A month back, President Joe Biden released his annual budget proposal outlining his policy priorities for the coming year. With respect to the digital asset industry, the proposal touched upon crypto mining. Specifically, Biden called for a 30% tax on all electricity used to mine Bitcoin and other cryptos.

On Tuesday, May 2, the White House’s Council of Economic Advisers contended that the Digital Asset Mining Energy [DAME] excise tax “encourages firms to start taking better account of the harms they impose on society.” In fact, they also underlined how this is an example of Biden’s commitment to addressing, both, “long-standing national challenges” and “emerging risks” like the economic and environmental costs of mining.

Also Read: President Biden Proposes 30% Tax on Electricity Used to Mine Cryptocurrency

Putting things into perspective

It is a known fact that mining Bitcoin requires a lot of energy. As reported in an article recently, the Bitcoin mining industry consumed an aggregate of 161 TWh of electricity last year. Notably, the power consumption was higher than in countries like Sweden. In fact, the network consumed 1,738 kWh of electrical energy on average for every transaction processed on the blockchain. To contextualize, the same amount of electricity could power an average U.S. household for two months.

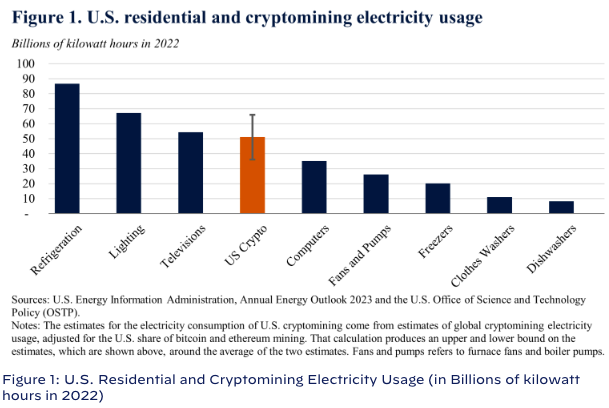

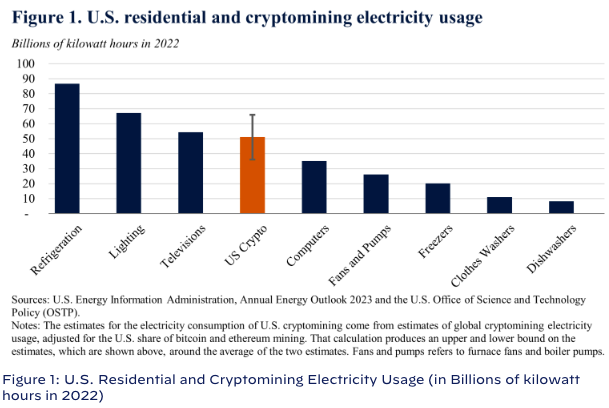

The council’s report cited a New York Times investigation piece. According to the same, the power consumption associated with 34 of the largest crypto-mining operation, is equal to the power used by the surrounding 3 million homes. In fact, the CEA report highlighted that the amount of electricity used in crypto mining in the U.S. last year was “similar” to the amount used to power all of the country’s home computers or residential lighting.

Also Read: Bitcoin: WEF Video Showcases Mining, But Omits ‘B Word’

Chalking out the banes associated with crypto mining, the economists argued,

Is the tax imposition a straitjacket solution?

To ensure that crypto mining is not “simply pushed from one local community to another,” the advisers stated that a national policy is needed. The report noted,

“Of course, the DAME tax is not a panacea—it is only one example of the Administration’s efforts to fight climate change, reduce energy prices, and increase access to electrified options for all Americans.”

The DAME tax is estimated to raise around $3.5 billion in revenue over 10 years. The ultimate aim of the tax is to “start having crypto miners pay their fair share of the costs imposed on local communities and the environment.” That being said, it should be noted that the Republicans have resisted efforts to punish the crypto sector. So, with Republicans currently controlling the White House, the tax imposition might not essentially see the light of day.

Also Read: Bitcoin’s Energy Use is a ‘Skyscraper’, Ethereum a ‘Raspberry’: Research