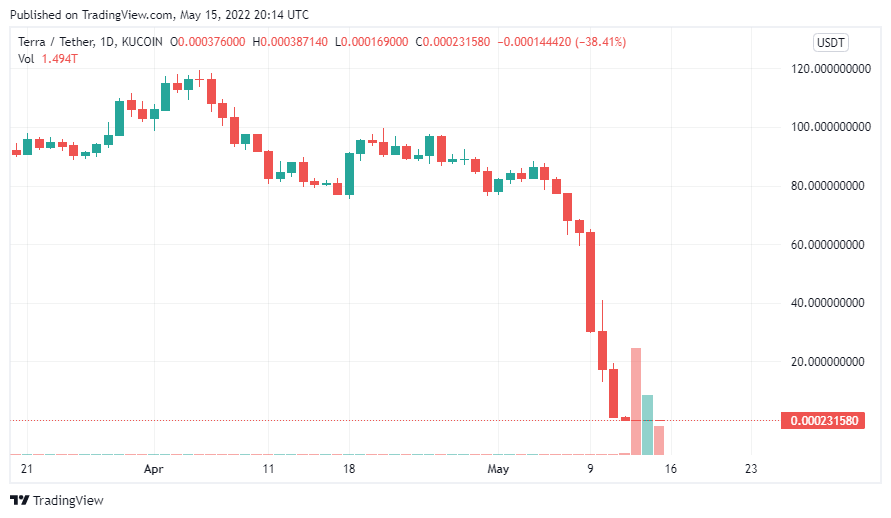

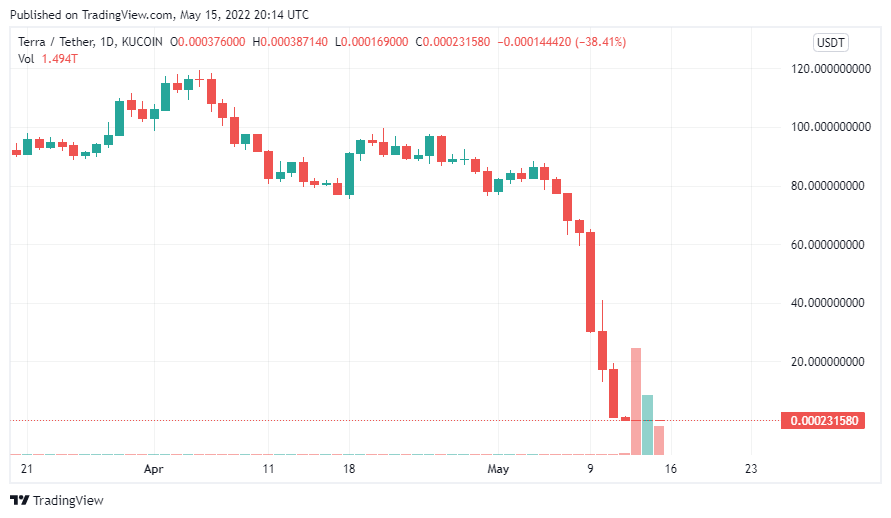

The week has witnessed the fall of one of the most anticipated coins out there. Once $119.18 worth at its peak, LUNA is now trading way below than one ever imagined. The entire Terra ecosystem collapsed to ashes overnight.

AT the time of writing, LUNA is trading at $0.0002374 with a market cap of $1,604,703,573, according to data from CoinMarketCap. TerraUSD, the most promised algorithmic stablecoin that is designed to stay stable at the price of $1, dropped and is now trading at $0.1705.

Where did it all begin? What was the trigger point that caused the downfall? Let’s check it out.

May marked the doom of LUNA

The Terra Foundation was doing quite well till April, when they had acquired 2508 BTC in April, holding over 42,406.92 BTC in its reserve. Everything seemed to be on track with the foundation’s dream of acquiring $10 billion in bitcoin. But eventually, everything took a U-turn, changing the fate of LUNA.

After a mysterious and anonymous whale unloaded $285 million worth of UST on the open market, the crash was triggered. Between May 7th and 8th, 2022, the whale unloaded its vast holdings. UST’s 1:1 USD peg is thrown off by the sheer magnitude of the dump. After the withdrawal, UST dropped to $0.98, allowing for a free slide.

Polygon’s CISO Mudit Gupta came to Twitter to call attention to a string of “suspicious” UST occurrences that occurred in quick succession. Terraform Labs first pulled $150 million in UST liquidity from Curve.

A freshly funded address bridged $84 million in UST to Ethereum exactly one minute later, and the Terra ecosystem’s stablecoins were dumped four minutes later, triggering a sell-off. Do Kwon immediately came to the defense, stating that the 150 million UST was removed to get it ready to deploy it into 4pool the following week. He also added that he had removed 100 million UST to lessen the imbalance.

UST began de-pegging following the massive withdrawals from Anchor. The withdrawals caused the UST deposits to plummet to $11 billion from $14 billion, causing UST to depeg.

LUNA and UST began plummeting the next day

Following the news, LUNA and UST began falling. The stablecoin, which had one purpose of staying stable at $1, failed, dropping to $0.986.

UST, on the other hand, set a fresh low of $0.6065 in the late hours of Monday. In effect, it was down by over 40% from where it had been before the de-pegging.

Terra’s native LUNA coin took a punch to the head as a result of this. It plunged to $24.8 after losing more than 60% of its value in only 24 hours following the de-peg.

The situation created a panic among the investors as Binance was also quick enough to halt LUNA withdrawals due to a large number of requests.

Do Kwon’s initial words gave a hint of relief

As the price of LUNA and UST started stooping lower, Do Kwon broke his silence and came up with a plan which was not revealed during the time.

The Terra community has been concerned about the status of the ecology.

The CEO stated that he is “near” to launching a UST recovery strategy. He thanked everyone for their support and urged them to “hold tight.” Kown also stated that he did not mean to keep silent in the midst of the commotion, justifying his action by claiming that he required “razor focus” to deliver.

LUNA began falling abruptly

Do Kwon came up with a recovery plan on May 11 to save the Terra ecosystem. Kwon was ready to divulge his rescue effort, despite the fact that the preceding 72 hours had been “very difficult.” A massive LUNA sell-off was sparked by money eager to get out of UST. This hastened LUNA’s demise even further.

He disclosed in a community proposal pitch that the only option to move forward was to increase the quantity of LUNA minted per day.

Because of the way the stablecoin’s algorithm works, the circumstance produced a significant arbitrage opportunity. This generated an endless loop of producing LUNA and diminishing current supplies to the point that LUNA is effectively worth $0 a few days later.

Once top 10, now 207

LUNA, which stood tall under the top 10 crypto-list, has fallen way far behind and is currently at #207. The Terra community seemed like it lost the trust of the team. To add to this, Do Kwon was also alleged to be behind a failed stablecoin, the Basis Cash.

But to everyone’s surprise, LUNA displayed a mini recovery on May 14, rising over 3,000%. This was following Do Kwon’s announcement to revive the network. He proposed to reconstitute the chain to 1 billion tokens with the entire focus on incentivizing the community.

The announcement may have come up as a ray of hope that showed a mini recovery for the lost child. The exact plan on when and how the entire proposal would be laid out is entirely left out to Kwon. But will LUNA be able to get its lost title back? Will it gain the trust of the community? Is there light at the end of the tunnel? Only time will tell.