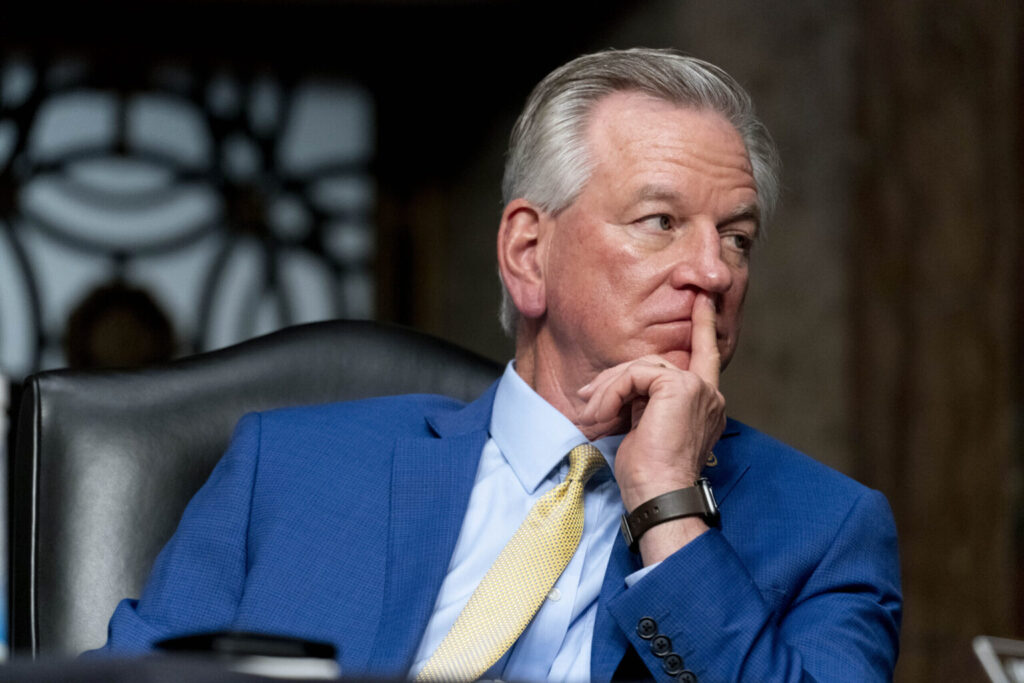

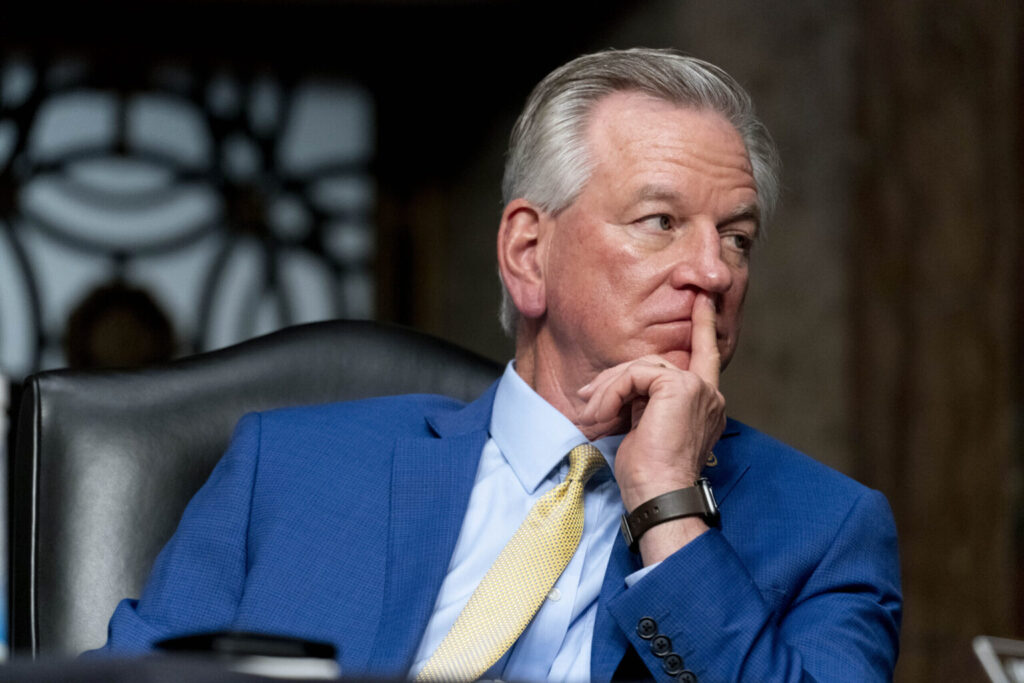

Tuberville’s crypto bill is poised to change retirement planning for many Americans. Just recently, on April 1, Senator Tommy Tuberville announced his plans to introduce something called the Financial Freedom Act, which would essentially allow regular people to include various cryptocurrencies in their 401(k) accounts. At the time of writing, this move could reshape crypto retirement plans nationwide by challenging the current restrictions that have limited cryptocurrency retirement savings options for most workers.

America is the country of FREEDOM, but under Joe Biden, the federal government tried to control how Americans invest their money.

— Coach Tommy Tuberville (@SenTuberville) March 31, 2025

President Trump is the Crypto President.

That’s why I am re-introducing the Financial Freedom Act to give AMERICANS the freedom to invest their… pic.twitter.com/28T7ZiRfPK

Also Read: Pi Coin: New Forecast Predicts Triple-Digit Spike in April 2025

How Tuberville’s Crypto Bill Could Impact Your 401(k) and Retirement Savings

The Financial Freedom Act Explained

Senator Tuberville’s crypto bill aims to expand investment options for retirement savings, and this isn’t actually his first attempt to influence 401(k) crypto regulation. He introduced a similar bill back in 2022 after the Department of Labor issued some rather restrictive guidance against crypto investments 401(k) plans could potentially include.

Tuberville stated:

The Biden administration just hammered the American people with regulations and tomorrow I’m dropping a bill called the Financial Freedom Act. And it allows families and individuals to invest their retirement funds into crypto.

Challenging Department of Labor Restrictions

