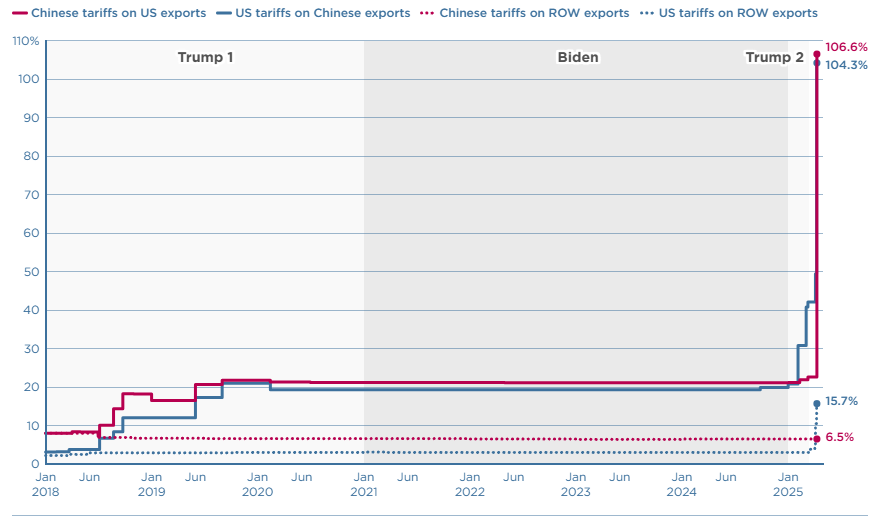

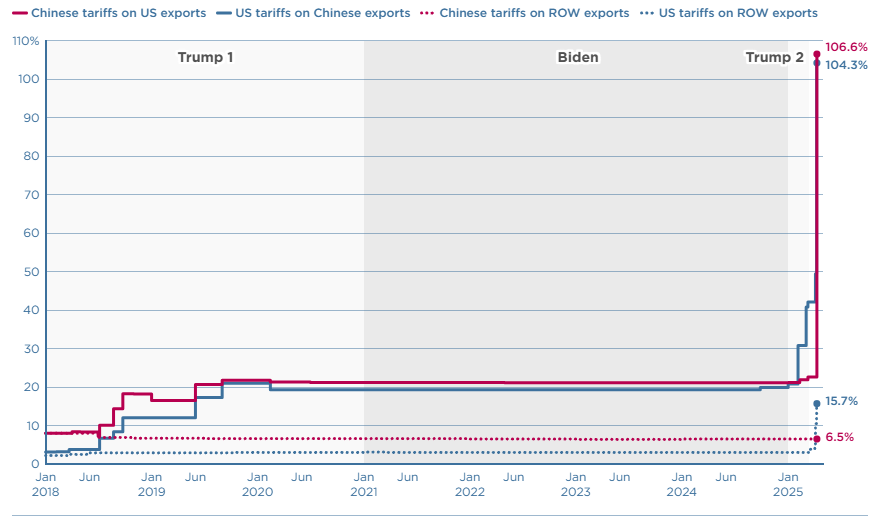

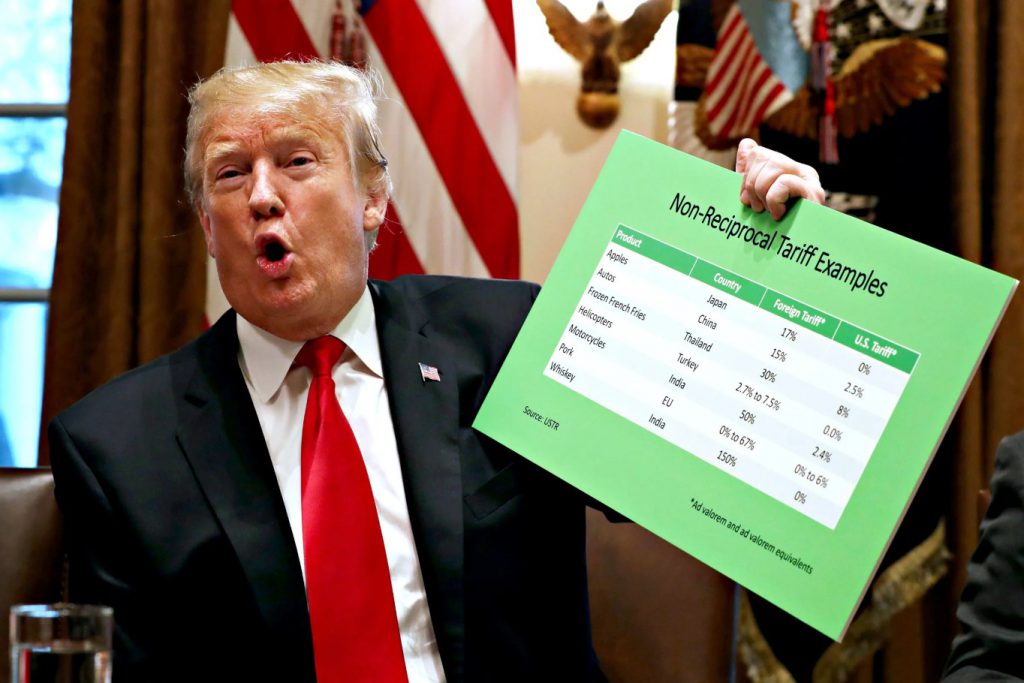

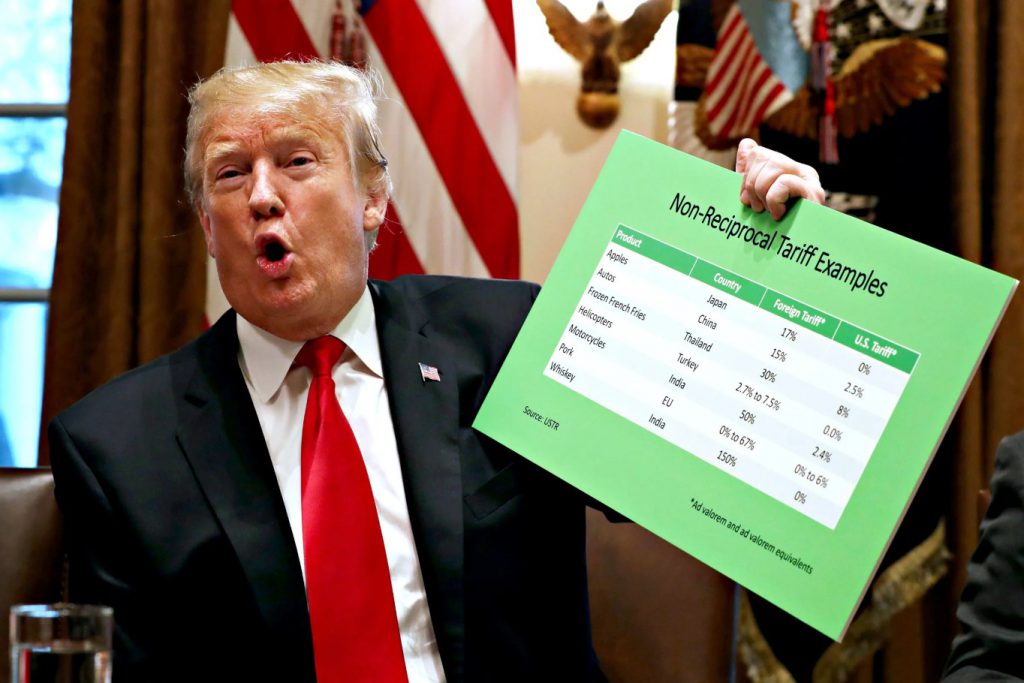

Trump China tariffs have skyrocketed to 125 percent right now, potentially forcing China to pivot toward stronger ASEAN and BRICS trade relationships. This dramatic tariff increase, which was implemented on April 9, 2025, follows China’s 84 percent hike on US goods just days ago and signals a major shift in US-China relations that could have lasting effects.

