The cryptocurrency market narrative has been clear since November 2021. Alts have followed Bitcoin and Bitcoin has mostly pared gains over the last 4 months. With the king coin off by 70% from its ATH, commentators and analysts remain mum on prospects of an altcoin season. However, recent data have rekindled talks of an altcoin dominant period and one could argue that the signs are overwhelming.

Top 10 Alts Strike Big After Bitcoin

Bitcoin’s move above $40K brought in significant gains for most of the large-mid altcoins last week. As it stands, the top 10 altcoins (excluding stablecoins) have outpaced Bitcoin’s weekly return on investment, barring LUNA. Some, such as Ethereum, Solana, Avalanche, and Cardano, grew by double digits last week and handily beat BTC’s weekly returns of 5.3%.

Altcoin Season?

Since November 2021, most altcoins have shared a similar fate. Bitcoin’s downtrend brought about an evasive period for altcoins, with the TOTAL2 index (market cap of top 125 alts excluding BTC) touching fresh lows in 2022. However, the candles broke above a 4-month resistance trendline on 17 March, indicating that altcoins were gaining strength against BTC once again.

The Bitcoin dominance chart amplified Bitcoin’s weakening relevance when compared to its lesser peers. The BTC.D chart slipped below an ascending channel on 20 March – a technical development that revealed that Bitcoin’s authority on alts was easing.

Layer 1’s Provide Sneak Peak Into Altcoin Season

Glassnode analyst, under the pseudonym @Negentropic_, drew an interesting comparison between layer 1 protocols and BTC. The finding showed that over the past year, an altcoin season is generally observed when layer 1 protocols start trending among the community. As per the chart, capital inflows towards the abovementioned layer 1 protocols were picking up the pace yet again, serving as a precursor for an altcoin season.

Additionally, @Negentropic_ established a positive correlation between Bitcoin’s price and the Stablecoin Supply Ratio (ratio of BTC’s market cap divided by market cap of all stablecoins). The analyst revealed that more stablecoins were being converted into Bitcoin and money (rightly so) would move into riskier coins during the next BTC rally.

Conclusion

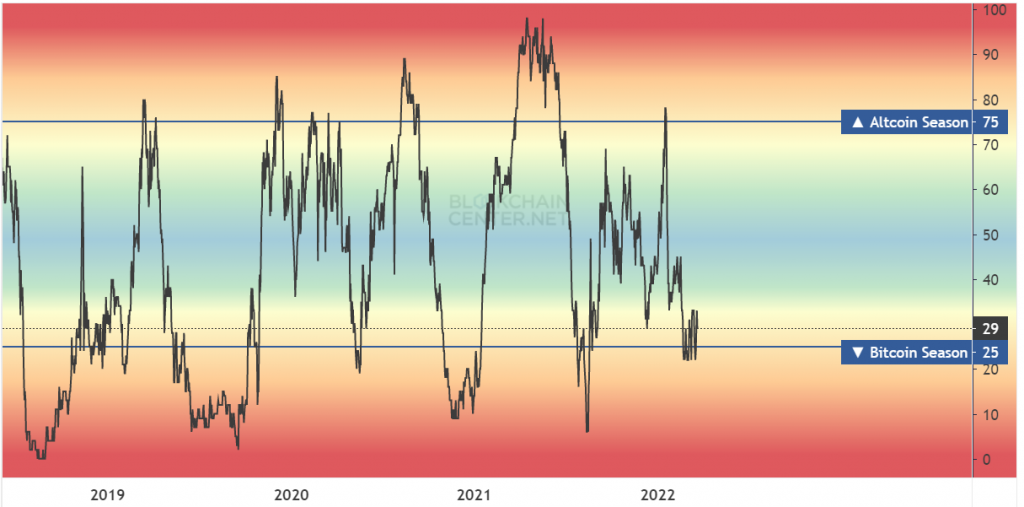

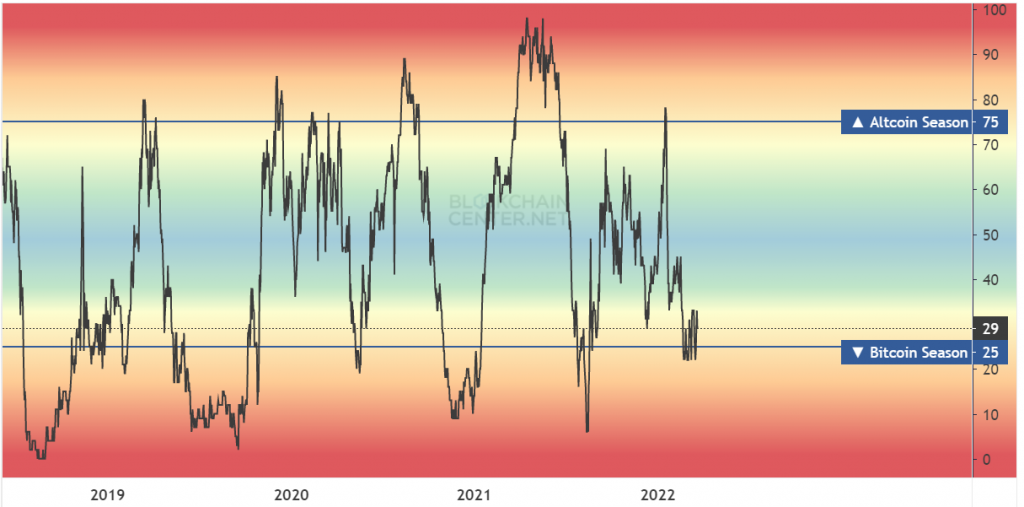

Currently, altcoins are still dependent on BTC’s success for their individual gains. A general barometer of an a provided by Blockchain Center shrugged away any premature talks of an altcoin season.

However, some early signs were difficult to ignore the pendulum could swing as early as the next risk-on broader market.