The Tuberville crypto bill directly responds to the DOL’s March 2022 guidance that basically discouraged 401(k) accounts from investing in digital assets like Bitcoin. The Department cited several concerns such as volatility and regulatory uncertainty as primary issues.

The senator was clear about the fact that:

The government had no business standing in the way of retirement savers who wanted to make their own investment choices.

Also Read: Will Dogecoin Rise in April 2025 After Elon Musk’s Recent Update?

This isn’t Tuberville’s first push for cryptocurrency retirement savings options. In May 2022, he introduced the original version of the Financial Freedom Act specifically to counter DOL restrictions. Around the same time, Representative Byron Donalds of Florida also introduced a House version of the bill.

The lawmaker highlighted that the Financial Freedom Act of 2022 would empower retirement savers and ensure no punishment for those employers who allow investors to exercise financial freedom.

Potential Impact on Retirement Investors

If the Tuberville crypto bill actually passes, it would significantly change 401(k) crypto regulation in several ways. For instance, employers could offer cryptocurrency investment options without having to fear legal consequences, thereby giving Americans a lot more control over their retirement accounts and how they’re invested.

The senator emphasized personal choice in his statements, saying people should diversify and do what they want to do since it is a free country.

Also Read: Gold Hits All-Time High of $3,149, Blockchain Boosts Ghana’s Trade

Looking Ahead

In many ways, the Tuberville crypto bill underscores the ongoing tensions between innovation and consumer protection in retirement planning. Whether it ultimately succeeds in unlocking crypto for 401(k) accounts depends on its journey through Congress and the broader regulatory landscape, which remains somewhat uncertain at this time.