A trader bets on market volatility as markets face new uncertainty. This investor made billions during the 2008 financial crisis by spotting market swings early. Now, they’ve built a team to watch both regular markets and cryptocurrency risks. They aim to spot early warning signs using proven trading strategies.

Also Read: Goldman Sachs Predicts 75 Basis Point Fed Rate Cut in 2025 – How It Will Impact Your Investments

How The Trader Returns To Capitalize On Market Swings And Risks

Building a Power Team for Volatility Trading

Stephen Diggle, Vulpes founder and former Lehman Brothers head, leads a new expert team. “Our team’s experience in the 2008 financial crisis and subsequent market cycles provides unique insights into current market conditions,” states Bert Verdicchio, Vulpes treasurer and fund chief risk officer. Robert Evans adds deep market knowledge from his years at top banks.

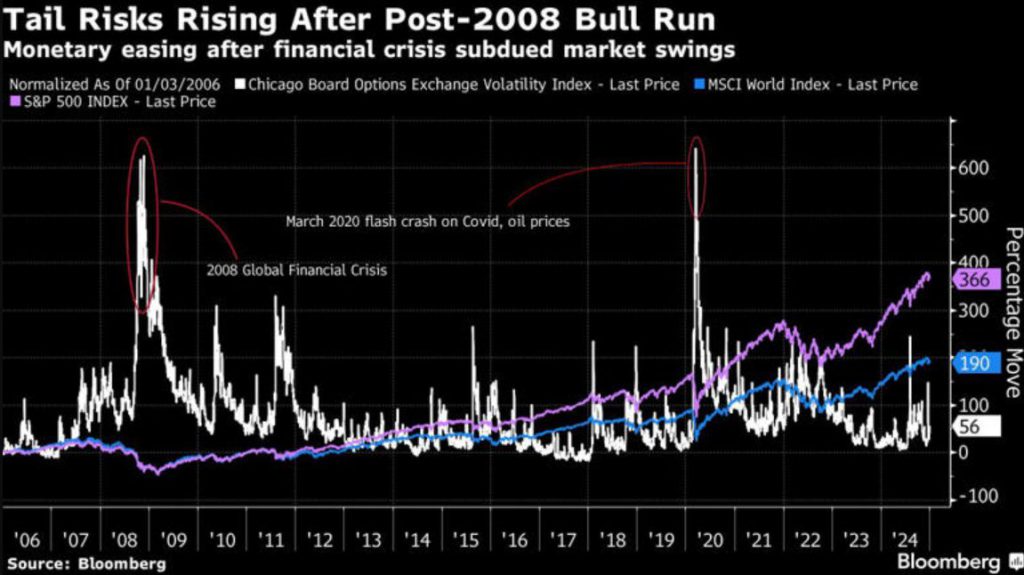

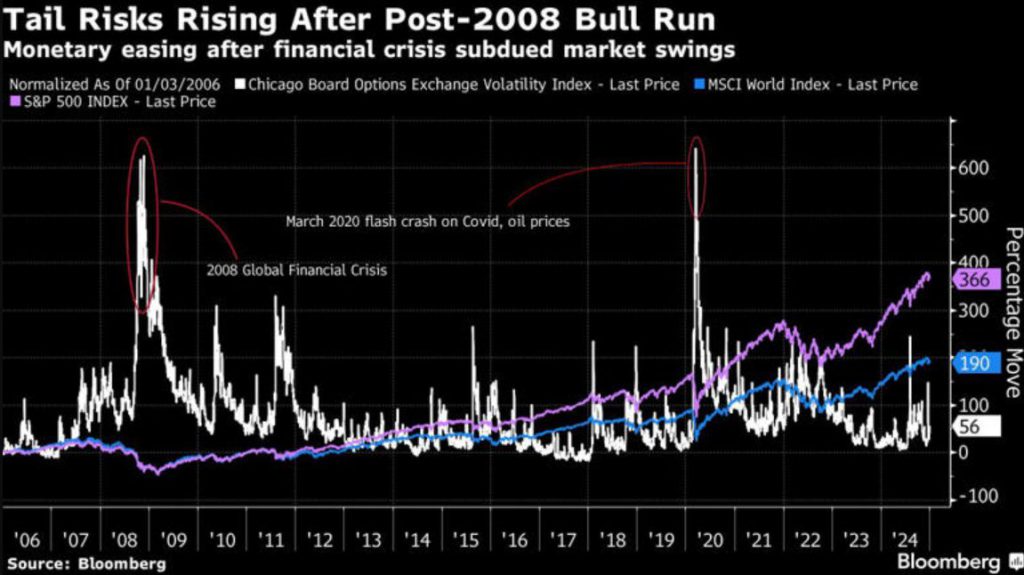

Learning from Past Market Cycles

The 2008 financial crisis changed how experts view market volatility. “The parallels between current market conditions and pre-crisis periods are striking,” notes Wilson Er, research and tail risk portfolio manager. Their research shows cryptocurrency risks might make market swings bigger, creating new paths for profit.

Also Read: Ripple Mid-Jan Price Prediction: Will The Trump Effect Help XRP Hit $3?

Technology-Driven Trading Approach

Keith Neruda runs the fund’s AI systems to spot market volatility signals. “By combining advanced analytics with traditional market wisdom, we’re better positioned to identify and exploit market inefficiencies,” Neruda explains. This tech helps them track market swings as markets grow more complex.

Expanding into Digital Assets

The team now watches both old and new markets, seeing how cryptocurrency risks affect global money flows. “The 2008 financial crisis taught us about interconnected risks. Today’s markets, including crypto, present similar opportunities,” says Steve Diggle. They mix old lessons about market volatility with new trading strategies.

Also Read: ADA Surges 25% in a Week: Ethereum Killer Gains Momentum with Whale Backing

Future Outlook

As traders bet on market volatility today, they mix skilled people, new tech, and deep market knowledge. Their success during the 2008 financial crisis adds weight to their current market views and trading strategies.