In the period between early November 2021 to mid-November 2022, the total cryptocurrency market cap noted a 76% free fall. Throughout December last year, it consolidated.

2023 has evidently been a boon for cryptocurrency assets. The market has already put on its recovery shoes. From the beginning of January until now, the aggregate valuation of all assets from the space has inclined by ~33%. Retrospectively, the global cryptocurrency market cap stood north of $1 trillion at press time on Monday.

Also Read: Why Is Bitcoin Trading at $37,000 in Nigeria?

With the market now at a critical juncture, whale purchases often act as precursors and hint toward the future course of action. As long-term investors set up large orders, bullish precedence is established for other short-term traders to reap from the action.

Data from Lookonchain brought to light that a particular whale has been accumulating dYdX since last year. Since October 2022, it has bought around 9.5 million tokens worth $21.4 million from Binance.

By buying tokens back to back over the past few months, it can be said that the whale was performing dollar cost averaging. Resultantly, the average price of its purchases so far stands around $1.62.

As per on-chain data, the last time the whale received tokens was on Jan. 20. From that point in time till now, the price of the asset has already inclined by roughly 80%.

What are other whales upto?

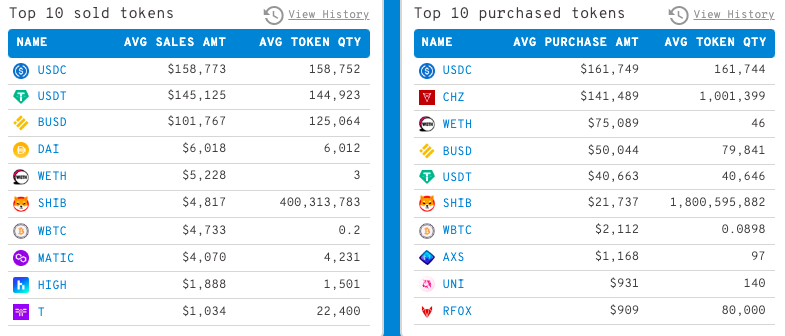

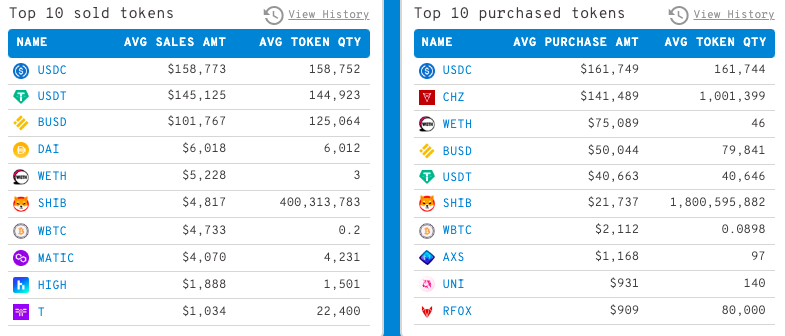

As far as the top 100 Ethereum whales are concerned, they have been accumulating altcoins like Chiliz, Shiba Inu, Axie Infinity, and Uniswap. Alongside, they’ve been adding dry powder in the form of USDC, USDT and BUSD also in their bags.

However, the said stable assets were also a part of the top sold token’s list, bringing to light the indecisiveness among whales. Apart from that, the top 100 Ethereum whales also sold a portion of their Shiba Inu and MATIC holdings over the past 24 hours.

Also Read: Whales Are ‘Moving’ Trillions of Shiba Inu Amid 52% Surge