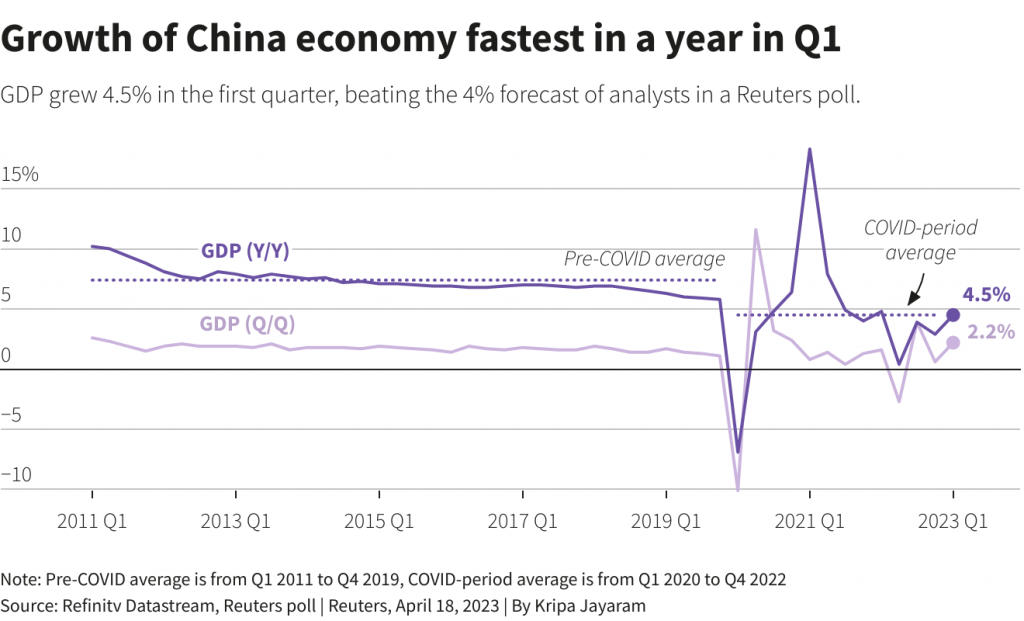

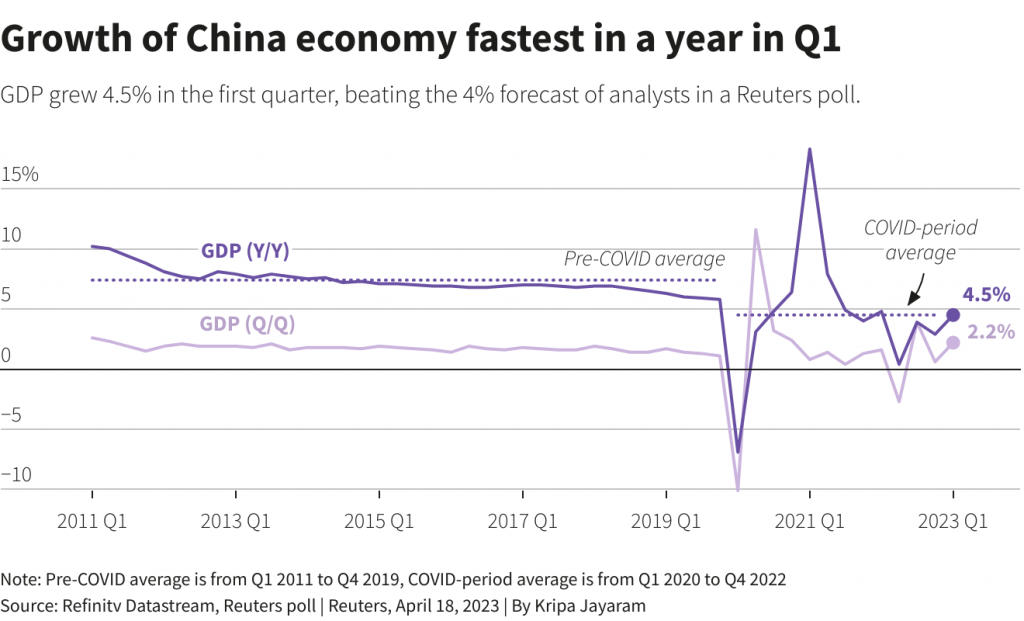

The U.S. dollar dipped on Tuesday after expectations that the Federal Reserve may raise interest rates in May. The dollar dip comes on the same day after China released data showing their gross domestic product (GDP) rose 4.5% in Q1 of 2023. The Chinese GDP outperformed estimates where analysts predicted it could see a growth of about 4%. China’s GDP rose by an additional .5% in the last three months, according to data from the National Bureau of Statistics (NBS). The Chinese economy gathered pace in Q1, 2023 after the government relaxed all Covid-19 restrictions. Lifting the pandemic lockdowns made the economy soar as businesses experienced increased demand from consumers.

Also Read: BRICS & Other Countries Show Less Desire To Hold the U.S. Dollar

The average Chinese household consumption saw an increase this year after facing Covid-19 restrictions for nearly a year. Strong economic growth is likely to boost the upcoming Q2 GDP. China’s previous quarter shows a growth of 2.9% and toppled all expectations this time around.

In addition, China saw its exports grow in Q1 signaling that the world depends on Chinese products to sustain businesses. The development shows that China is racing to be an economic powerhouse with $18 trillion in GDP.

“Economic recovery is well on track. The bright spot is consumption, which is strengthening as household confidence improves. The strong export growth in March also likely helped to boost GDP growth in Q1,” said Zhiwei Zhang, Chief Economist at Pinpoint Asset Management to Reuters.

Also Read: BRICS Advancing To Eliminate U.S. Dollar Financial System

The Rise of China Poses Risk to the U.S. Dollar

China’s growth poses a serious risk to the dominance of the U.S. dollar on a global scale. If BRICS and other countries decide to settle international trade with the Yuan, the USD could be under pressure. Chinese President Xi Jinping is advancing along with his allies Russia and Saudi Arabia to stall the USD’s growth.

However, the NBS spokesman, Fu Linghui said that China has a long way to go to capture the international markets. “The international environment is still complex and ever-changing. Constraints from insufficient domestic demand are obvious and the foundation for economic recovery is not solid,” he said in a press conference.

Also Read: Will the U.S. dollar Collapse Now That BRICS Are Developing Their Own Currency?