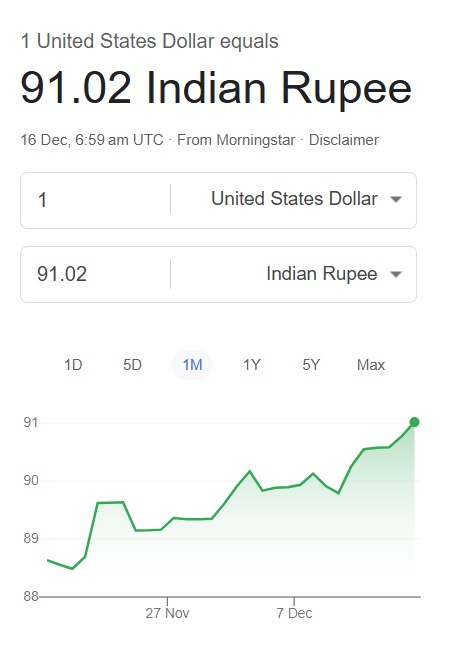

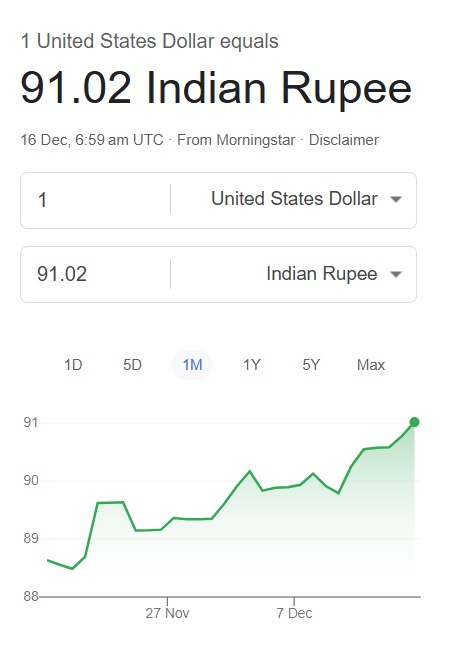

The Indian rupee has fallen to another lifetime low of 91.01 on Tuesday’s opening bell against the US dollar. The local currency is on an unending tailspin with repeated dips in the last 10 months. Analysts warn that a prolonged weakness could stop recovery efforts and directly affect the stock market.

On the heels of the rupee rout, the Sensex dipped nearly 450 points while the Nifty is down 150 points. The stock market is already feeling the pinch with leading equities trading in the red. HDFC Bank stock, the leading banking giant, is below the 1,000 mark and is trading at 994. The US dollar is pulling the steam out of the rupee, making it the least performing currency in the Asian markets.

At this speed of decimation in the currency markets, it wouldn’t take long for the Indian rupee to fall to the 100 level against the US dollar. The INR is down 6.80% against the USD year-to-date, which is its biggest fall in years. In the last five years alone, it has dipped by 20% and shows no signs of a recovery.

Also Read: Silver Price Now Equals Oil in a Major Market Shift Not Seen in Years

The Rupee’s Worst Performance Against the US Dollar

Watcher Guru wrote an article in January predicting that the rupee would fall to the 90-92 level against the US dollar. Its price was around the 85.93 range back then, and has fallen by another 6% since January. The downturn is affecting the import and export sector as goods are becoming costlier. Importers are the hardest hit as they need to shell out extra money to procure.

The entities put the burden on the consumers by raising prices to meet profits. The end user on the streets is the one who bears the brunt of the rupee’s decline vs the US dollar. Businesses and governments have their way of protecting themselves with various methods. The common man has only two options: either pay more or stop buying.