2022 proved to be a challenging period for the crypto industry. The entire market suffered under the reigns of the bear. Despite the market’s credible recovery this year, the bears had remained dominant in the market. However, the series of events that have transpired over the last couple of months, and especially this week, has got many believing that the bear market might be coming to an end.

Here are reasons why bears have exited the crypto market

- XRP’s Win

For a considerable period, Ripple diligently engaged in a legal dispute with the Securities and Exchange Commission [SEC]. The regulatory classification of XRP as a cryptocurrency was questioned and efforts were made to categorize it as a security. However, a significant shift occurred when Judge Analisa Torres ruled that XRP does not qualify as a security. This victory weakens the SEC’s ability to label all tokens as securities. This is because they were unable to succeed with the one that appeared most likely to be deemed a security token.

Greg Moritz, chief operating officer of crypto hedge fund Alt-Tab Capital said,

“If centralized crypto projects aren’t securities, then that may make it more likely for the Commodity Futures Trading Commission to be the primary regulator for the industry, which is something most people in crypto would prefer.”

The changing regulatory stance in the market would certainly prove to be beneficial for the industry.

- Macroeconomic events

According to the founder of DeFiance Capital, Arthur Cheong, the most challenging phase of macro tightening has passed. The Consumer Price Index [CPI] is decreasing and the interest rate has turned positive. Earlier this week, the U.S. inflation rate dipped to 3%.

The likelihood of observing rate cuts in the market during the next year has increased. Typically, when inflation rises, various asset classes, including crypto, tend to experience a decline. Despite Bitcoin being touted as an inflation hedge, it has demonstrated itself to be more of an “inflation-proof” asset rather than an “inflation-resistant” one.

Increasing Institutional Interest

The recent surge of interest in spot Bitcoin ETFs serves as evidence for the aforementioned claim. BlackRock’s submission of a Bitcoin ETF application indicates ongoing institutional acceptance of crypto as a recognized asset class. Moreover, XRP’s recent legal victory contributes to this trend. Many prominent hedge funds have been reluctant to stay in the crypto market due to concerns over tokens being classified as securities and trading on unregistered security token exchanges. The evolving market dynamics have the potential to attract greater institutional interest to the crypto market.

Also Read: BlackRock Spot Bitcoin ETF Could Bring $30 Trillion in Capital

- No room for tourists?

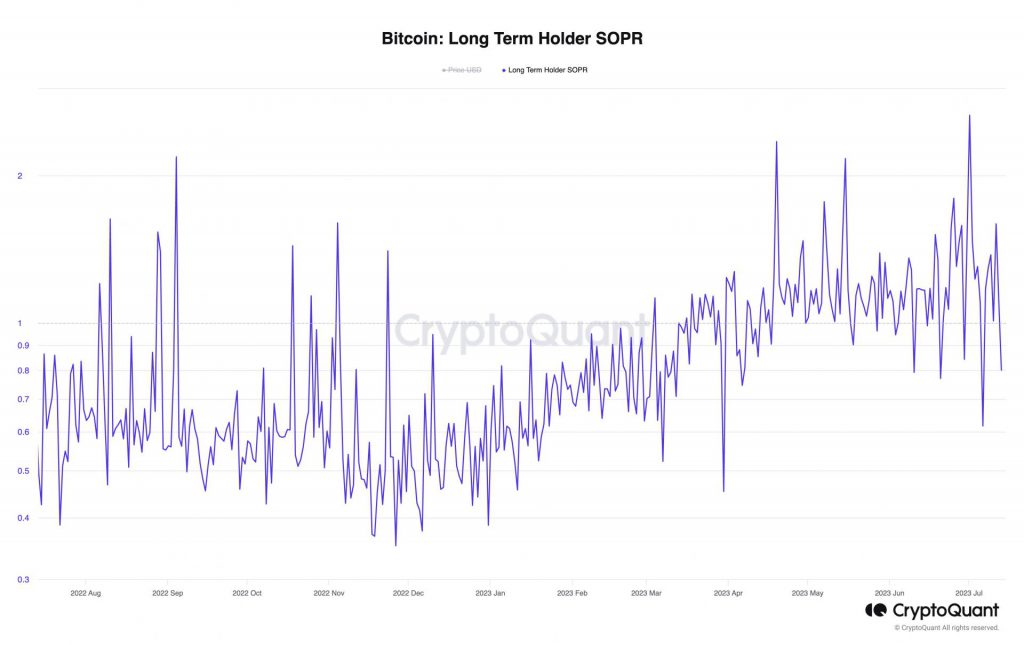

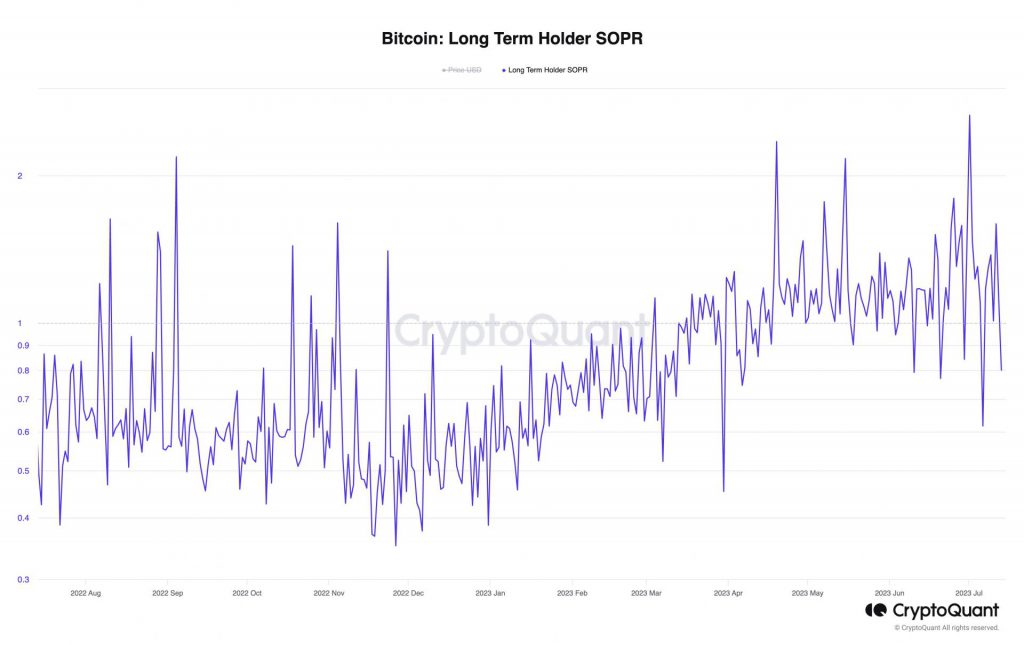

Cheong emphasized that a significant number of market participants who were merely “tourists” in the crypto industry have already been eliminated. In this context, “tourists” refer to individuals who do not have a long-term intention of holding their tokens or remaining active in the market. The bear market experienced in 2022 already weeded out many of these tourists. Consequently, those currently holding tokens are less likely to engage in near-term selling activities.

As seen in the above chart, Bitcoin’s long-term holders have witnessed a notable increase since December 2022.

- Hong Kong’s major crypto moves

In a recent development, Hong Kong made the decision to fully embrace cryptocurrencies, permitting retail traders to engage in buying and selling digital assets. This strategic move was aimed at repositioning the region as a prominent hub for digital assets. However, it also has the potential to unlock significant opportunities for financial institutions across Asia to enter the crypto market in a legitimate manner.

Also Read: Crypto Hubs 2023: Did Dubai, Abu Dhabi, Hong Kong Make a Cut?