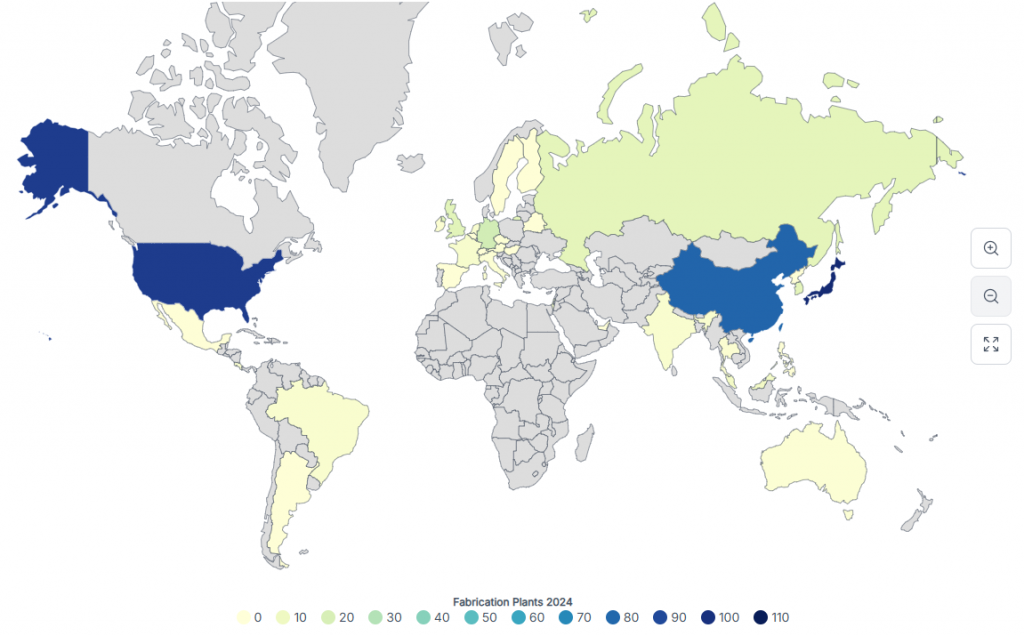

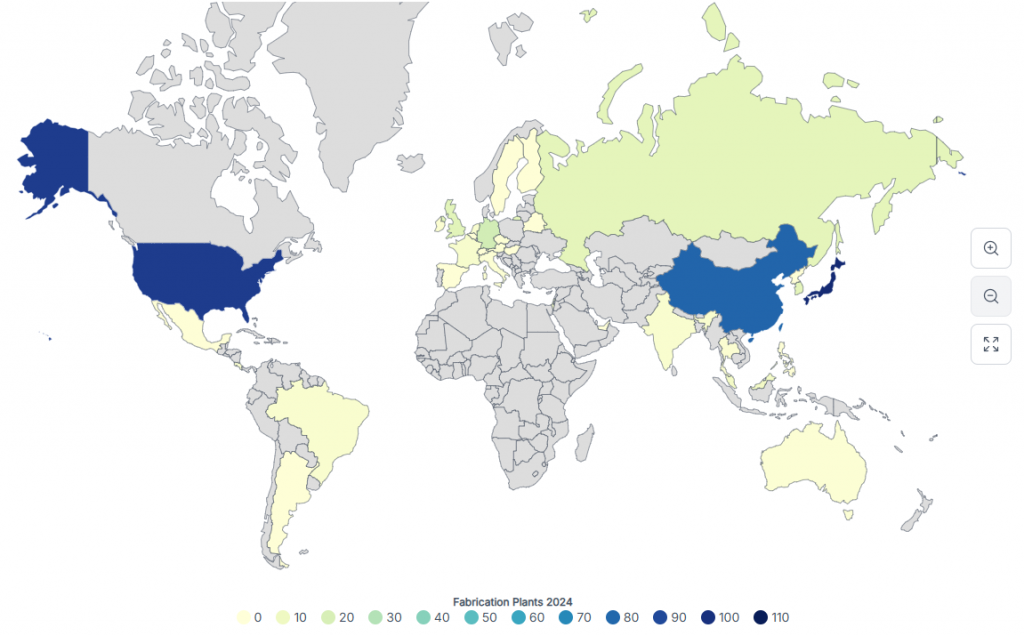

Trump’s chip tariff plan that was announced on Wednesday will actually impose a devastating 100% tariff on semiconductor imports, and companies will only get exemptions if they’re manufacturing right here in the United States. The semiconductor import tax is going to threaten to double costs for imported chips, which means major manufacturers like Samsung are being forced to reassess their global operations right now and this could potentially trigger a broader US trade war.

Trump Chip Tariff Plan Sparks Samsung Selloff, Trade War Fears

Samsung stock impact became immediately visible as markets actually reacted to Trump’s aggressive trade policy announcement. The Trump chip tariff plan represents one of the most sweeping challenges to the global semiconductor industry right now, and South Korea chip exports are facing some significant disruption at the time of writing.

Trump said during his Oval Office meeting with Apple CEO Tim Cook:

“We’ll be putting a tariff on of approximately 100% on chips and semiconductors. But if you’re building in the United States of America, there’s no charge.”

Market Response Shows Vulnerability Right Now

Samsung stock impact reflected broader concerns about the semiconductor import tax affecting Asian manufacturers and all. However, Samsung shares actually climbed 2.47% as Apple announced it will use chips that are produced at Samsung’s Texas facility, showing how the Trump chip tariff plan favors companies with U.S. operations.

Treasury Secretary Scott Bessent explained the administration’s strategy, stating:

“I think that one of our greatest vulnerabilities are these, is this external production, especially in semiconductors.”

Also Read: BRICS to Discuss Joint Response to Trump’s Tariffs

Trade War Implications Are Spreading Globally

The US trade war implications extend beyond bilateral relationships, and the semiconductor import tax could actually reshape global supply chains. South Korea chip exports, which are valued in billions annually, now face an uncertain future as manufacturers are evaluating costly production relocations right now.

Trump emphasized the broad application of his policy, telling reporters:

“It would be more. It would be also Samsung and anybody that makes that product.”

The Trump chip tariff plan fundamentally shifts America’s approach from the cooperative CHIPS Act strategy to aggressive trade protection. Samsung stock impact serves as an early indicator of how markets view this dramatic policy change, and the semiconductor import tax is potentially forcing manufacturers to choose between market access and production costs at the time of writing.

Also Read: Goldman Sachs Cuts India GDP Forecast as Trump Threatens 25% Tariffs

South Korea chip exports face particular pressure as the country’s economy heavily depends on semiconductor manufacturing. The US trade war approach risks retaliatory measures that could harm American exporters and create broader economic instability across the technology sector right now.