balance in recent weeks. Outlining the notable shift, one of Glassnode’s recent reports highlighted,

“This is a notable shift from the relatively weak values (yellow-red) during the lead-up to the sell-off, with Whales in particular being large scale distributors.”

During bearish trends whenever HODLers amass Bitcoin, it points out that the psyche is shifting from uncertainty to value accumulation, and this is a good sign.

Ark Invest’s exec opines on Bitcoin’s future

ARK Invest founder Cathie Wood recently spoke on lines in a recent episode of the hedge fund’s In the Know YouTube series. She said,

“It does appear, according to our metrics, that short-term holders have capitulated. That’s very good news in terms of putting in a bottom. Long-term holders are at an all-time high at 65.7%. That means they’ve been holding Bitcoin for at least a year. We’ve got some very strong holders or HODLers here. That’s also very good news…”

She was, however, quick to add a word of caution and said that the market might note some long-term holder capitulation to mark the bottom before marching ahead.

Opining on her inclination of what to expect next, Ark Invest’s exec said,

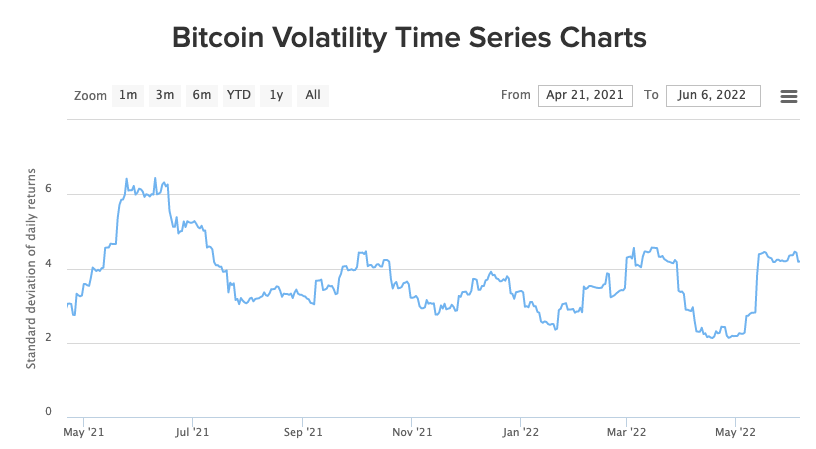

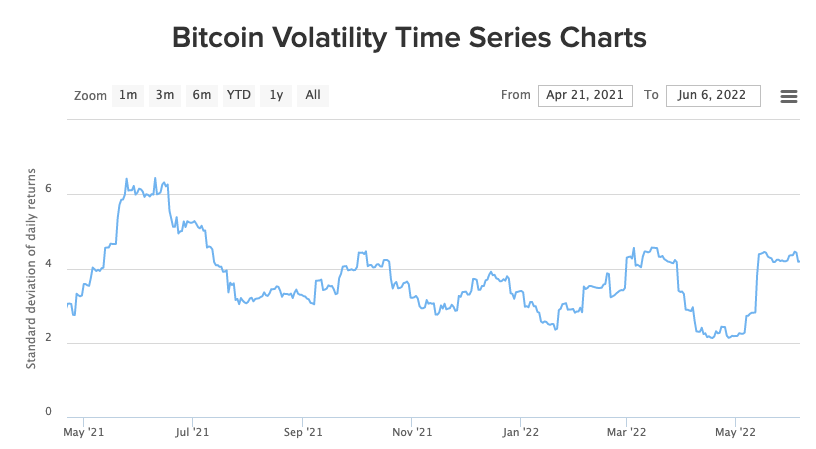

“Now, we don’t know if it’s up or down, but you can see from other metrics in the piece that our thinking right now or our judgment call is the next big bout of volatility in Bitcoin will be to the upside.”

Volatility, as such, is a double-edged sword and possesses the potential to instigate a price swing in either direction. In May, Bitcoin’s volatility glided up, but of late, has been consolidating, indicating that a price breakdown/breakout is imminent.

Without getting overly optimistic, investors need to hold their horses and wait for a clear-cut trend to be established, especially after the recent set of events that disrupted the market’s recovery. Concluding on similar lines, Wood said,

“Nonetheless, we are on guard. You know, the Terra disaster, it was a fiasco for crypto, I think, in terms of raising or giving regulators even more incentive and reason to come in and regulate a little bit more with more of a heavy hand than we would anticipate.”