In 2025, AI stocks were king on the US stock market. NVIDIA, AMD, and Intel were some of the top options throughout most of the year to invest in. On the other hand, top tech giants like Alphabet, Meta, and Amazon also reaped a benefit from the AI wave, thanks to heavy investments in AI-focused projects and data centers. Now in 2026, many investors are still on the track of AI, looking for the best potential stock to invest in for the rest of the year. Will AI stocks reign supreme again? If so, which are the best to invest in.

NVIDIA (NVDA)

NVIDIA is seen as a strong value play with projected 49% earnings growth through 2027, while partnerships in AI and significant upcoming earnings reports are crucial for investor sentiment. The semiconductor sector is shifting focus towards compute engines like Nvidia, enhancing its market position. Further, its dominance in AI remains a strongpoint despite the increasing competition.

At press time, NVDA is trading near the top of its 52-week range and above its 200-day simple moving average. Wall Street analysts maintain a bullish outlook on Nvidia with price targets ranging from $220 to $320.

Taiwan Semiconductor Manufacturing (TSMC)

Meanwhile, TSMC has become another household name in AI and on the tech stock market. Earlier this month, the company’s stock hit a new all-time high of 348.42, thanks to a solid earnings report. The world’s largest contract chipmaker posted stronger-than-expected fourth-quarter earnings and revenue, which fueled not just TSMC but other chip stocks too. The company reported non-GAAP earnings of $3.14 per share for the quarter, topping market expectations. Revenue rose to $33.73 billion, up about 26% from a year earlier and slightly higher than the prior quarter.

Underscoring this announcement was its decision to spend $52 billion to $56 billion on production capabilities throughout the year. The news was welcomed by investors, as it shows there is huge and lasting chip demand in the AI space.

Nebius (NBIS)

Nebius (NBIS) is a smaller business that’s deploying Nvidia GPUs filled with TSMC chips to be rented out to clients looking for AI training power. Demand for Nebius’ platform to expand is incredible, and management believes it will grow from a $551 million annual run rate at the end of the third quarter to a $7 billion to $9 billion run rate at the end of the year. That’s huge ROI potential since the stock is a great buy now.

Alphabet (GOOGL)

Alphabet (GOOGL) has performed well in 2026 so far, up over 7.9% since January 1. The Google developers’ success in AI has been seen in various Google products, including internet search, cloud computing, digital advertising, autonomous vehicle unit Waymo, YouTube, Gmail, Workspace, and Google Maps. Last year, Google introduced its newest artificial intelligence model: Gemini 3. Google improved the chatbot’s ability to code, search, and create images, which has benefits in numerous Google applications.

Raymond James have raised their price forecast for Alphabet (GOOGL) stock, providing a bullish outlook on Google Cloud and AI efforts. “We believe Google is likely entering a cycle of improving AI stack narrative and upward revisions that could create one of the highest quality top-line AI acceleration stories in the public universe,” Raymond James analyst Josh Beck said in a report. Other analysts on Wall Street, including BofA and Morgan Stanley, share similarly bullish forecasts for Alphabet GOOGL as a top AI stock.

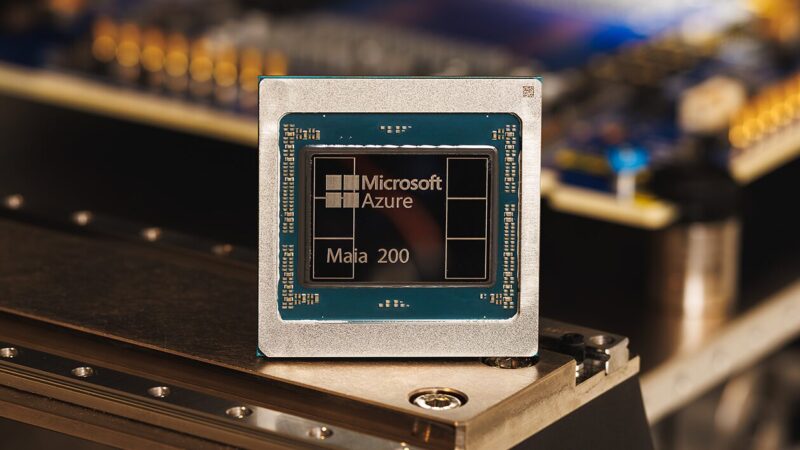

Microsoft (MSFT)

Microsoft (MSFT) is the one stock on this list that can also be seen as a “buy the dip” scenario. MSFT is down over 11% in 2026 so far, and the recent decline indicates renewed worries about sluggish Azure cloud growth, increasing AI costs, and dependency on OpenAI. Despite that, Microsoft’s earnings last week were better than forecasted, and it still lays a solid platform for the stock to eventually rebound.

According to TipRanks MSFT stock stats, the firm may end up hitting its ambitious price target of $678 in the next 12 months.