Trump Bitcoin ETF developments have reached a milestone as Truth Social officially filed for a Bitcoin exchange-traded fund on NYSE Arca. This Truth Social Bitcoin ETF filing represents a significant shift in cryptocurrency regulation and could trigger another Bitcoin price surge as institutional adoption accelerates right now.

JUST IN: 🇺🇸 President Trump's Truth Social filed for a Bitcoin ETF 🚀 pic.twitter.com/txxMqKJytu

— Bitcoin Magazine (@BitcoinMagazine) June 3, 2025

Also Read: Trump Calls Xi ‘Tough to Deal With’ Amid US-China Trade Strain

Trump Bitcoin ETF Filing Signals Shift in Cryptocurrency Regulation

The Trump Bitcoin ETF application submitted through Truth Social marks a turning point for both the Trump media organization and also the broader digital asset landscape. This Truth Social Bitcoin ETF proposal comes amid evolving cryptocurrency regulation frameworks and, at the time of writing, growing institutional interest in Bitcoin investments.

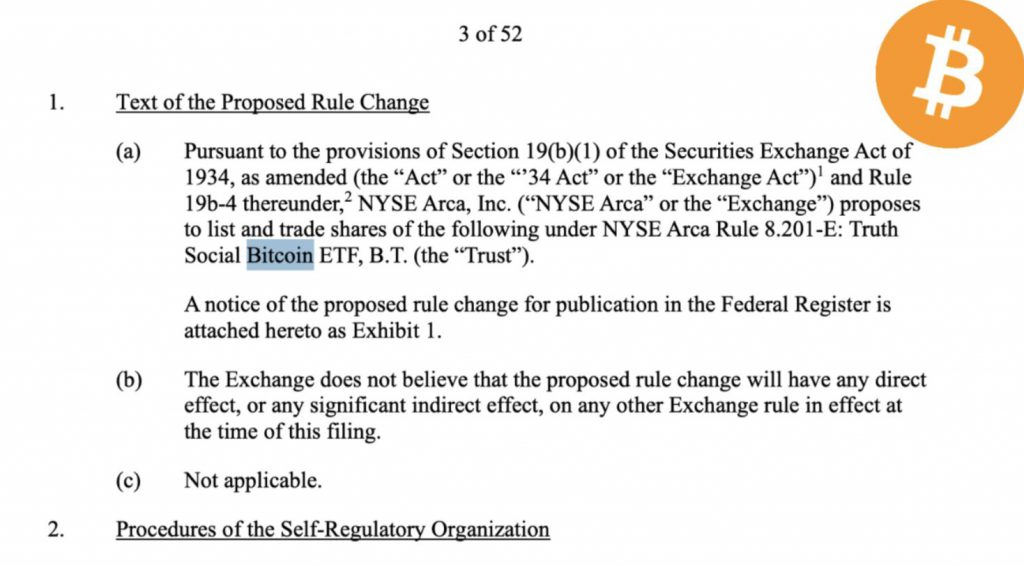

According to the filing documentation, the proposed ETF seeks to track Bitcoin’s performance while also providing investors with regulated exposure to the cryptocurrency without direct ownership complexities.

Strategic Bitcoin Reserve and Market Impact

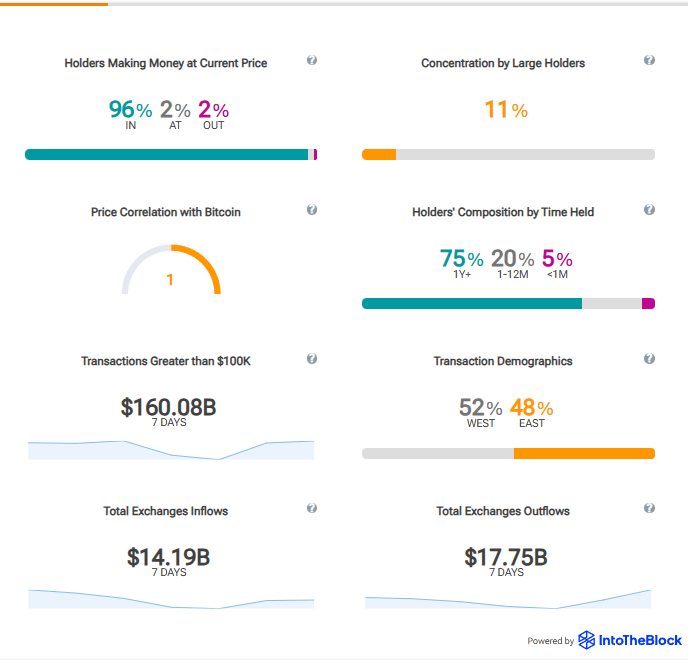

The Trump Bitcoin ETF filing aligns with discussions around establishing a strategic Bitcoin reserve at both corporate and governmental levels. This Truth Social Bitcoin ETF initiative could accelerate Bitcoin price surge momentum as it legitimizes cryptocurrency investments among traditionally conservative investor demographics right now.

Market analysts suggest this development addresses key investor concerns about cryptocurrency regulation uncertainty while also providing a regulated investment vehicle for Bitcoin exposure.

Regulatory Framework and Approval Process

The Truth Social Bitcoin ETF application benefits from improved cryptocurrency regulation clarity that has emerged in recent months and also follows established procedures. The Trump Bitcoin ETF proposal follows established NYSE Arca procedures for digital asset products, potentially streamlining the approval process.

The filing addresses regulatory requirements for Bitcoin ETFs while also positioning itself within the current framework that has become more receptive to cryptocurrency investment products. This regulatory evolution supports the potential for Bitcoin price surge activity as institutional barriers continue to diminish right now.

Market Positioning and Investment Strategy

The Trump Bitcoin ETF represents more than traditional cryptocurrency investment—it signals mainstream political and also media acceptance of digital assets. This Truth Social Bitcoin ETF filing could establish a strategic Bitcoin reserve approach for media companies seeking cryptocurrency exposure.

Also Read: Goldman Bets $1.4B on Blackrock’s Bitcoin ETF: 516 Trillion SHIB Set to Be Hit

The application demonstrates how cryptocurrency regulation developments have created opportunities for high-profile entities to enter the Bitcoin investment space through established exchange mechanisms and also regulatory pathways.

The Trump Bitcoin ETF filing through his own social network represents a significant development in cryptocurrency adoption, combining political influence with digital asset investment strategy. As this Truth Social Bitcoin ETF progresses through regulatory review, it could catalyze further Bitcoin price surge activity while also contributing to strategic Bitcoin reserve discussions across various sectors.

This cryptocurrency regulation milestone shows how mainstream acceptance continues expanding right now, potentially opening doors for similar high-profile Bitcoin ETF applications in the future.