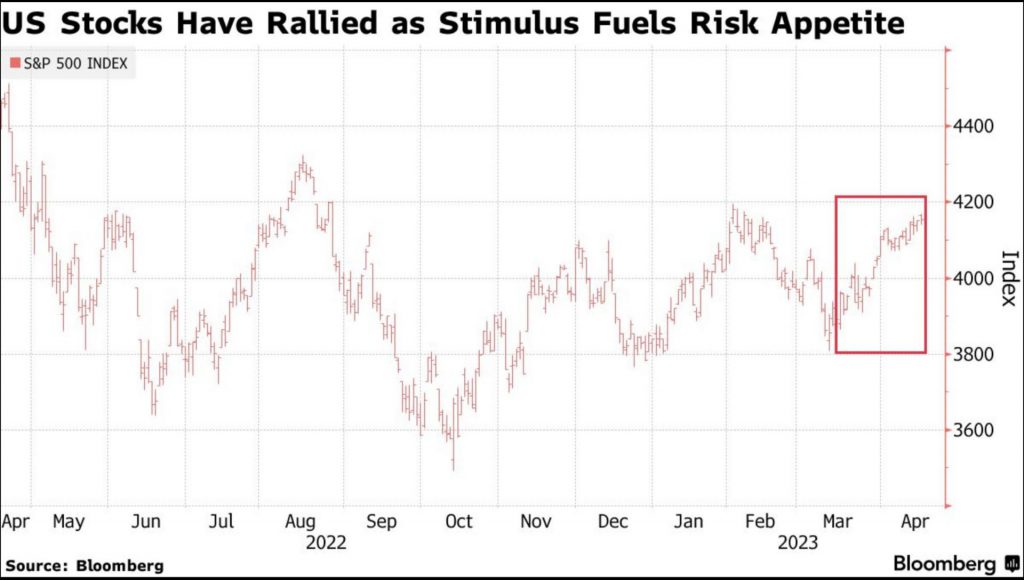

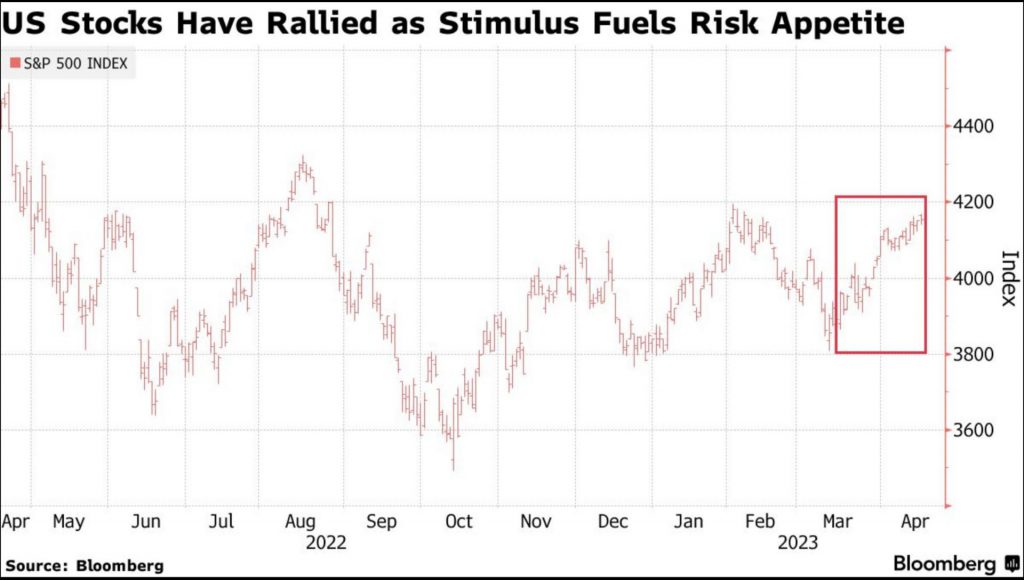

U.S. stocks and risk assets will take a hit when central banks withdraw around $800 billion of stimulus, according to Citi. The funds were deployed to sustain the global economy during the pandemic. The risk rally, according to Citi strategist Matt King, is because of central banks injecting over $1 billion in liquidity. Furthermore, during the U.S. banking crisis, the Federal Reserve increased its balance sheet by $440 billion, King added.

In response to declining earnings expectations, the worldwide surge of policy assistance has held down real yields. Moreover, it has supported equity multiples and tightened credit spreads. King said that global central banks’ “stealth” quantitative easing has stoked the market’s euphoria.

According to King, support is expected to stall as China’s central bank reins in lax policy settings amid strong growth. Meanwhile, its rivals in the U.S. and Europe revive quantitative tightening.

Read more: BRICS: More Countries Abandoning the US Dollar as Reserve Currency

When does Citi think stocks could take a hit?

King stated that the development could remove $600 to $800 billion worth of global liquidity in the coming weeks. The Citi strategist added that it would not be surprising if the markets “experience a sudden pressure of loss.” However, King is not the only one to share this perspective. Others have started to doubt this year’s risk rally as well. Equity market pricing, according to Nick Ferres, chief investment officer at hedge fund Vantage Point Asset Management, is excessively optimistic.

Ferres stated that “Market breadth supporting the rally has been extremely poor.” He further added that equity investors seem to desire all the advantages of rate reduction. However, the same investors are not willing to endure the pain that would bring that about, he said.

Citi’s study comes amid U.S. stocks growing by as much as 8.2% this year. Bitcoin (BTC), on the other hand, has made gains of nearly 80% this year, year-to-date. It has almost doubled since December 2022. With stocks poised to take a hit, it could lead to bigger inflows for the crypto market or Bitcoin might face the brunt of the impact as well, due to market correlation.