Trump-Xi trade conflicts are flaring up again due to Trump’s latest remarks about Xi Jinping made on Truth Social. As a result of the Republican leader concluding that Xi is very difficult to negotiate with, worries about relations with China have increased and this may also have an impact on continuing tariff exemptions and could lead to extra pressure on the dollar. At this time, this news is prompting discussions about the BRICS group due to the increasing unpredictability in worldwide trade rules.

JUST IN: 🇺🇸🇨🇳 President Trump says "I like President XI of China…but he is very tough and extremely hard to make a deal with." pic.twitter.com/l6OYLb5z80

— Watcher.Guru (@WatcherGuru) June 4, 2025

Also Read: Trump’s Truth Social Files Bitcoin ETF on NYSE Arca

How Trump’s Xi Remarks Intensify Trade Tensions and Impact USD

The president’s characterization of Xi Jinping as extremely difficult to negotiate with could be been interpreted by financial analysts as an early preview of what potential future trade policies might look like. These Trump Xi trade tensions comments suggest that any return to the negotiating table could prove particularly challenging for both nations, and also for global markets watching from the sidelines.

Trump stated on Truth Social:

“I like President XI of China, always have, and always will, but he is VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH!!!”

Immediate Market Response

Currency markets have also reacted to the heightened Trump Xi trade tensions with increased volatility in the United States dollar right now. Traders are currently assessing how these comments might influence future China US tariff exemptions and also broader trade relationships between the world’s two largest economies.

The comment is relevant now since talks about BRICS news are accelerating and member states are considering ways to trade outside of those driven by the West. As a result of this regulatory uncertainty, the global financial system is facing additional pressures and this is also affecting sentiments among investors from various industries.

Historical Context and Future Implications

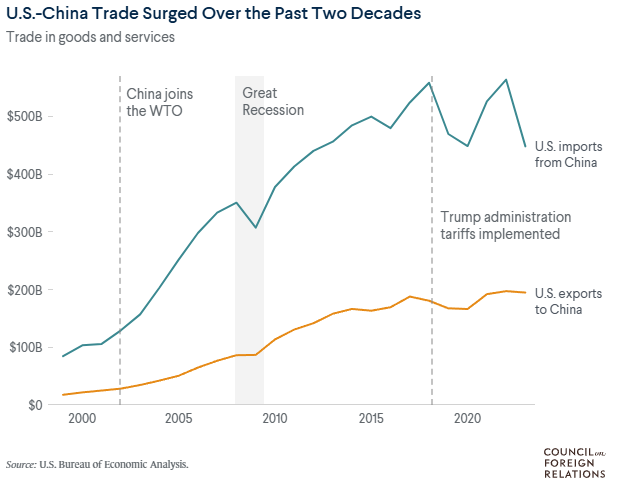

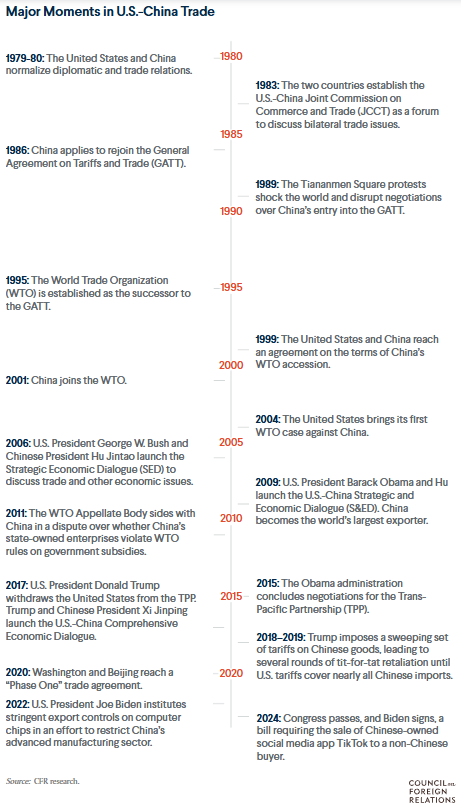

The current tensions between Trump and Xi can also be traced to earlier talks between the two when Trump was president. While the Phase One deal was meant to pacify things temporarily, Trump’s remarks on Xi Jinping have made it clear that huge disagreements with China are far from over.

The results on China US trade could be big if the tensions lead to genuine policy shifts in the future. Shifting trade between major countries creates legal uncertainty, which bothers businesses the most and even affects how they plan their supply chains.

The ongoing BRICS discussions suggest that all member countries are more seriously looking into creating fresh new economic relationships to protect themselves from swings in US-China trade. The same applies for using USD as the main currency for trade. Central banks are also keeping a close eye on how these developments threaten the position of the US dollar as the main reserve currency.

Also Read: De-dollarization: Trump’s 10% Tariffs Fuel Fragile US Dollar Future in Asia

Economic Implications Moving Forward

The persistence of Trump Xi trade conflicts creates ongoing challenges for global economic stability right now. Market participants are also rightly monitoring how these developments could affect everything from supply chains to currency valuations, and also how they might impact investment flows.