Also Read: Global Tariffs Paused, But Trump Slams China with 125% Hike

Trump’s Tariff Reshape Global Trade & Boost China’s ASEAN & BRICS Relations

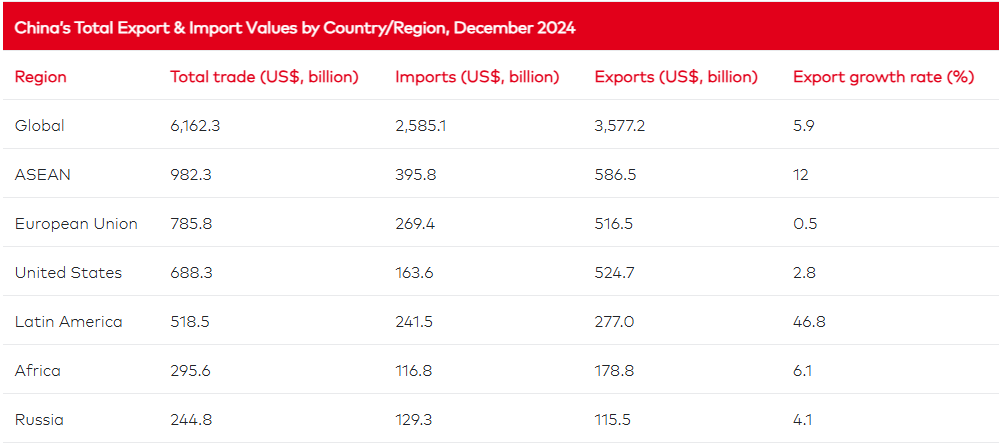

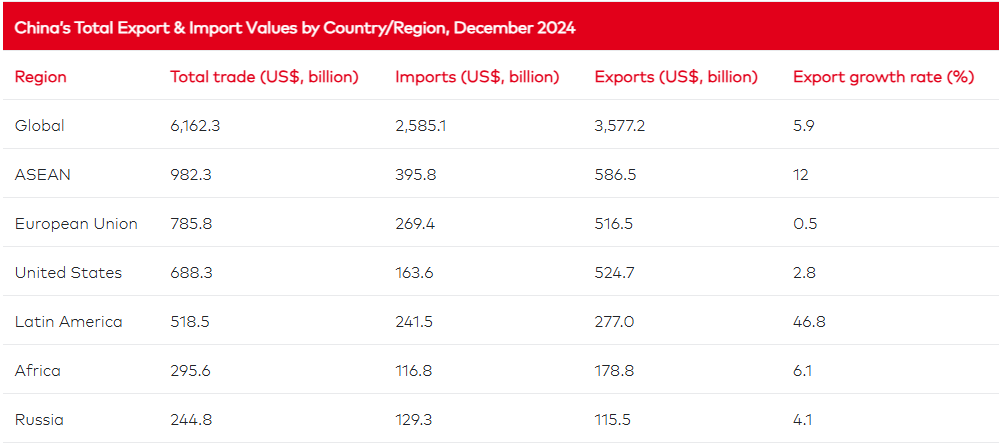

The US currently ranks as China’s third-largest trading partner, behind both the ASEAN and the EU. ASEAN trade with China has actually reached a whopping total of about $982.3 billion in 2024, with exports growing by about 12 percent compared to just 2.8 percent for US exports. This positioning essentially gives Beijing some flexibility in responding to Trump China tariffs at this moment.

Chris Devonshire-Ellis, an expert on China’s global trade relations, was clear about the simple fact that: “China has invested an estimated US$1.75 trillion into its Belt and Road Initiative – specifically designed to secure multiple supply chains to China to cater for any future supply chain problems.”

Also Read: 50 Countries Eye De-Dollarization & Reduce US Dollar Dependency

BRICS Alternative Gaining Momentum

The China-BRICS trade right now exceeds $1 trillion annually, and this figure will continue to grow exponentially. By increasing exports to non-US markets by around 8.5 percent yearly, China could possibly absorb its entire US export volume within just two years or so. Not bad, right? Trump’s China tariffs may actually accelerate this transition, similar to how Russia redirected EU trade within two years after the sanctions were imposed.

Also Read: De-Dollarization: 6 Global Alliances Race to Ditch the US Dollar

Long-Term Strategic Implications

Analysts project the US economy to grow around 1.7 percent this year, while China expands at 5 percent and India grows even faster at 9 percent. ASEAN relationships offer immediate alternatives for Chinese exporters affected by tariffs and other trade restrictions.

Devonshire-Ellis suggests:

“With Beijing wanting access to trade stability and not Trumpian unreliability, that is more likely to become a new trend than not. China’s export growth, the emergence of the BRICS and global consumer markets, and the new supply chains opening up with the Belt & Road Initiative all point to China’s extensive planning about to come into timely operation.”

Also Read: Two Economic Giants Team Up to Shatter US Dollar Dependence with 6 De-Dollarization Projects

The most significant concerns about Trump China tariffs may not be their impact on China but rather on the United States itself, as China continues building and expanding ASEAN and BRICS trade relationships that could permanently reshape global economic patterns for years to come.