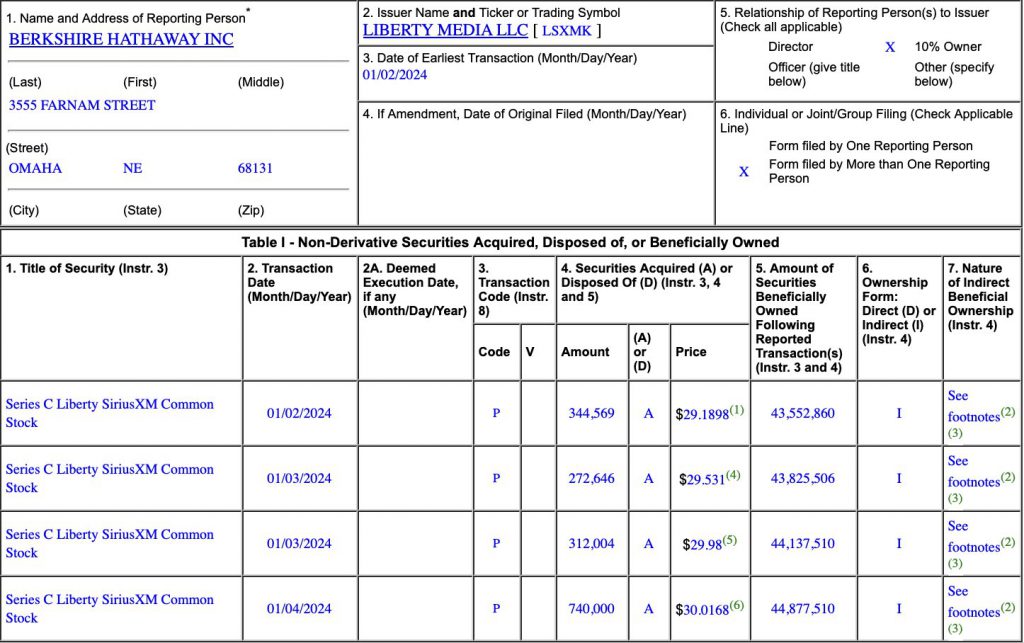

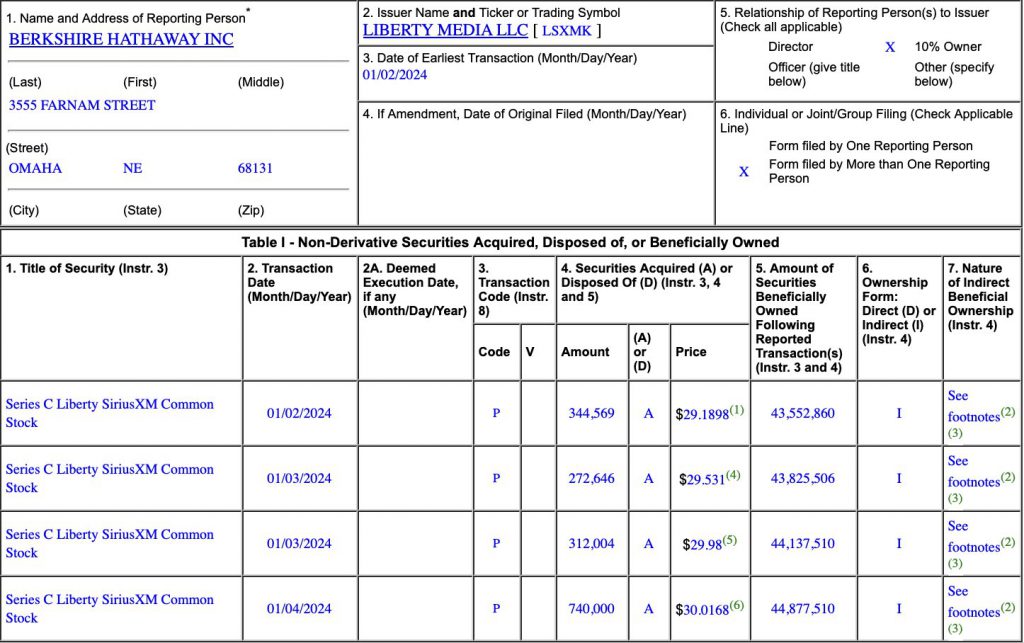

Ace investor Warren Buffet initiated the largest ‘buy’ transaction in the U.S. stock market on Wednesday. Buffet’s Berkshire Hathaway has expanded its portfolio by purchasing extensive stocks in the Liberty SiriusXM Group (LSXMA). The large transaction was initiated on January 17, 2024, as Berkshire Hathaway purchased 1,591,178 stocks in the Liberty SiriusXM Group. The overall purchase from Buffet’s investment firm was worth $82 million at the trading price of $30.39 in Liberty SiriusXM.

Also Read: 3 Countries Agree To Launch BRICS Currency To Challenge US Dollar

Berkshire Hathaway expanded its shares in Liberty SiriusXM with the big purchase and now holds 22,889,612 stocks. This acquisition comes weeks after Buffet purchased the same stock and is steadily accumulating more.

Also Read: BRICS: JP Morgan Predicts Future of the US Dollar Against Chinese Yuan

Warren Buffet Remains the U.S. Stock Market’s Top Buyer

Warren Buffet is also eyeing two stocks to accumulate this year in 2024. Data shows that Buffet is considering buying stocks of Occidental Petroleum (OXY) and rebuy shares from his own firm Berkshire Hathaway. Buffet is looking at stock buybacks in Berkshire Hathaway and plans to repurchase shares worth billions of dollars.

Also Read: These 25 Countries Are Ready To Join BRICS in 2024

Buffet’s Berkshire can buy back its shares at any time if the price is below the stock’s intrinsic value. However, the only condition is that Berkshire Hathaway needs to keep $30 billion worth of cash, cash equivalents, and U.S. Treasury bills. If the criteria are met, Buffet can initiate stock buybacks and have more mileage in the U.S. stock market.

Berkshire Hathaway currently holds ownership stakes in more than 65 companies across the U.S. stock market. The investments are made in diverse sectors ranging from technology, oil and gas, entertainment, and the media.

Also Read: BRICS: Investors Bet Indian Rupee Will Rise, US Dollar To Decline

The conglomerate’s net worth currently stands at $122 billion in 2024 and could go further if the U.S. stock market rallies this year. He is now the 10th richest person in the world and the sixth richest person in the U.S.