Justin Sun’s Tron has been around for over 5 years but has never really been contested among crypto elites. Well, that could change soon. Recent gains have pushed TRX to the 14th spot on the crypto ladder, making it more valuable than Shiba Inu and competitor Polygon. Here are a few contributing factors to Tron’s recent success.

While most top-mid cap alts consolidate following an early May decline, Tron has generally bucked the broader market trend. Its price was trading at a 25% premium compared to its 11 May low and was among the rare top 20 alts that flashed a positive weekly return on investment.

Three factors were largely responsible for Tron’s price increase – the introduction of a new stablecoin USDD, TRX burns, and a rising total value locked.

Tron introduces USDD

Amidst all the market chaos that followed after the Terra crash, Tron’s new algorithmic stablecoin USDD, which was launched earlier during the month, has continued to thrive. The stablecoin maintains price stability by utilizing funds from the TRON DAO Reserve, which is backed by Bitcoins, TRX tokens, and USDT, among other assets. The reserve has also onboarded well-known blockchain institutions to mint USDD and ensures that the peg remains stable at $1.

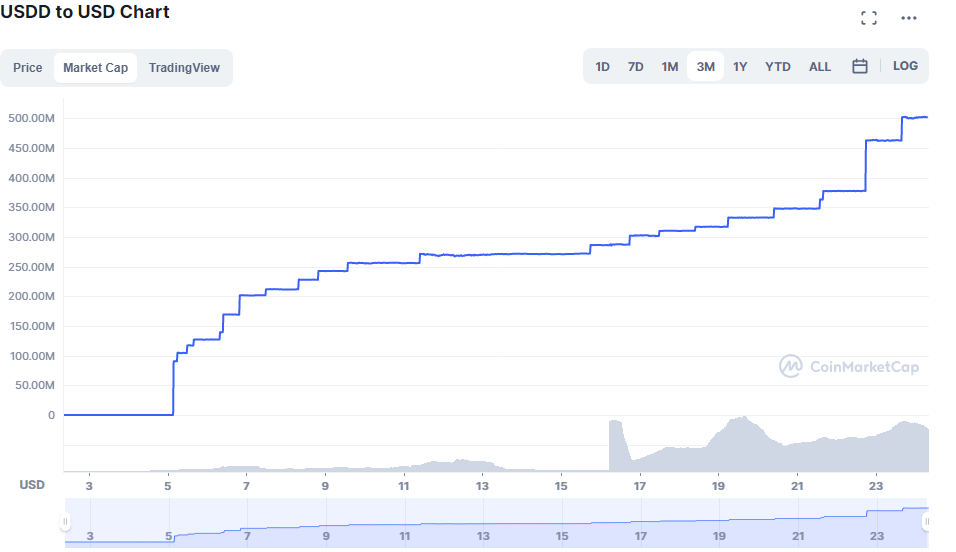

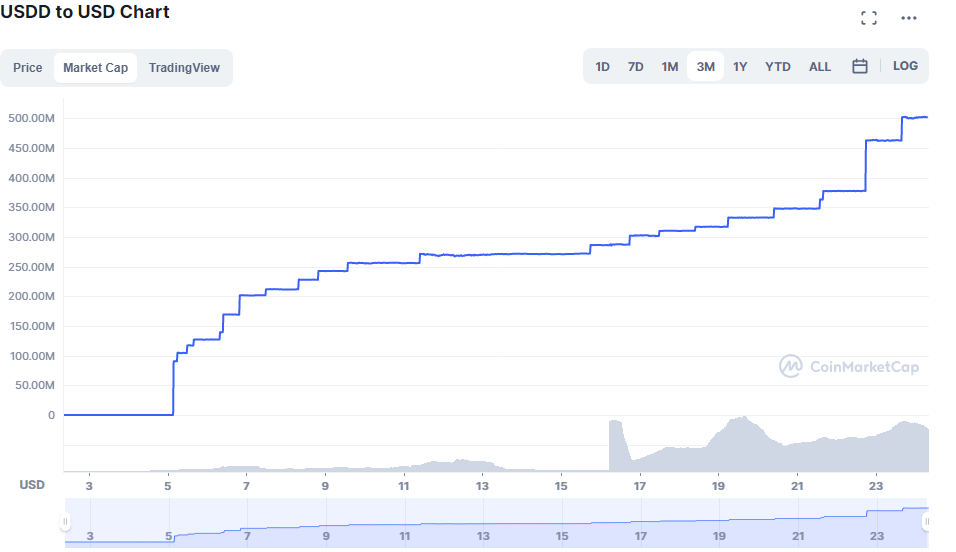

Although USDD utilizes the same algorithm as UST, investors appeared to place their trust in Justin Sun’s alternative. According to CoinMarketCap, USDD’s circulating supply has risen to $500 Million since its launch. The figure climbed significantly in the last two weeks, at a time when most other stablecoins were dumped amidst investors’ worries.

Tron burns

In order to sustain USDD’s value at $1, Tron implemented a greater burning rate in the stablecoin’s arbitrary swap mechanism. The mechanism dictates that $1 worth of TRX will be burned to mint each USDD.

In that regard, Tron burned over 1 Trillion tokens yesterday – the single biggest TRX burn in its 5-year history. The reduction in supply, in theory, makes the remaining tokens more valuable in the market.

Rising Total Value Locked (TVL)

Meanwhile, the Tron network has also experienced more users staking assets on its platform over the past few weeks. As per DeFi Llama, lending platform JustLend’s TVL rose by 51% over the week to $2.7 Billion. The same contributed a significant portion to Tron’s $5.34 Billion TVL, which was now the third-highest by blockchain after overtaking Avalanche.

Bitcoin rebounds

While Bitcoin bearish troubles are still persistent, the world’s largest asset has triggered several relief rallies amidst alts after rebounding from $29K. A risk-on market has also allowed traders to open up their risk-apatite and place bullish bets on TRX. The same is visualized by recent spikes in exchange volumes.

Conclusion

The factors contributing to Tron’s rise are certainly more organic than pumps and dumps. Currently, a figure of $600 Million separates Tron from the next biggest network, Avalanche, and should its growth trajectory remain intact, investors might just see Justin Sun’s platform gain more ranks on the crypto ladder this week.